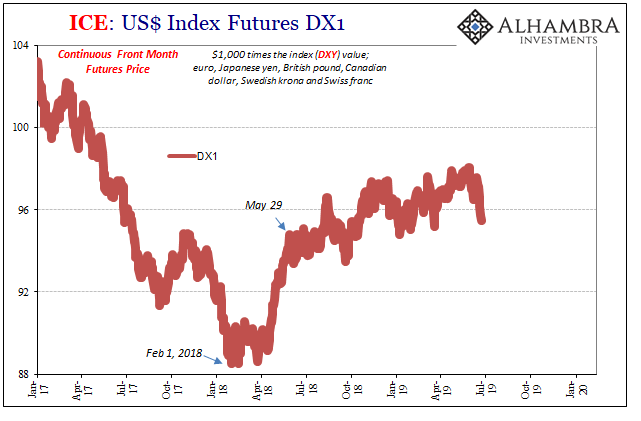

Back last June, the dollar had broken its upswing. DXY, one major dollar index, had fallen sharply as had most if not all of the rest. This one had given up most of its “gains” in a relatively short period. That said, to some, the greenback had definitely hit its high. All downhill from there.

It didn’t help, supposedly, that the President was almost regularly tweeting his disapproval of both the US currency’s direction and Jay Powell’s. At least with the latter the Fed Chairman finally seemed to be coming around. Rate cuts were becoming a certainty.

Which, we were told, would only undercut the dollar’s ability to stay aloft. The President, the trend, and the Chairman. What could possibly keep the dollar moving higher when so much, allegedly, was stacked against it?

After a four-month rally, the US Dollar Index — which tracks the greenback versus a basket of six other major currencies — has fallen 1.6% in June, nearly negating all of its 2019 gains.

But it could fall even further, depending on Trump’s negotiations in Osaka, Japan later this week [June 2019].

Another one from the same time:

A growing chorus of analysts have started to pencil in expectations for a weaker dollar in 2019, particularly as expectations grow for Federal Reserve rate cuts. Fed-funds futures, which six months ago were forecasting official interest rates to continue rising this year, now reflect trader expectations for as many as three cuts before year-end amid fears rising trade tensions could amplify a global economic slowdown.

Here’s Morgan Stanley’s currency analyst (one of them, anyway) on June 10:

We turn bearish on USD. Recent USD weakness may accelerate as long positions become unwound, particularly against AUD and CAD. Rest-of-World weakness is likely to cause investors to move forward market expectations of Fed cuts, weakening the USD and lowering front-end interest rate differentials. We suggest fading USD rallies. DXY has broken support at 97.50. A break below 96.95 suggests further tactical downside momentum

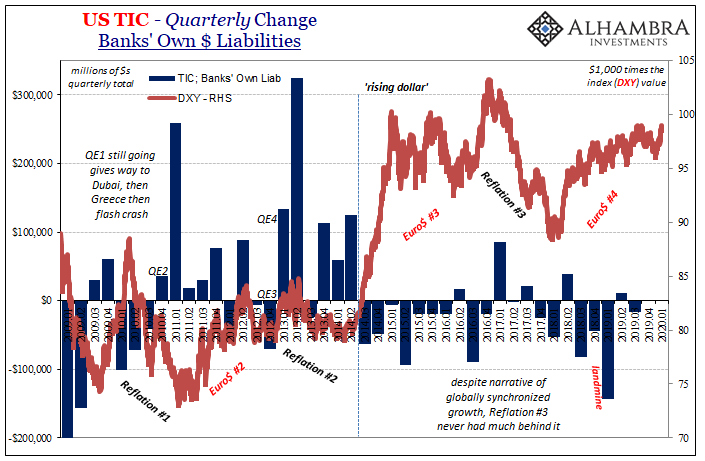

The dollar index in question would actually get as low as 95.487 by June 24. And then it promptly turned right around and moved to another new high by October – despite two (then three) Fed rate cuts premised upon global headwinds and disinflationary pressures.

