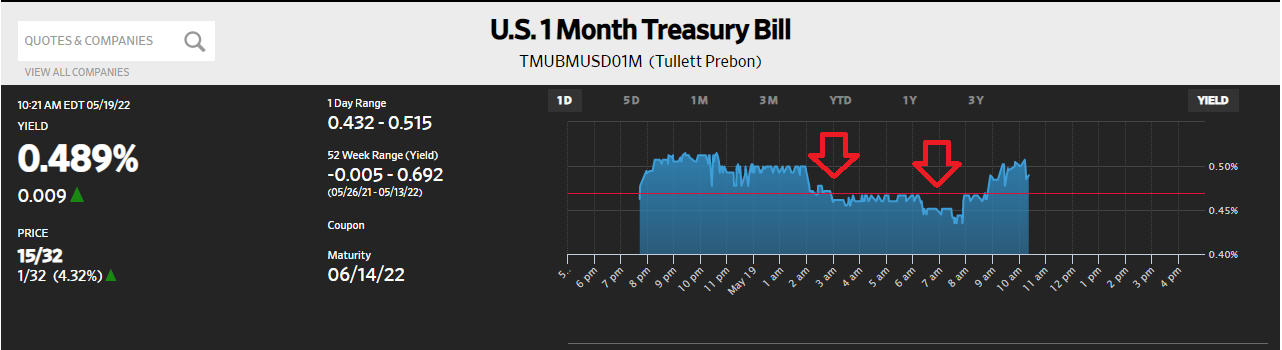

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:

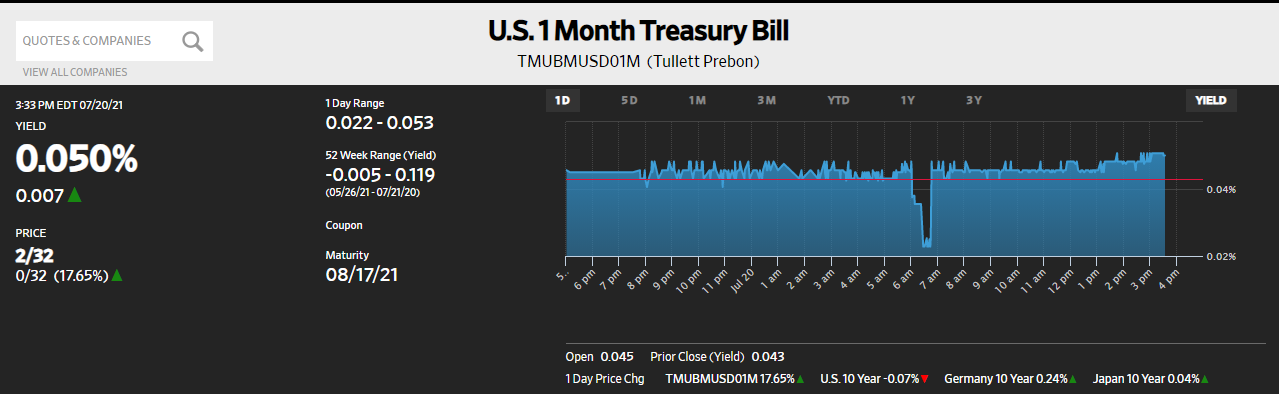

During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like derivatives, the system sorting out, and handing out, any short run consequences.

This time, this morning, it was sustained bids all the way from Asia through Europe into the US open. It shouldn’t have been surprising given the strains of illiquid-ness all over global markets yesterday. To give you a sense of the difference, I’ll include a chart from a scramble from last year, one that I called a “really good” example.

If below was a good illustration, then what do we call or say about above?

I’d call it a much bigger problem.

Fragile, as we’ve been documenting all along. The fact that T-bill rates have been so low to begin with, the 4-week so far down under RRP and IOER, and then going lower, the problem of tight collateral supply and redistribution has itself become the baseline case – only made worse on days like yesterday.

Huge selloff yesterday. RRP set for 1.30% in less than month. And 4w bill is stuck under 0.50% getting huge bids in the "repo hours." Don't forget derivatives, too, need collateral esp. when wild price swings.

— Jeffrey P. Snider (@JeffSnider_AIP) May 19, 2022

The utility of Tbills (not bank reserves).https://t.co/eCYCTfC7XF

One more from @EmilKalinowski and the Euro$ University Youtube vault: Episode 91 on scrambles for collateral, like the one which just happened a few hours ago. https://t.co/CUmP1IX235

— Jeffrey P. Snider (@JeffSnider_AIP) May 19, 2022

About these scrambles last summer, it was with this caution in mind:

What I wrote last year [March 2020] still applies here: “under normal and even less-than-ideal conditions these are just rolled over.” We know via warnings and the behavior in the bond market we’re operating in less-than-ideal conditions, especially scarcity in bills. Though today’s action wasn’t easily rolled over, it was apparently difficult, it still got rolled over.

This right here is the reason why we are on the hunt for more escalating warnings, out looking for the big ones; many of those which have not yet happened.

