After constantly running through what the FOMC gets (very) wrong, let’s give them some credit for what they got right. Though this will end up as a backhanded compliment, still. After having spent all of 2018 forecasting accelerating inflation indices, from around New Year’s Day forward policymakers notably changed their tune.

Inflation pressures that were in December 2018 building underneath leading officials to fear a harmful breakout, by January 2019 they were suddenly “muted.” What’s more, this flip flop occurred in between Chairman Powell’s press conference justifying what will be the last rate hike and the publication of the meeting minutes for the same meeting.

Same FOMC planet, totally different inflationary worlds.

I wrote back in January:

Something big is clearly missing, and the official minutes admitted this fact (in their own muted fashion).

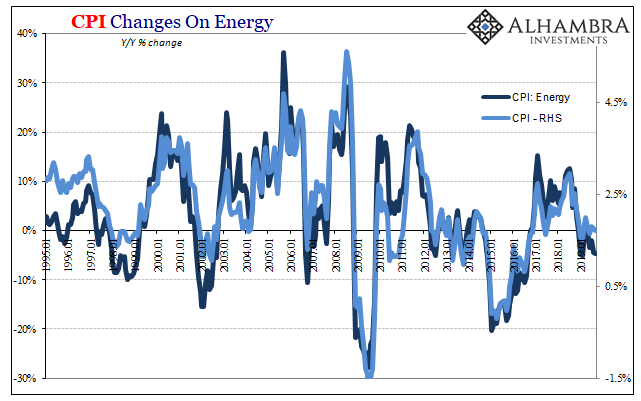

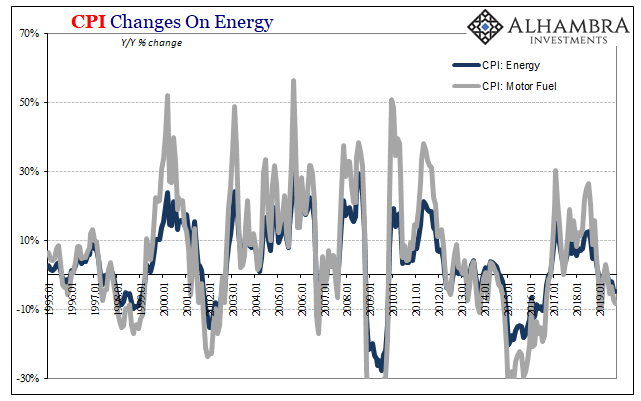

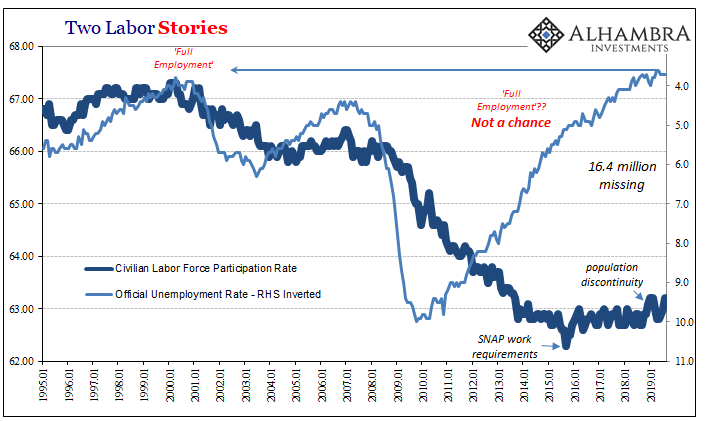

Of course, this is all theater. The only thing moving the CPI was WTI not wages. That didn’t stop the media from playing along with its constant, fatuous writings about the non-existent labor shortage. The LABOR SHORTAGE!!!! was nothing short of emotional projection (including the Beige Book).

The greatest boom in decades has turned out to be the most fragile boom ever; therefore, it wasn’t a boom.

Ultimately, that’s what Powell and the rest finally fessed up to. The inflation indices were being moved around solely by oil prices, and therefore the PCE Deflator hit the Fed’s target for that reason alone. Not wage pressures or any other economic factor which officials had been counting on to confirm their boom views.

At some point, the boom had to boom. By the end of 2018, they finally realized it never did.

Or, at the very least, the situation was more complicated than it was made out to be. The official FOMC position is still that there was a boom, but because of labor dynamics and structural forces it was very different than prior booms.

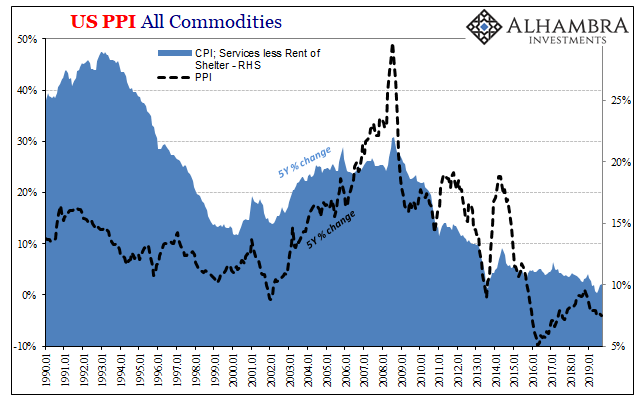

Again, let’s give them credit for getting something right. As I pointed out earlier this week with the CPI’s cousin, the PPI, prices are as much about ability to pay them as anything else.

