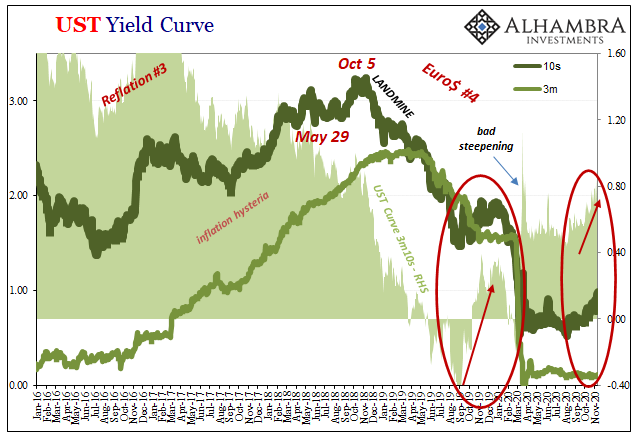

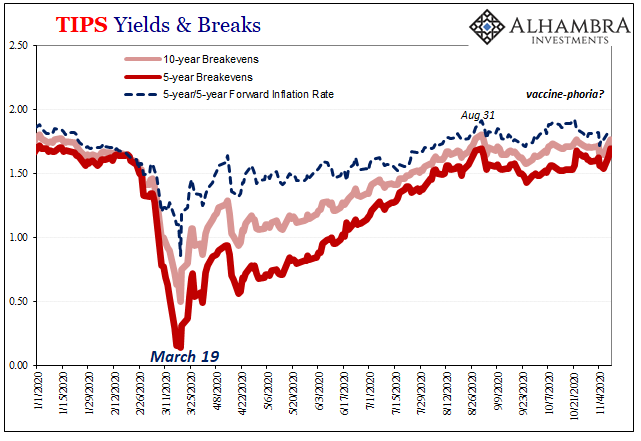

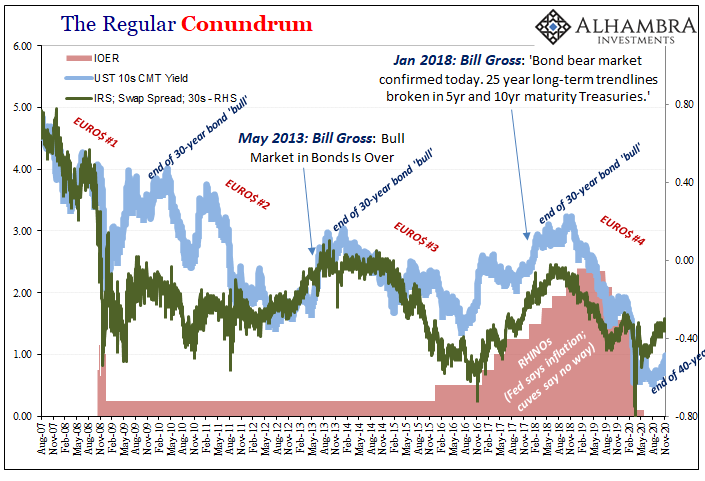

What’s interesting about vaccine-phoria is that it’s largely been contained to just the one part of the bond market. Nominal Treasury yields at the long end have surged, while those at the shorter end have moved up a bit, too. Predictably, the calls for the BOND ROUT!!!! have grown, typically referencing the guaranteed end of the so-called 40-year bond “bull.”

If the 10-year rate gets over 1%, they say, that breaks some pattern on some chart that means something to someone somewhere. Stop yourself if you’ve heard this before. How about January 2018:

Gross: Bond bear market confirmed today. 25 year long-term trendlines broken in 5yr and 10yr maturity Treasuries.

— Janus Henderson U.S. (@JHIAdvisorsUS) January 9, 2018

You can draw trendlines and claim this or that round number for a specific Treasury means something substantial, but none of them have been yet. There is no bull market in bonds, only a bear market in the global economy because of how central bankers don’t know their job (or even what their job is supposed to be). That’s what has to change first, and never does.

