For a cabal of superpatient supergeniuses, the Chinese tend to play with fire quite often. According to many, the Communists have perfected the art of technocracy and are merely waiting out the impetuously free West. The dollar system will destroy itself (there’s the kernel of truth) allowing a perfectly positioned China to swoop in and rescue the global economy with its scientifically specified yuan.

Some even have gone so far as to claim the new world order of CNY will surely be gold-backed.

I’m sorry but I just don’t see it. The Chinese to me resemble an increasingly frantic regime pushed around by forces way, way beyond their control. In a vain attempt to placate them, authorities continually appeal to the dangerous and disproven. That doesn’t strike me as patient choice, more like running out of choices.

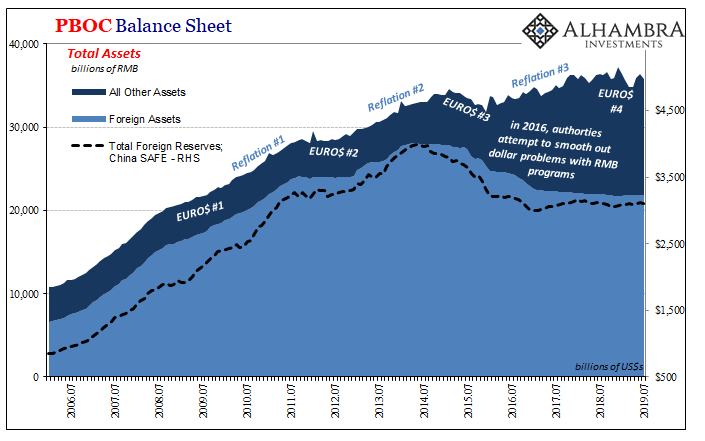

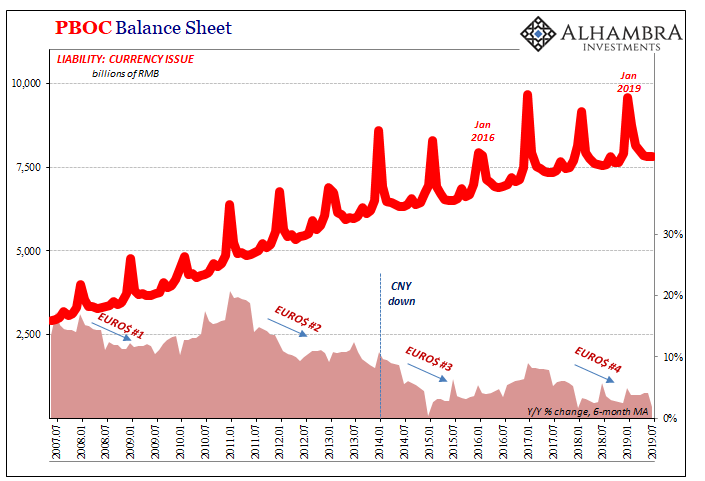

What you cannot help but observe from the central bank is an obvious position of weakness. The PBOC’s balance sheet does not grow. Period.

The reason is very simple and straightforward – there is no “hot money” or “capital inflows.” The essence and telltale sign of the eurodollar squeeze or dollar shortage. The foreign money that used to make its way onto the central bank’s balance sheet, the true basis for the RMB system, just isn’t there. In fact, it is still disappearing.

The only difference between now and 2015 is that authorities seem to have learned something about “selling UST’s.” Unlike what’s written in the Economics textbook, it doesn’t make things better rather it tends to make things worse. Much worse. Therefore, you can understand why they might purposefully avoid doing so as much as humanly possible (as I talked about in detail here).

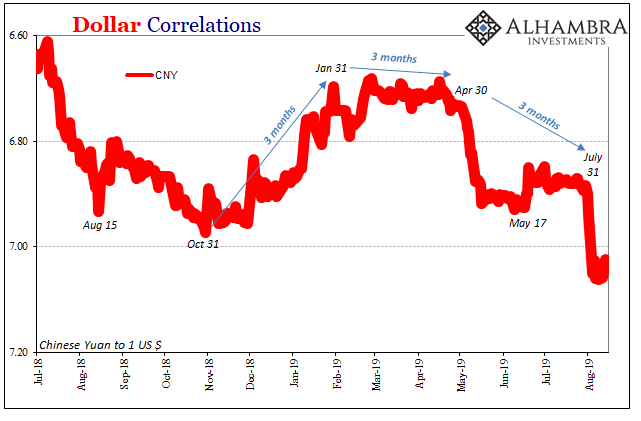

That meant just letting CNY plummet during the middle of 2018 and then in all probability coming to its rescue once it neared 7 at the end of last October (coincidentally just as the global economy struck that eurodollar landmine). This put CNY on its regular three-month interval; again, a display of barely hanging on.

Combined, the lack of balance sheet growth plus all these ticking clocks has meant diminished monetary capacity. No central bank would voluntarily choose to run their printing press in reverse unless it was an option forced upon it by an array of only bad options. The least worst doesn’t sound like policymakers in control of the situation.

