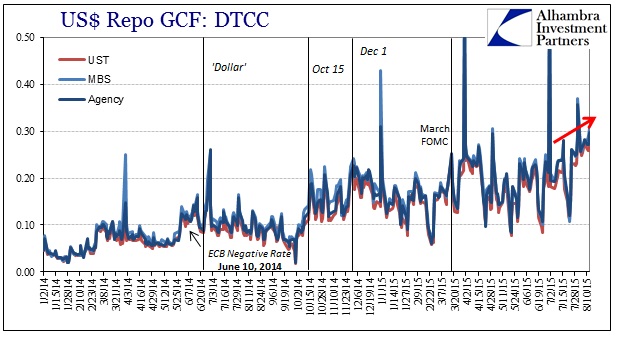

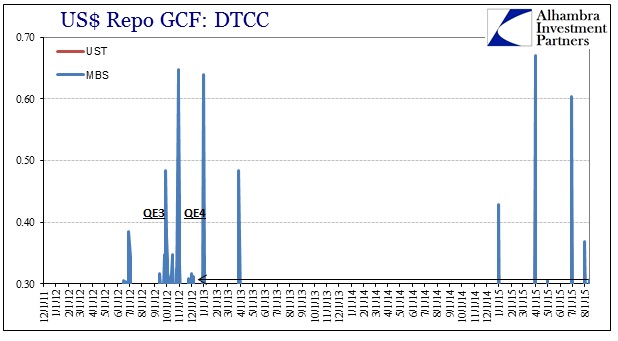

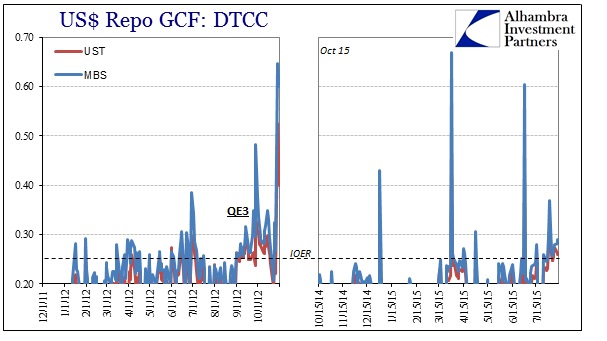

Not that we needed another reminder about liquidity, but the GC repo rate (indexed) for MBS on August 12 was just posted at 30.7 bps. That is the highest non-quarter or month-end rate since just before QE4 in December 2012. The UST repo rate, as well as the agency rate, was of similar proportions and comparisons at just under 30 bps.

All the usual caveats apply when interpreting repo activities, including and especially that DTCC’s figures are only what is known and posted. The vast majority continues as bespoke and bilateral, so there is a great deal that is just assumed. However, given what we know of the state of the “dollar” today, it seems not just plausible but completely reasonable that the DTCC numbers are not only germane but maybe even a tad toward the optimistic.

In any event, it is getting rough out there and helps presume the PBOC’s dilemma. Time yet for QE5?

Stay In Touch