Numbers really don’t tell us much all by themselves. Context always matters. That’s why 19th century British statesman Benjamin Disraeli claimed there are three kinds of lies; lies, damned lies, and statistics. Numbers employed in isolation are either misleading or useless. In the 20th century, Darrell Huff wrote in his classic How To Lie With Statistics:

Averages and relationships and trends and graphs are not always what they seem. There may be more in them than meets the eye, and there may be a good deal less.

That’s always what struck me most about “globally synchronized growth.” Even while it is was in full swing during 2017, it was at best a midget. The numbers all looked good until you put them into some context; any context. There was a good deal less to it than how it was ever described by anguished central bankers eager to be let off the hook for an unrelenting decade of malaise and failure.

In market terms, it was the commodity space which seemed to be most friendly for them. The prices for real stuff, particularly base metals, these are always reflective of real economic conditions. The fundamental laws of supply and demand with actual physical things, all of which pointed toward an absolutely brilliant breakout.

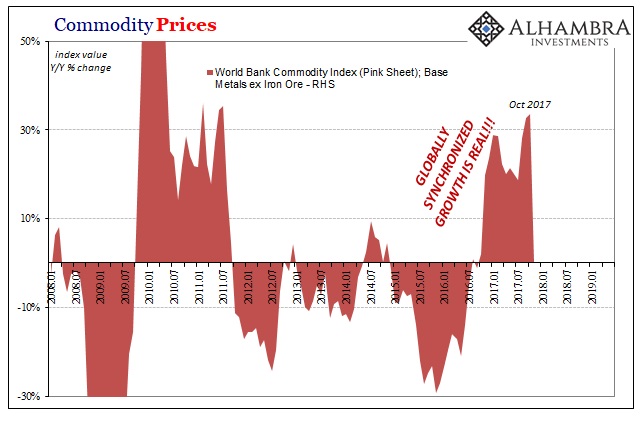

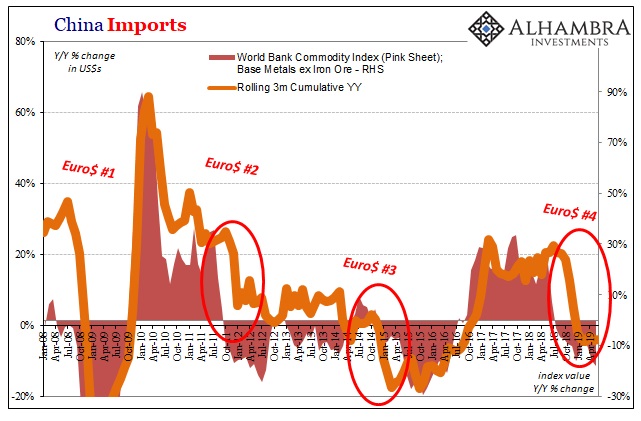

By the start of 2017, base metals (excluding iron) in the aggregate (according to the World Bank’s data sheet) were rising by almost a 30% annual rate. The global economy hadn’t seen that kind of “optimism” since the early days of “recovery” back in 2010 and the first half of 2011.

For a central banker or Economist looking to put 2015-16 behind, speaking constantly about “transitory” factors merely delaying the inevitable inflationary breakout, this was it. How tantalizing it must’ve looked, to have the commodity space be on their side for the first time in a very long time.

Looking at these growth rates, officials all over the world would certainly have colored their economic analysis with these substantial gains. How could +30% price changes have been anything else?

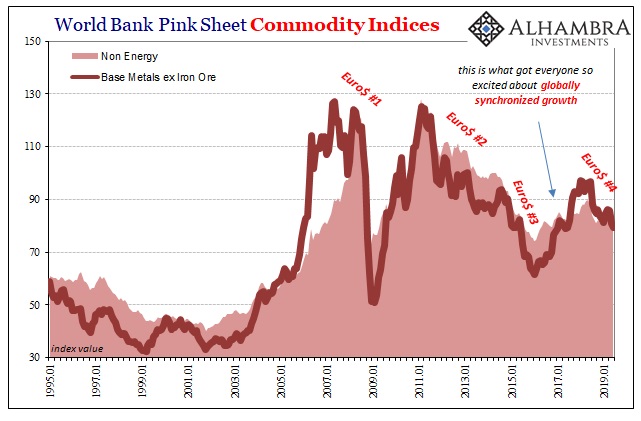

Quite easy, actually. When you put those numbers into some relevant context, the context of the post-2011 era, they really weren’t impressive at all. In fact, you might have got the sense that rather than indicating things had changed (for the better) it all just confirmed how nothing had.

