Stodgy and mundane, the very model of prudence and wisdom. That is what central banks are supposed to be, even in this new age transparency paradigm. The central bank being put on display for the public has been opened up for those very reasons. So you can be assured they are the very model of prudence and wisdom.

Constant tinkering and ad hoc changes, however, can lead one to think otherwise. Creativity and invention are afterthoughts in the modern economy, necessary prerequisites for our modern life. But there are some places where innovation just doesn’t belong. Last year, I referenced the LABOR SHORTAGE!!! as one; just pay workers what they want and you can find all that you need. No innovation required.

The same goes for central banks. Perhaps too many people view them as some sort of impenetrable black box, the wizards of mathematics who come up with beautifully complex equations to decipher the mysteries of the vast economic universe. In antiquity, the various Oracles scattered throughout the ancient peoples operated the same way under the same cloak of illusion. They were just getting high off the volcanic gases and spouting nonsense.

But it was, at least, interesting nonsense.

If a central banker can’t sit still, constantly twitching for a new program idea there’s the palpable sense they just don’t know what they are doing. Monetary authorities really shouldn’t have to go back to the drawing board so many times. This is not the place for constant experimenting.

To begin with, we are all taught from the very start these are the real masters of the universe. As Bernanke once bragged, there’s this thing called the printing press.

But that’s what 2008 really was; the markets indeed the entire global economy pleaded with the man to use it. Put up – or shut up.

Rather than the either, however, Bernanke opted to experiment. Not in money, but in various forms of the same puppet show. And, as the cliché goes, the show must go on.

Give the man credit. He came across as arrogant and wooden, but that’s exactly what the role demands. Like some character directly out of Hollywood central casting, Ben Bernanke really looked and sounded the part.

In terms of inflation expectations, a very important element to all this monetary policy trickery, the majority of the public applauded his performance. What is QE? Don’t know, but it sure sounds like that Bernanke guy does. His central bank and those around the world like his were given the benefit of the doubt even after botching 2008 so badly it halted the entire global economy for more than half a year.

The key to any performance, movie or live show, is the suspension of disbelief. You know what you are watching is all fake yet you become emotionally involved in the best of them because they give you enough for you to buy in. That was QE. With the media constantly calling it “money printing”, why not?

For several years, the show kept running. After, curiously, four of versions of it, Bernanke thought the routine such a success that he left it for his predecessor, Janet Yellen, to shut it down as her first major act.

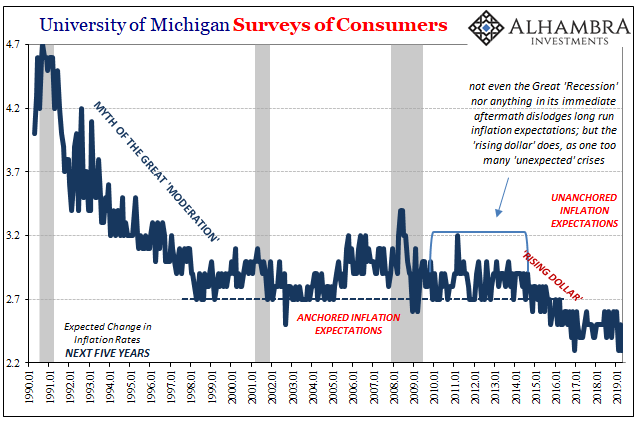

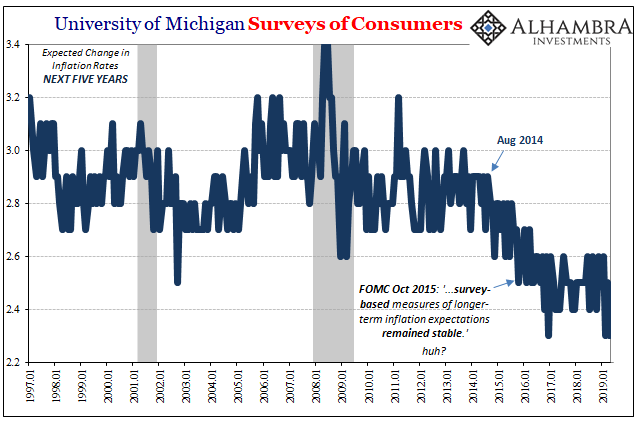

Without the puppet show, the public returned to their disbelief. Stepping out of the analogy now, long run inflation expectations tell us something important about how everyone collectively views monetary policy. Up until August 2014, according to the University of Michigan’s Surveys of Consumers, Americans, largely, were willing to see monetary policy as likely to succeed over the long run.

What that meant as expectations remained anchored was, yes, the economy was still a mess but there would come a time in the not-too-distant-future where one of these monetary experiments would finally pay off. The Great “Recession” had left a huge hole, a big indent in the economic trajectory but by and large people felt Bernanke and company given enough time would finally fill it back in.

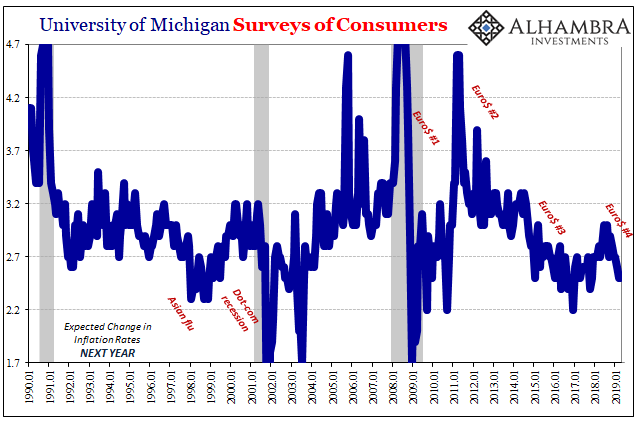

When oil prices started to crash in the summer of 2014, however, and no more QE puppet shows on the bill, what was left? More and more facing up to the prospects that whatever became bad all the way back starting in 2007 it may be beyond the grasp of central bankers to fix.