That’s the part everyone seems to be missing. It amazes me in this day and age how the “currency experts” are experts only in reciting shorthand and myth. These aren’t separate things, meaning the thing which is weakening the global economy is the currency at hand.

And it gets to be reinforcing, this upward trend. The more the dollar destroys economic momentum, the more momentum it will pick up for its next rise. It just doesn’t go in a straight line.

Forgetting (not carefully observing, or not caring) about what happened in June, the experts again pounced when DXY seemed to put in another “top” last October. Poking above 99, over the next several months the dollar weakened at the same time sentiment improved. This time was even more assured than in June, the rising dollar was done. Kaput. No way in hell it could possibly get back up again.

It would fall as low as 96.058 by the end of 2019.

But had anything really changed; I mean, substantial, meaningful changes in money as well as economy? Some central banks did some things and it wowed the usual suspects susceptible to being wooed and wowed in such a way (the entire financial press). Outside of that, though, 2019 really had ended badly despite all the robotic hope and hype.

Because of it, a renewed King Dollar wasn’t that hard to figure for 2020. Sure, coronavirus and what it might mean for the global economy. That’s the point, though. The pandemic by itself isn’t (yet) that big of a deal and though markets might be looking ahead to more extreme negative scenarios there’s been plenty to be worried about right here and now.

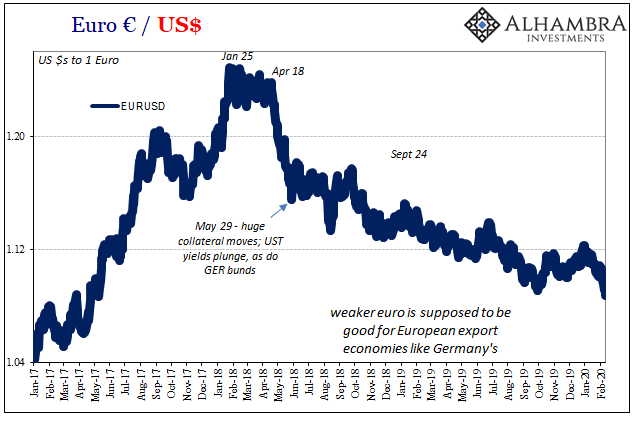

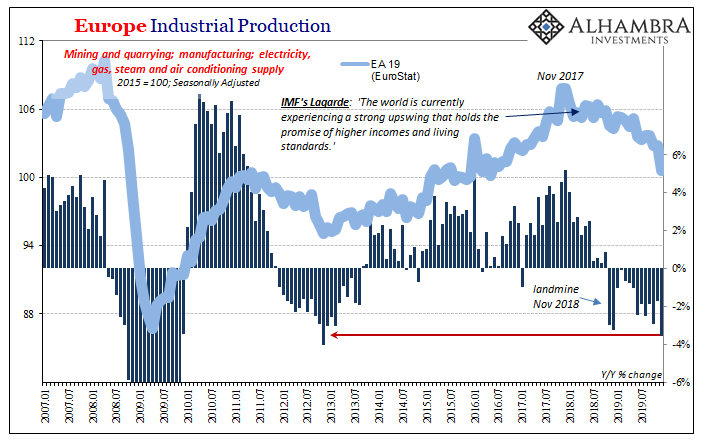

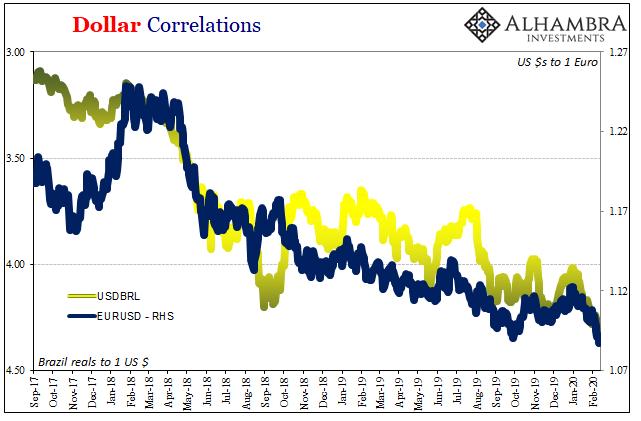

Starting with Europe that can’t seem to peg its bottom. It’s been foretold for months, instead that economy keeps doing the opposite of what everyone says it is supposed to. They all whispered how it got better in December; nope, sharp pick up in the downside direction which is now spreading to the whole of the European economy outside of just Germany.