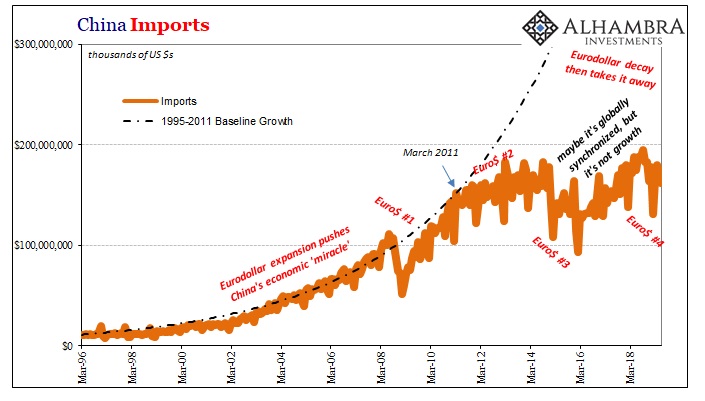

Nothing ever goes in a straight line, a fact which would include the downward spiral following after Euro$ #2 in 2011. In fact, that’s really the only message on the board here; that it was this second global monetary eruption three years after the first which really killed any chance at a global recovery. The very idea had been dead a long time before 2017.

Despite the impressive price increases in that year, these really were nothing more than base effects of those commodities having been beat down by near unrelenting monetary deflation that had lasted for years. Rather than see 2017’s gains as moving in the right direction, the proper reaction would’ve been to wonder, is this it?

A global inflationary breakout wouldn’t just need inflation, it should also have at least a little breakout.

This alternative though more appropriate view of Reflation #3, for that’s all globally synchronized growth proved to be, recognized all along the bait and switch. As commodity prices, no matter how impressive the year-over-year changes they were still tied to fundamental forces in the real economy. Real economic activity that, with their own somewhat impressive year-over-year changes, added up to a good deal less than what was claimed.

It works both ways, too, though not in linear or symmetric fashion. As of the latest data from the World Bank, base metal prices were down by 18% year-over-year in June 2019. But whereas +30% in 2017 was less inspiring than it seemed, -18% in 2019 is actually worse than its face value.

It’s one thing to fall 20% from a basically healthy trendline around what might reasonably be called normal. It’s quite another to do so after years of declines and only a small retracement in between.

The same goes for real economic activity. In this case, Chinese imports. According to data released today by China’s General Customs Administration, the value of inbound goods during June 2019 was 7.3% less than the value in June 2018. That -7.3% is worse than it appears because of what you see two charts above. It’s not just the subtraction from last year, already a concern, it’s because of the subtraction from last year plus how far behind last year had already been.

It’s the nature of living in a non-linear world, a big reason why the real economy effects of Euro$ #4 have the potential to be worse than they were in Euro$ #3. To put it simply, and bluntly, globally synchronized growth was nothing more than lying statistics. The global economy was seriously harmed starting in 2014 and never really healed.

As the bond curves uniformly staked out, based on the context, Reflation #3 never had a chance.

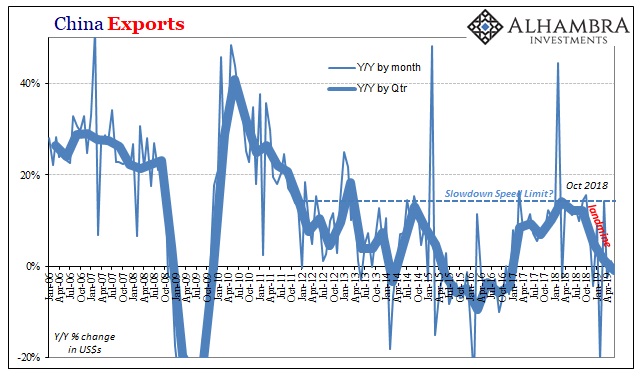

On the other side of Chinese trade, exports declined 1.3% year-over-year in June. For the whole second quarter of 2019, exports fell by 1% – the first decline on a quarterly basis since Q4 2016. For all the talk about tariffs on Chinese goods, exports in the first half of 2019 were basically flat with the first half of 2018.

China’s economy is far weaker inside than out.

Trade wars are definitely playing a role but only a limited one: exports to the US were down 7% last month, but the value of Chinese goods heading to Europe also declined, by 3%. It is weakness all around the world economy.

It may have been globally synchronized in 2017, but it wasn’t trade wars which kept it from being actual growth. And it isn’t trade wars that have turned what was never anything more than small reflation into the next synchronized downturn. Thus, even Jay Powell can see in which direction the arrow is pointing.

However, uncertainties about the outlook have increased in recent months. In particular, economic momentum appears to have slowed in some major foreign economies, and that weakness could affect the U.S. economy.

Not “could” but “when” and by “how much.” The problem was never the synchronized part, it was always in classifying it as growth. And, what’s worrying Powell, is that the word still applies in 2019 as the minus signs appear again if for now elsewhere.

Stay In Touch