Since then, last July, those warnings did happen and one after another (after another). Not as much funding was rolled over after yesterday’s liquidations, thus this morning’s sustained appetite for the best of the best of the best collateral. Like cows (or sheep), everyone herded into the more usable upper tier.

Why?

The question in light of Wednesday really answers itself. The following will appear tomorrow at RealClearMarkets recalling this week’s Target/Walmart contributions to the overall global picture:

Pile a (more than) realistic recession threat into this deflationary money mix and it all gets very dangerous very quickly. The more deflationary money restrains normal financial function, the more it will add to the downside supply shock tendencies, merely confirming risk aversion in deflationary money-makers leading to more deflationary money constraints. And so on.

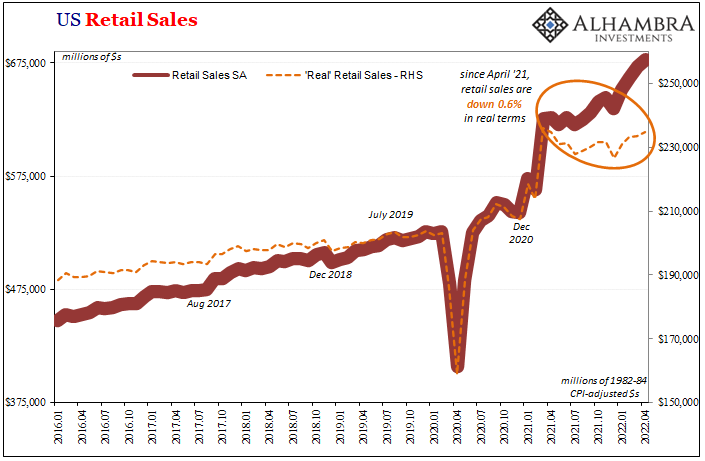

What management for the two largest retailers both admitted in their quarterly numbers and presentations, the same quarter when, remember, GDP went negative (and then the Household Survey on employment did, too, by April), was pure demand destruction. They just came out and said it; consumers are being hard hit by prices and are now actively cutting back on (higher margin) discretionary purchases.

Worse, for the retail sector, higher costs are also hitting retailers hard, too, because contrary to all previous talk about companies finally having achieved pricing power, neither Target nor Walmart was able, or forecasts either will be able, to pass higher input costs (including shipping) along to their already-harmed and desperate customers.

This was never inflation.

Think forward about the consequences. The glut of goods which has arrived this year, a glut much of which is still coming.

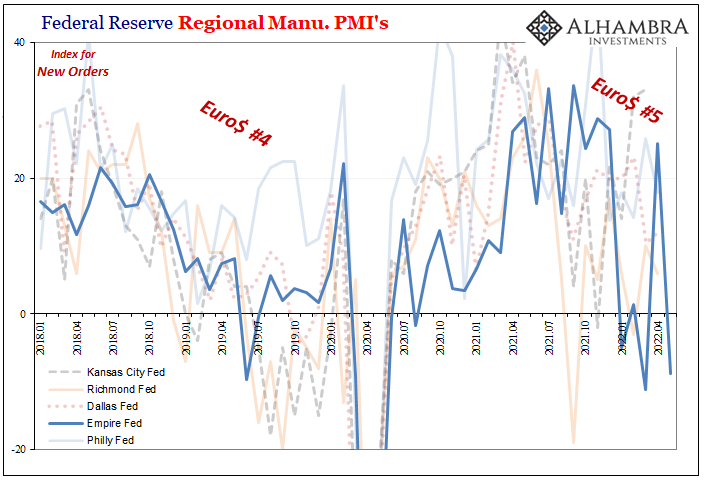

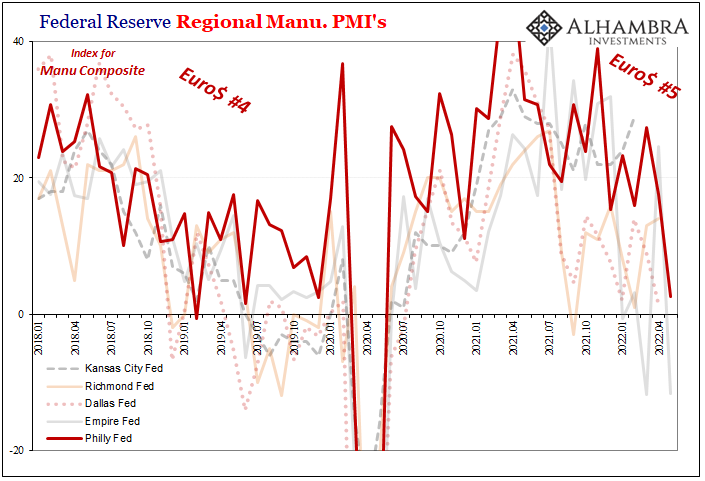

Just when consumers are now seriously scaling down, it is the absolute worst timing – yet entirely predictable since markets have been warning about this for a very long time already. Euro$ #5 dates to last May.

We continue to see the numbers backing up the retail anecdotes. Just this week, the Empire Fed manufacturing survey crashed for the second time in three months, the May 2022 headline -11.6, with New Orders -8.8. Its cousin from Philadelphia dropped to 2.6, the lowest since 2020 (even though New Orders here gained this month) and deep within downturn territory already.