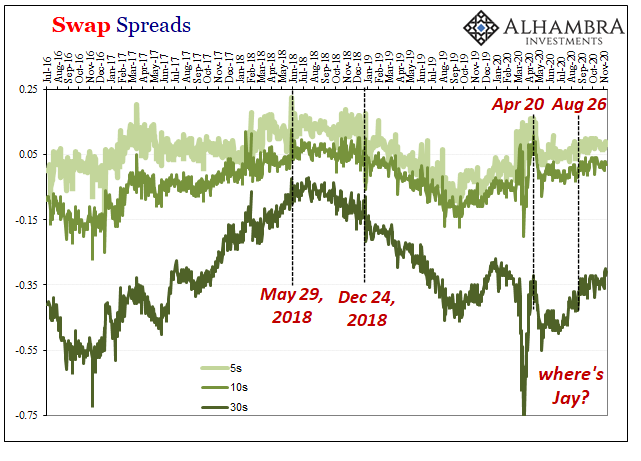

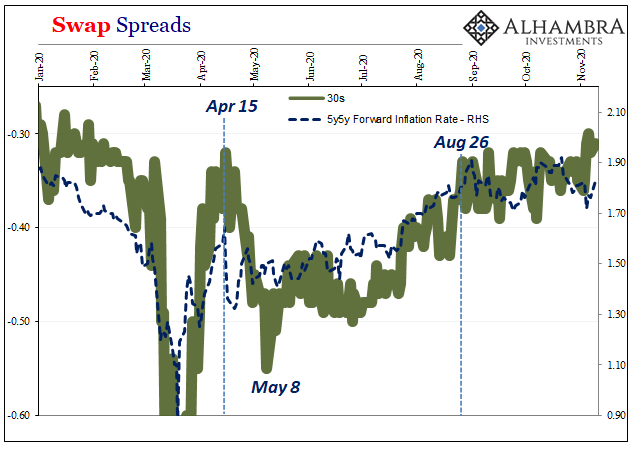

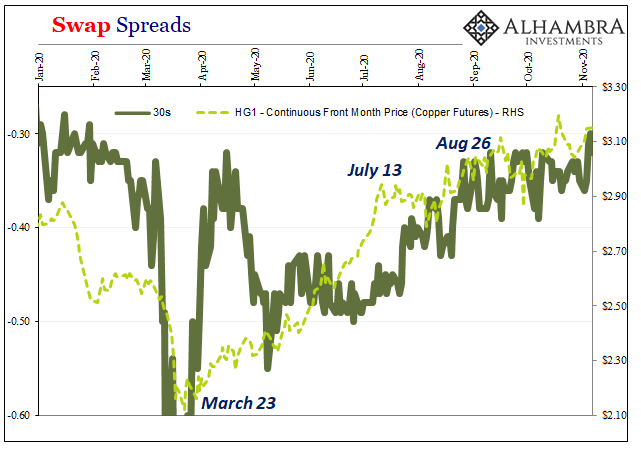

The thing is, there’s not been much movement elsewhere the past few days and weeks despite renewed reflation-ish euphoria. Even the vaccine news hasn’t sparked a widespread, blatant shift. Inflation expectations, a big one, haven’t moved all that much nor have, importantly, swap spreads. It’s all nominal rates recently.

Even copper has been muted despite what you’d think would’ve been the best news for it. A global vaccine for COVID should, those promoting it claim, bring the global economy back up to its prior booming condition within no time at all. Get China back up and running full bore and the mining business booming again (though Xi already has something to say about this).

It had been copper, more than many, which had bumped up into the initial rebound survivor’s euphoria. Though much of it had to do with supply cuts, like crude, up until July this metal was like stocks apparently on its way to the moon.