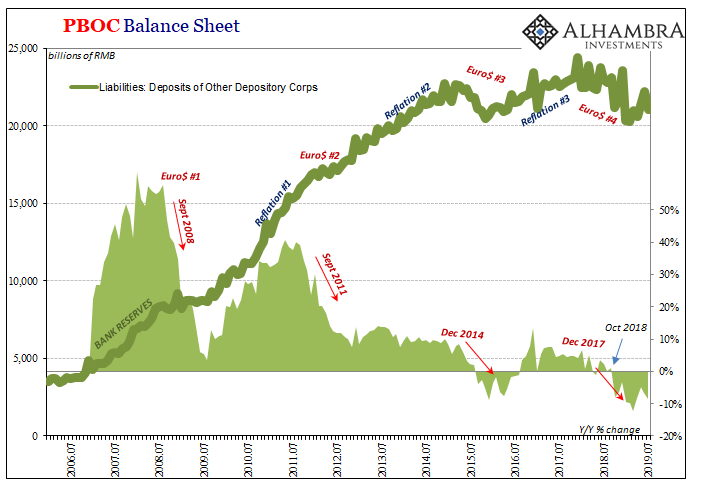

Indeed, because of this background, the RMB money system continues to be bled drier. The latest statistics for July 2019 show overall bank reserves falling by a little more than 8% year-over-year, the largest decline since March. It has now been a steady retreat since last October (imagine that).

Only trying to maintain good working order, systemic liquidity at minimal levels, the central bank has attempted to offset this deep, sustained reduction in bank reserves with RRR cuts. Essentially, if the PBOC is going to cut back overall reserves it hopes that the private system will make up for it by being freed to use more of its own previously locked up.

Therefore, RRR’s are not stimulus as everyone always says they are a convoluted attempt trying to manage the internal money system starting already within a huge (and growing) hole.

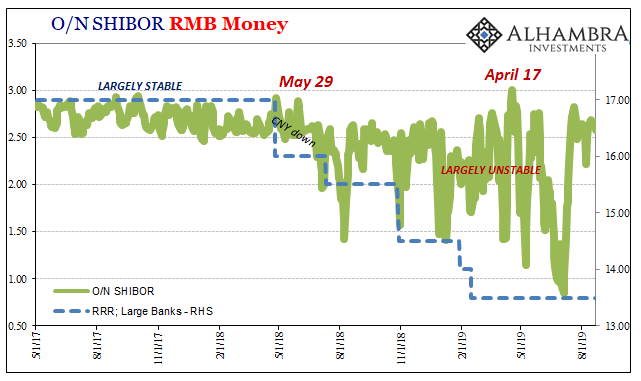

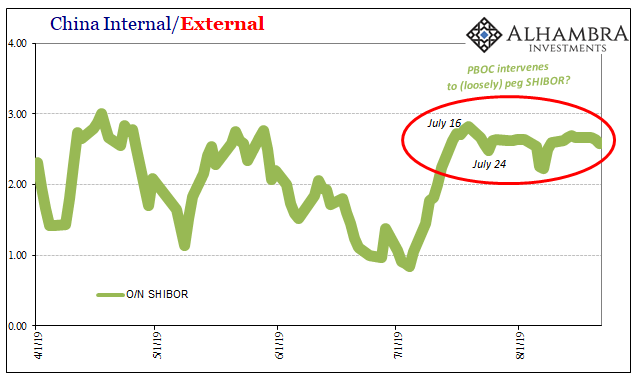

The results have been, to put it charitably, uneven. Ever since the PBOC started down this road (for a second time) the primary liquidity measure (overnight SHIBOR) has become a wonder of instability. The unsecured interbank market this year has been practically schizophrenic, roaring back and forth from one extreme (multi-year lows) to another (multi-year highs).

As the primary overdraft market, this is hardly the situation conducive to short run effectiveness let alone some key provision in the successful execution of a long-range plan for world domination. The PBOC, in all likelihood, has come to see it this way, too.

By almost surely taking over SHIBOR, the central bank is admitting the RRR offsets are just not working. But the PBOC has no choice except to continue contracting bank reserves. Thus, in swoops yet another convoluted stab at stability. The near-peg to overnight SHIBOR comes as several line items on the PBOC’s asset side of its balance sheet (RMB programs) show a modest uptick in July.

It seems that no longer trusting private banks and RRR’s, the central bank is back to (over)managing short-term liquidity so as to grab hold of a harmful situation nowhere near under control.

The reason for this far less-than-desirable situation in bank reserves and interbank markets is also quite simple. Currency.

To produce even historically small increases in RMB currency issue, the lack of balance sheet space requires the central bank “pay” for them somewhere else. That somewhere else is bank reserves.

Even as the latter declined sharply in July, that only carved out enough liability space for a minimal 3.5% year-over-year increase in currency issue. The 6-month average is just 1.8%, the second lowest on record, but that’s distorted by February’s Golden Week. The average growth over the last five months is just 3.1%.

To reiterate: I fail to see an enlightened group of long-range thinkers expertly and patiently executing the perfect plan combining all the best and right pieces in all the best and right ways. In my view, this is all evidence (on the central bank’s balance sheet!) of increasingly desperate bungling officials throwing whatever they can at the wall and just hoping something sticks; buying them just enough time that through nothing more than sheer random good luck it all just goes away.

This latter view would seem to fit with the idea of Emperor Xi, who has to be less than thrilled about what’s going on and what top officials are telling they can actually accomplish. Realizing the lack of any good options and what that truly means, he is taking proactive steps to maintain himself, and the Communist government, in the growing expectation there’s not much chance he or his court can realistically do anything about it.

Stay In Touch