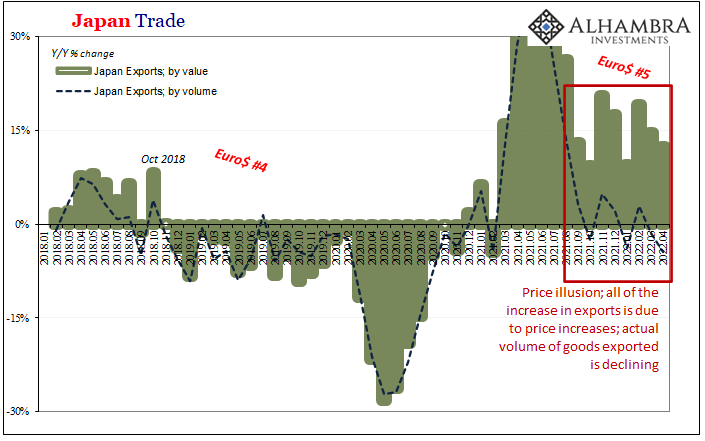

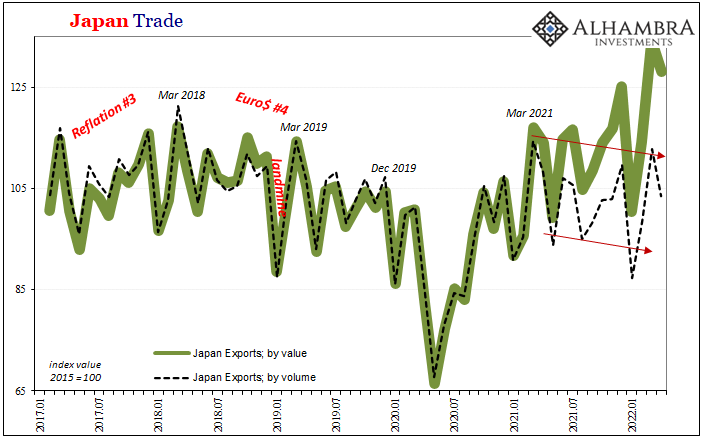

Overseas, the Japanese are facing more recessionary prospects. GDP there suggests output has been uncertain at best, slightly negative then slightly positive, alternating between each for the past five quarters (with Q1 2022 to the downside like in America).

And those were achieved when the price illusion hadn’t yet turned so dark. What I mean is, export (and import) growth had been huge by value while before now still positive by volume. Over the past half year, really since last October, exports by volume are more negative than not.

In the latest update released today, Japanese exports by volume were down 4.4% year-over-year, the worst since September 2020 and a trend that is becoming all-too-clear.

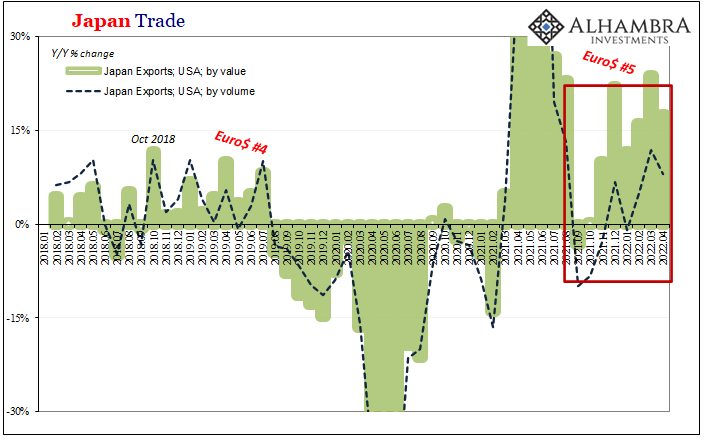

A trend that is almost certain to get far worse over the coming months, if we are to believe Target, Walmart, and T-bills. That -4.4% still includes a relatively decent positive contribution from exports to the United States (below). Yes, the inventory glut coming to America from Japan has kept its overall export situation from becoming a total recessionary disaster.

What the Fed surveys show, as do Japan’s imports representing its own struggles with pricing, is that any export boost due from America’s consumers likely reaching its own end. Now or in the coming months. Spending here just can no longer keep it all up, and so, like “inflation”, it’s likely to be coming all back down.

Globally synchronized.

The thing about the supply shock version of “inflation”, however, is that while prices go up in its buildup first half, the whole economy comes crashing back down during its terminal second phase.

Bills (and other indications) said all along there was never the money to make it genuine inflation. Without the money, this was always going to be, yes, transitory.

Worldwide, market-wide, that much is really starting to become very clear. Even the hashtag #recession was sent trending on Twitter this morning. While Target, Walmart and Bill have been talking loudly each in their own ways, that’s really saying something.

With #recession trending this morning, good time to dig out this tweet since the world is beginning to wake up (not Bill, though, he's been awake all morning) to the possibility, and how we're all a little bit closer. https://t.co/zHSbw0I0kj

— Jeffrey P. Snider (@JeffSnider_AIP) May 19, 2022

Stay In Touch