The fact that they keep on experimenting with new ideas tends far more to confirm that suspicion. In just the last few months, there’s talk of a brand new standing repo facility to do something about federal funds, the very thing that the Federal Reserve should be able to do blindfolded under water, and now officials signaling a desire to directly target the yield curve (even though, according to Greenspan, the yield curve isn’t independent of monetary policy).

For the month of April 2019, UofM’s survey showed just 2.3% expected inflation five years from now. That matches the lowest in the series history, a long history. It had previously been set in just one month toward the end of 2016, the lagging end of Euro$ #3. That low now registers in two of the last three months (February and April 2019).

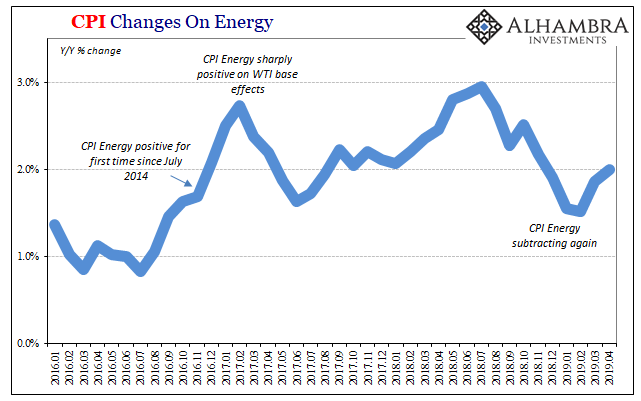

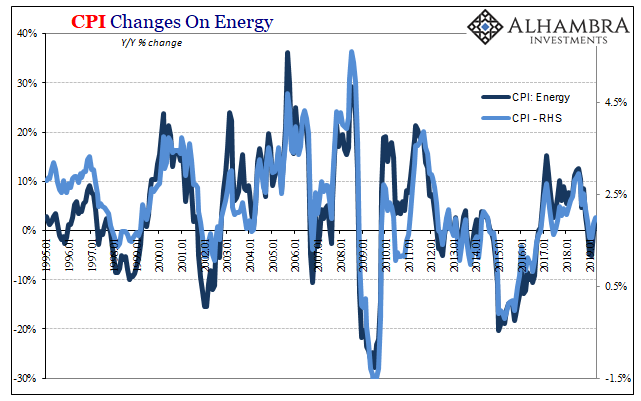

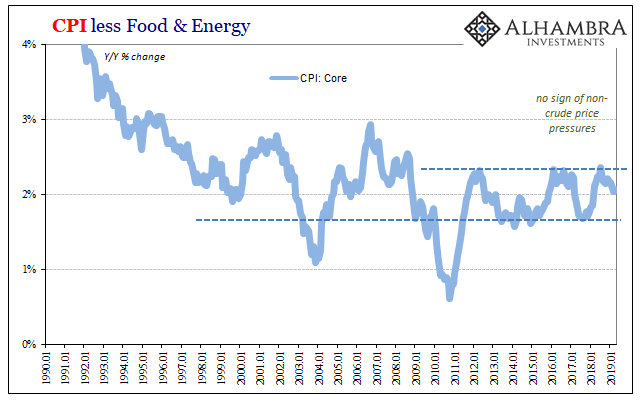

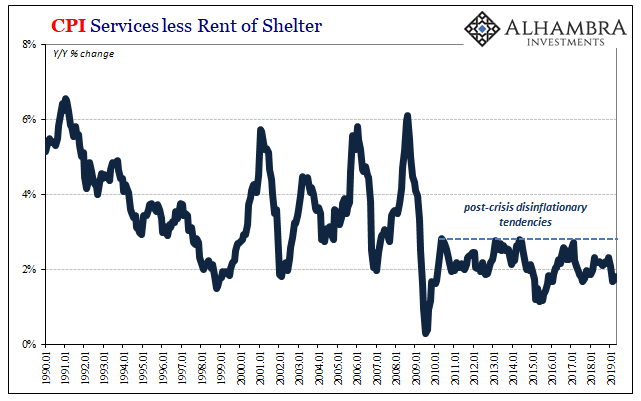

This is the context for the CPI as well as the PCE Deflator. Central bankers keep saying inflation is going to return to their normal. From there, the whole economy. What’s holding it back are “transitory” factors.

Recent inflation data merely confirms suspicion, more evidence for the surveyed position. The only thing transitory is when oil prices (or food prices in Asia) move up and make these various indices seem less glaringly contradictory.

In short, inflation data and expectations: Federal Reserve officials nor any of their fellow performers can fix an economy that’s still broken. Ben Bernanke’s chief contribution was exhausting, squandering so much goodwill and benefit of the doubt. For what?

In terms of monetary policy, it simply means the show’s writers are hard at work again rewriting the script, costumers and set designers freshening the look, and the actors brushing up their dialogue cues. It will certainly look and feel different. The public, before the production is even finished, already knows that it has seen this show before.

Stay In Touch