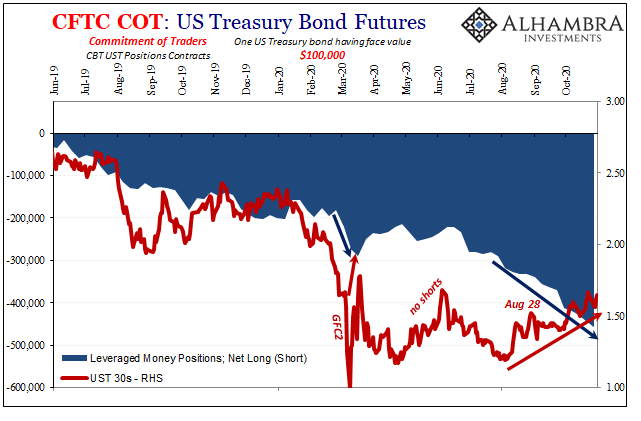

Instead, over the past week or so it’s pretty clear what’s been going on. The enormous short position at the long end of the Treasury market has been making all the noise. At each and every opportunity, those leveraged money specs have been using whatever news to short even more: first it was Election Day at the prospects for the “blue wave”; then last Friday the drop in the unemployment rate, ignoring the rest of the labor data; yesterday, Pfizer’s big announcement even though a vaccine doesn’t change much between now and 2022; and today right when Dr. Fauci said approval for it should be a done deal by next week, the long end which had been rallying stopped in its tracks.

At each of those points, Treasury prices got slammed (yesterday most of all) while other markets curiously sat mostly to the side. Even stocks (after the initially ridiculous buying surge which quickly faded). It is – so far – the absence of follow-through in key places which right now “should” be corroborating the alleged weight behind this latest BOND ROUT!!!!

The nominal jump in yields is nakedly oversized given the more muted response everywhere else. Even the US dollar’s exchange value against most currencies initially fell, as share prices rose, only to turn around and bump upward yesterday and today.

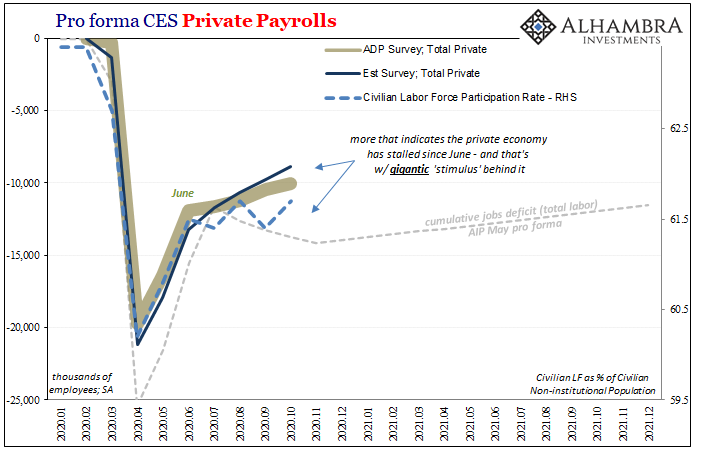

In short, vaccine-phoria looks to be limited to Treasury shorts rather than the broad-based recognition of stirred up reflation. Pfizer’s potential healthcare success notwithstanding, what realistically in the economy is changed by it between FDA approval next week and the end of next year? While the company ramps up production for global distribution, that leaves more than a year in between without answers for this:

Markets fluctuate, they surely do, and this year Treasury yields have understandably traded within a very narrow range. They weren’t going to do that forever, not with everything, seemingly, lining up against them. Gigantic positives in almost every economic account, massive QE, ginormous fiscal aid, the whispered prospects for digital helicopter drops, the DOLLAR CRASH!!!, election relief, the fact that a vaccine was going to be discovered at some point, and then the historic-sized speculative short long bond position gambling on one of those things being something substantial, something more than a news item.

What’s been holding down yields against all that? Some will always say it’s the Fed and QE, while in truth, from swaps to the dollar (staying stubbornly high – even DXY since late August) to less enthusiastic copper, it’s the yet-to-be-overcome risks of an intermediate term not just filled with COVID cases but more so the recognition that the global economy has truly been harmed by all that’s gone on in 2020.

And Xi Jinping Thought.

The rebound was good, but was it enough? Was it ever going to be able to be?

That initial wave of survivor’s euphoria gave way to more doubts and uncertainty as the (economic) situation changed over the summer. That ecstasy has been revived the past few weeks on a limited basis, a new though narrower form predicated on future extrapolations based off news events including the introduction of this vaccine “miracle.”

The path of least resistance continues to be reflation-ish. And even now, it’s suspiciously less than clear that this is the case. Markets fluctuate in the short run. That’s what they do. The real question is, has something meaningfully changed? And I don’t mean the 10-year hitting triple digits. Meaningfully changed.

It’d be nice, for once, if this was true. It’s been said to be true time after time after time after time, yet here we are. Again.

Stay In Touch