The concept of an economic “false dawn” was almost entirely unfamiliar to the postwar US experience. We came close in 2002 and the first half of 2003, but eventually the housing bubble era took over. The dot-com recession was mild, sure enough, somehow, though, recovery seemed so elusive for a longer period than the contraction itself.

There is supposed to be symmetry in these business cycle swings. In fact, there had been in each and every recession between the Great Depression and the dawn of the 21st century. It was so dependable that Milton Friedman in the nineties finally published his “plucking model” version of the economy after having sat on it for twenty years waiting for more business cycle evidence to confirm it.

It would stand to reason, then, given the scale of the economic disaster in 2008 and the first half of 2009, the recovery that came out of it should have been equal in the opposite direction. At no point during the last decade did that ever seem likely.

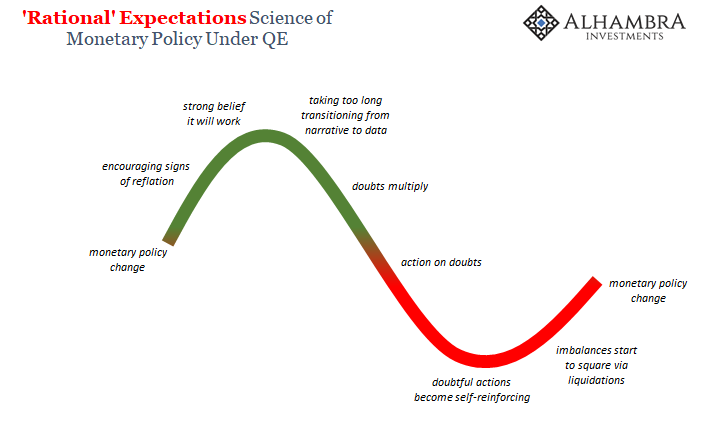

In the middle of 2014, though, policymakers were beginning to think for a second time there was a chance. Having learned very little from their 2012 experience, officials were primed for success so close they could feel it (emotion, not rational analysis). That earlier year had begun seemingly on a high note, too, even after what had just happened in 2011, a high degree of optimism permeated the landscape which ended instead with two additional QE’s and an economy near to recession.

For QE’s 3 and 4, in 2014 this time would be different. Chairman Yellen wandered up to Capitol Hill in July to testify before the Senate Committee on Banking, Housing, and Urban Affairs. Her theme was the labor market. It was clearly improving; therefore, the likelihood of a false dawn had been greatly diminished in the official models.

Based on this view, the FOMC first under Bernanke had begun to taper the last two QE’s and then under Yellen they were expected to be terminated entirely.

It was actually Yellen who brought up “false dawn” in testimony. In attempting to be more modest, she referenced how the economy was recuperating mostly as expected with officials most proud of the way things were going for payrolls and employment. However, as Yellen admitted to Chairman Tim Johnson:

Ms. YELLEN. But the Federal Reserve does need to be quite cautious with respect to monetary policy. We have in the past seen sort of false dawns, periods in which we thought growth would speed, pick up, and the labor market would improve more quickly, and later events have proven those hopes to be unfortunately overoptimistic.

She never really got into why this had been the case. Things seemed to be going in the right direction and then they didn’t; the recovery had before been halted. Why?

It was Senator Mike Johanns who would press Ms. Yellen on the issue, quite perceptively using the labor market in framing his damning admonishment. It seemed like the unemployment rate hadn’t been a complete measure.

Senator JOHANNS. The Fed has said that you look at the labor market. You have just reiterated that in your testimony. Originally it seemed like the benchmark you were trying to achieve was 6.5 percent [unemployment rate]. It is now 6.1 percent. But to me, that does not tell the story.

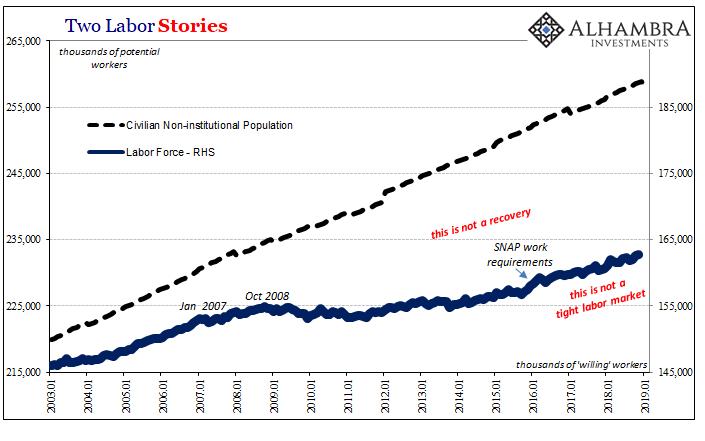

The Senator from Nebraska politely asked the Federal Reserve Chairman her thoughts on how there could be so much as a hint of recovery when labor participation in 2014 was as low as it had been since the Carter administration. Furthermore, what Johanns was specifically looking for was a clear response from Janet Yellen about how this maybe should have an impact on monetary policy and therefore analysis of the overall economic situation.