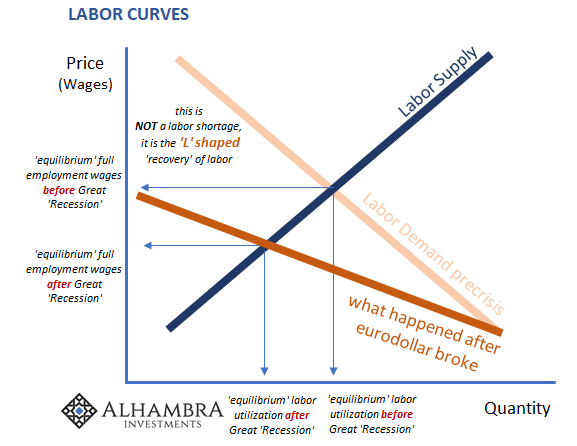

We are herded toward believing that businesses in particular are harmed by rising input costs; and on an individual level that’s true. Systemically, however, input prices especially those of commodities tend to be rising significantly when things are going well. When businesses can pay more for inputs (including labor) they will, focused instead on the top line.

It’s the same thing on the consumer side. If workers aren’t working much and aren’t getting paid a huge amount when they are working, companies just won’t be able to pass along higher prices to them. You can’t spend what you don’t make. Whereas businesses perhaps over-manage their cost structure during times of extended malaise and lethargy, consumers pinch pennies far more than they might under a different set of circumstances.

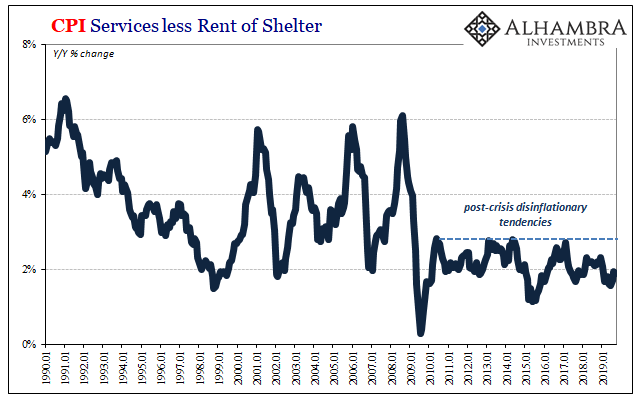

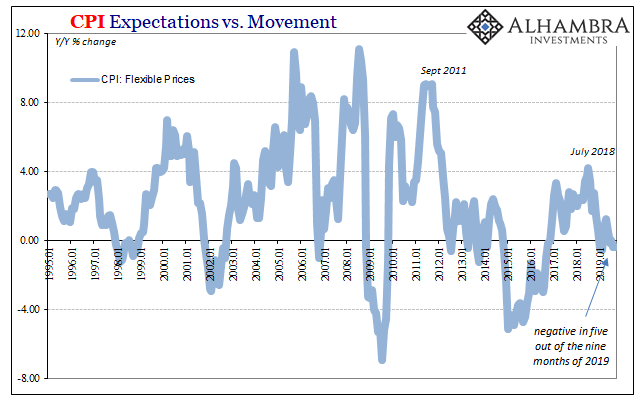

Thus, when separating the rest of the CPI from oil, no surprise that’s what we find. Of the various “core” inflation measures, especially the one for services, when we look at it on a longer time scale what you see is this inability of anyone, business or consumers, to pay higher prices. Inflation doesn’t happen – disinflation does simply because the economy has yet to come anywhere close to a boom.

In other words, as is typical, when Powell gets something right it’s more of an accident because he always gets the big picture wrong. He ends up (eventually) admitting to reality, but missing the boat as to why it happened this way.

Despite all the QE’s, all those bank reserves, there is no denying the trends here post-2008.

Imagine that, a monetary break disrupting the whole economic trajectory especially the inflation trend. It’s hard to take Economists seriously when they try to say it was all must some misunderstanding, some big cosmic accident (R*) of bad timing.

Rather, all the evidence keeps pointing back in the same direction. At the Federal Reserve. The economy very conspicuously switched to one of at best low-growth not because of aging Baby Boomers and increasingly drug afflicted American workers, as well as those who supposedly refuse to go back to school, the changeover was made very clearly in 2008.

What was it that happened in 2008, again? If you ask Jay Powell, he’ll probably give you one answer today and then a different one tomorrow if more convenient. Especially as more and more that downside trend re-emerges (for the fourth time).

Stay In Touch