More than China’s COVID-19, that likely explains the euro and its part of DXY. The risks from Europe are rising and so the dollars become that much more expensive (scarce) from and to there. Unsurprisingly, to us, that just transmits the shortage elsewhere to other still-vulnerable locations like Brazil or Argentina. The latter’s capital controls have been heightened, and yet the peso keeps leaking lower by the day.

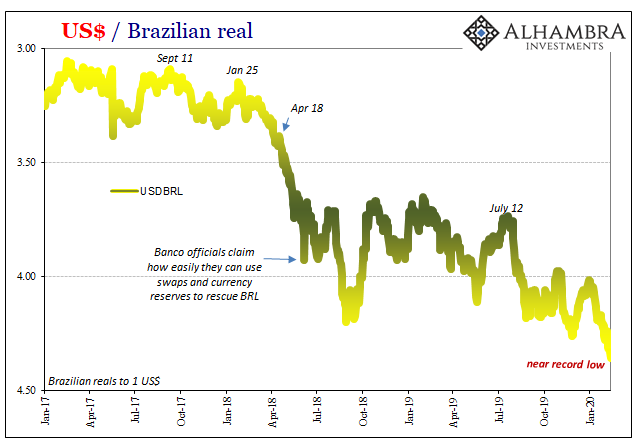

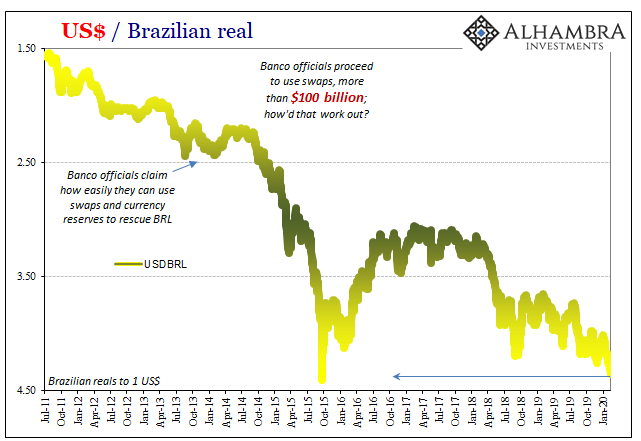

As for Brazil, the real is within spitting distance of a record low even though its central bank has promised the economy is and will be booming (sounds vaguely familiar) and that it can control the currency if it so chose. Which only raises the question of what they might be waiting for.

The answer, as usual, is all these predictions for the dollar’s demise. It’s been two years – TWO YEARS!!! – and it’s got to turnaround one of these days, right? I mean, Trump, rate cuts, deficits, foreigners selling UST’s, everyone hates it.

If you are the head of Banco do Brasil and the entirety of US officialdom keeps telling you the dollar’s going lower, that everyone wants the dollar to go lower, you tend to listen (because you are a central banker who, by your very nature, is immune to learning).

All-star @JeffSnider_AIP is back with a year-end review and 2020 outlook for the U.S. Dollar and the Eurodollar systemhttps://t.co/Ixsm426WiX pic.twitter.com/FFh8jkKJsv

— MacroVoices Podcast (@MacroVoices) December 23, 2019

DXY just matched October’s high today. Not coronavirus, rather a pretty clear sign Euro$ #4 isn’t done. We see it in the data, more so by the day, and it’s in the markets. Not just repo.

Global dollar shortage = globally synchronized downturn. The one creates the other, and then both feed on each other. Especially since 2014.

Stay In Touch