Was there really much to be optimistic about?

Knowing full well today that 2014 was, indeed, another false dawn, the relevant portion of Yellen’s response to Senator Johanns should be plastered in massive letters into the façade of the Marriner Eccles building, the Fed’s headquarters in Washington.

Ms. YELLEN. But when we see diminished labor force participation among prime-age men and women, that suggests something that is not just demographic. And so my personal view is that a portion of the decline in labor force participation we have seen is a kind of hidden slack or unemployment.

Personal view, fine, why wasn’t it her professional view, too? As a keen student of John Maynard Keynes, Janet Yellen didn’t bring up his views on deflation. She should have. Nothing wrecks an economy starting with the labor market quite like it. And as the Fed Chairman was admitting before the Senate, yes, there did seem to be a significant “hidden slack or unemployment.”

The cycle merely repeats, only this isn’t the business cycle. Having lived through Bernanke’s false dawn in 2012 and then Yellen’s two years later, the only question today is whether the third false dawn (2017) is written down in Jay Powell’s column. In truth, they all belong to the Federal Reserve, the institution’s only true standard of measure.

The unemployment rate, of course, fell below 4% in the middle of 2018. Once again, many people mistook this for a definitive economic signal of recovery when they should’ve remembered Yellen’s personal reservation. By then, markets had already turned into the red as I noted at the end of last June:

Doubts have multiplied and I think we are back somewhere in the red again. There are way too many indications pointing in that direction – so many that officials have been forced to address this situation, even if their tempered explanation is childishly nonsensical.

In the mainstream there was T-bills, nuclear war in Korea, inflation hysteria, Italian populists, Brazilian populists, English populists, etc. No one would’ve pegged the unemployment rate for the big problem, and surely not in suggesting why things weren’t turning out to be so boom-y.

The only two things that mattered belonged to Keynes – deflationary pressures (eurodollar) and what they do in keeping the labor market dangerously under wraps. The (global) economy can just never recover and therefore remaining in a precarious, weakened state it is susceptible to green turning into red.

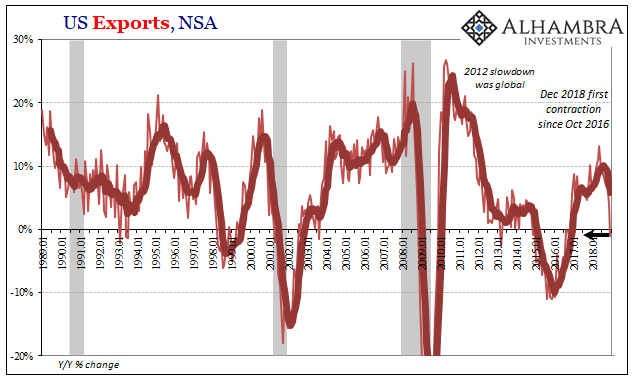

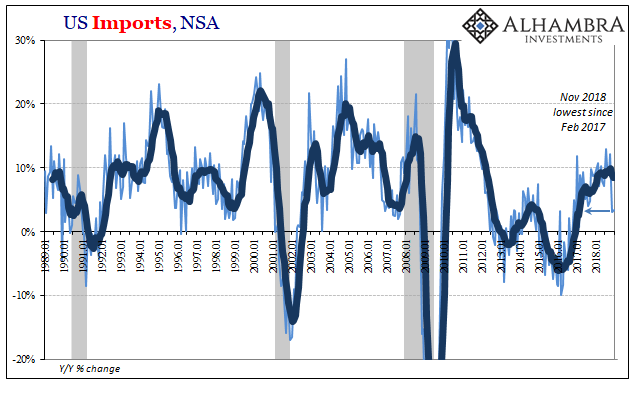

The Census Bureau is still catching up on the end of last year with its various data. In terms of US trade, what they are now seeing in it is red, red, red. Global trade had already succumbed, the US merely lagging along the same direction.

US exports contracted in December 2018 (-1.1%) for the first time in more than two years; since the last eurodollar cycle downturn. Imports were up if just barely (+3.4%) for the second month in a row. November and December together certainly seem to suggest something substantial had changed in terms of US demand for global goods (and it wasn’t just petroleum prices).

The asymmetry of this economy is showing up yet again, more and more 2017 proving the third false dawn. For many people, this is wildly unexpected and because of this recency bias they believe it cannot be anything significant; the boom temporarily disrupted by transitory factors soon to be easily forgotten. The reason they think this way, quite simply, is the unemployment rate. It isn’t really the dawns that have been false.

Stay In Touch