In order for rate cuts to be insurance for a boom to continue, there first has to be a boom able to be continued. The FOMC meeting yesterday didn’t directly kill the idea, but that’s actually what’s coming up in the latest projections.

This is why there’s been so much attention focused on inflation. The very idea of a strong economy rests solely upon the labor market. Business and consumer spending has “slowed” in the official statement. Here’s what the latest one said yesterday:

Information received since the Federal Open Market Committee met in May indicates that the labor market remains strong and that economic activity is rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. [emphasis added]

Economic activity at a moderate pace is a serious downgrade from last year when the word “strong” was very loudly added to the language. It didn’t last very long, but it continues on in the commentary about the labor market for that one reason; if the latter is actually strong then the whole economy can get back to being the same thing if given a little rate cut boost.

So, the whole thing rests upon the labor market. Without inflation, however, there’s no confirmation the unemployment rate is anything like accurate.

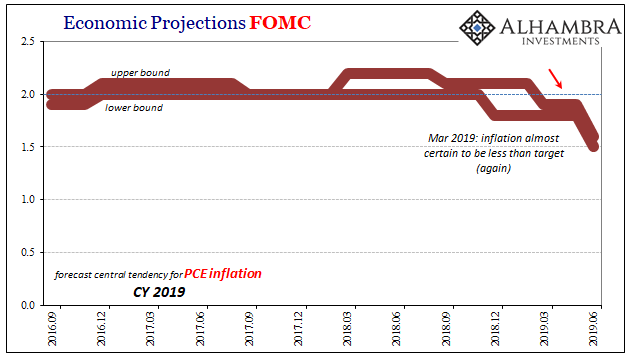

In fact, more evidence keeps piling up against it. This includes the updated inflation projections from the FOMC.

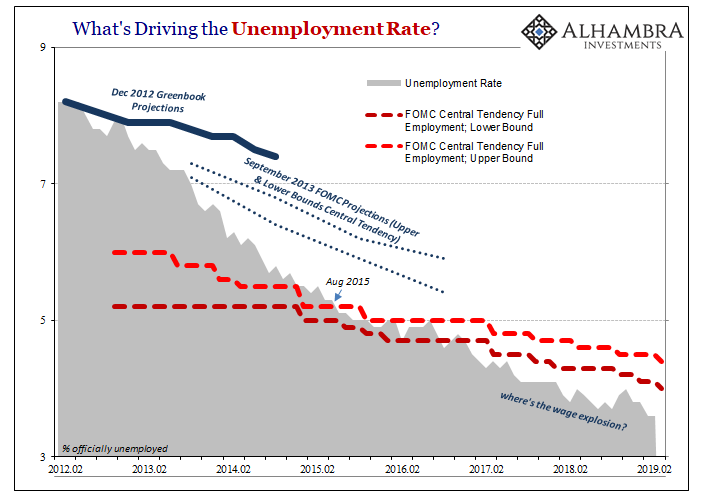

It is impossible to reconcile another miss on inflation (the target is 2%) with an unemployment rate substantially below every range of full employment. In fact, this has been an error in the making for years. Maybe it’s fitting how the unemployment rate first entered that territory in the month of August 2015 – when CNY and a Wall Street crash were then interrupting Janet Yellen’s anticipated liftoff.

That was almost four years ago.

In short, the unemployment rate has defied characterization for so long there’s really no honest debate left. The Fed has tried to recalculate the level of full employment but only to catch up with an unemployment rate that seems to have no boundaries.

If you have to cut your estimates for full employment by that much, you really have no idea where or when that is. And if you have no idea about this, you have no clue whether or not the labor market is strong or weak (slack). Therefore, the economy is an entirely open question which makes rate cuts look very, very different.

That’s really why projections for inflation this year have turned toward weak. The FOMC models aren’t picking up full employment from 3.6% because that number can’t be real.

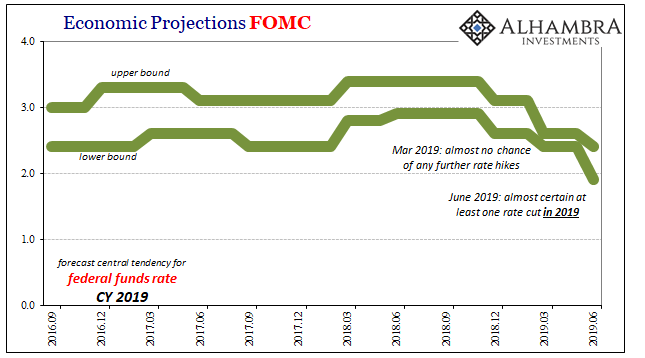

In common sense, this is plainly obvious. If you planned on nothing other than rate hikes in 2019 but then change to only rate cuts, most people would more than wonder just how strong anything actually is. Even if it was strong last year, something big must’ve changed.

One or the other must be wrong. By the Fed’s very own models, we know which one it is. Not that anyone needed the confirmation, it’s been this way for years.

Betting on rate cuts to boost a strong labor market back into a strong economy is a very different proposition than betting on rate cuts officials are backed into because they really don’t know what’s going on.

Stay In Touch