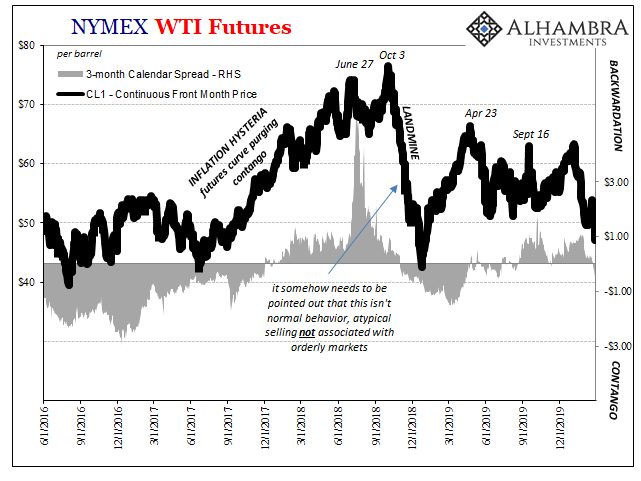

The WTI futures curve is supposed to be in backwardation, though the word “supposed” is a loaded term. Backwardation is more of an ideal condition than one you might find most often in practice. There’s almost as much contango as backwardation in the futures market’s history.

It’s not so easy to balance all the complexities that are spun through oil futures prices. For the unfamiliar, backwardation is when there is no reward for storing crude. If anything, storage is being punished and therefore an indication of physical oil on the move seamlessly (or nearly so) from producer through the pipeline to the ultimate end user wherever, nowadays, that may be.

Contango, on the contrary, there’s money to be made in rolling over physical deliveries. Parking it somewhere, absorbing the cost and getting paid a higher contract price down the curve. It’s an indication that there’s too much oil flowing in, or not enough being forced out of tank farms. Someone has to pay for the imbalance, and the futures market is where the paying takes place.

Contango isn’t a singular shape, however. Like the yield curve or eurodollar futures, you have to appreciate the nuances in how it moves and what that means when it ends up in whichever profile.

Ever since oil prices rebounded in early 2019, contango had been limited to just the front months. That’s where most of the trading is done, so it was an important indication nonetheless, but the rest of the curve behind those largely remained backwardated.

Even that much disappeared during the mini-hype from September 2019 forward, and has re-emerged again in 2020.

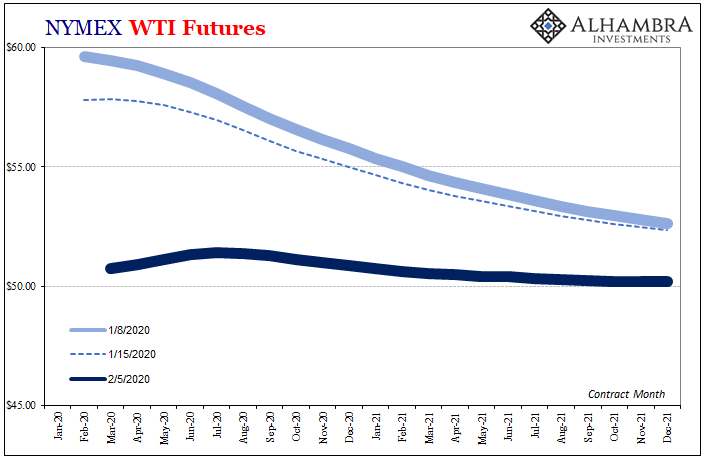

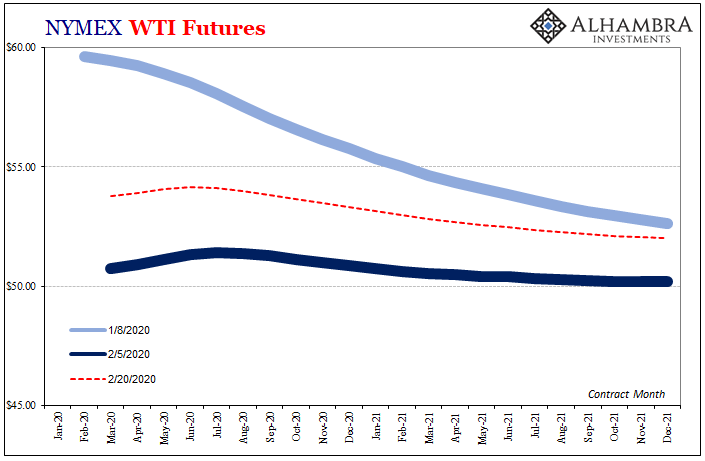

The latest move in the curve, though, is different. If we back up to early January and that last peak in oil prices, you can see and therefore better appreciate how the market has evolved.

Even as oil prices dropped from near $60 to around $50 (spot), the curve shape was as I described above: a little contango in the front and then pleasing backwardation the rest of the way down to the outer contract months and years where little trading takes place. It was a warning that the oil market was turning pessimistic, but not so much that it was a categorical shift beyond maybe coronavirus fallout sticking to the short run.

From early February to about a week ago, WTI had been rebounding in price where the futures curve retained its shape the entire way. Though overall prices were higher, not really much change in the outlook for risks.

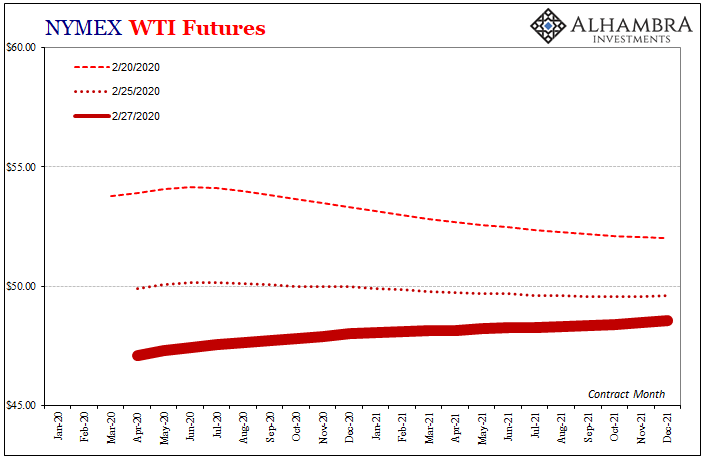

Over the last week, something clearly snapped. More than the plunge in stock prices, the curve has morphed into the same kind of shape it did back in October/November 2018 – the first warnings of the impending landmine. Instead of backwardation past some minor initial contango, it’s now contango the whole way.

What I wrote at that time goes for today, too.

It may be that the reappearance of contango ultimately proves to be nothing more than a transitory factor that the market will sort out in good time. Then again, it might be like the summer of 2014, the first big step toward ugly.

Contango is term oil. The comeback of contango right now, at this critical juncture, is turmoil.

Today’s WTI curve is more in line with the shape that predominated during the oil crash of 2014-16; you know, the “supply glut” that turned out to be a worldwide economic disaster. Contango then was all about demand since the futures market, a market where investors contemplate everything about the future, had every bit of advance warning about the surge in US supply flowing in from the shale projects.

What had changed was perceptions about global growth; it was supposed to explode as the rest of the world joined the US and its “best jobs market in decades” on the road to happy recovery.

Except, Euro$ #3 got in the way and spoiled that once-anticipated surge in economic therefore crude oil demand. That’s what had changed, in a big way. This kind of contango highlights more serious doubts – those that last (few) time(s) proved to be well founded.

Like eurodollar futures and the yield curve, the WTI curve is expecting big things (again), just none of them good. These markets are pricing in steeper rate cuts (not just their renewal) as well as how despite them it’s going to upset the delicate physical balance of black gold.

It’s a clear escalation of an already precarious situation, a potential change in situation that extends beyond the threshold of virus-laden fears.

Stay In Touch