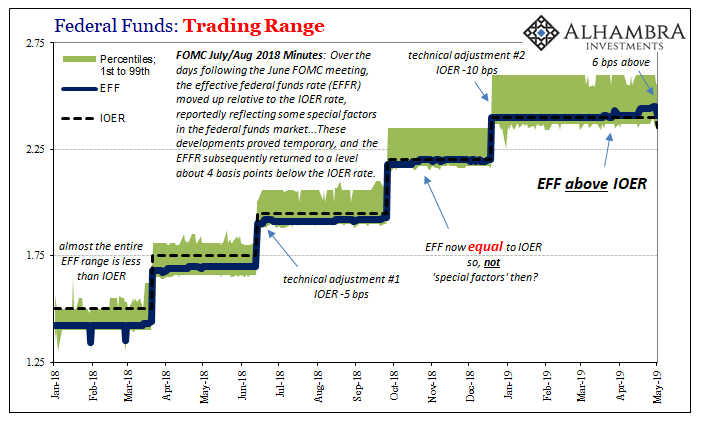

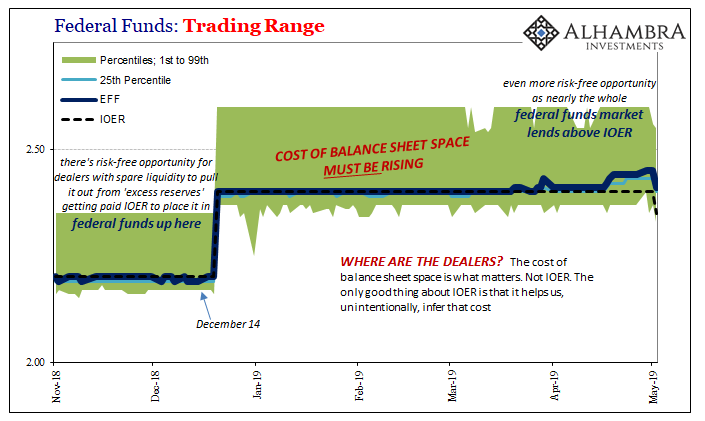

When all this federal funds business started, the effective federal funds (EFF) rate was pretty well established at 16 bps above the RRP “floor.” It had been that way, consistently, all throughout Reflation #3, all throughout 2017. So consistent, that dependable spread was a very solid indication of reflation.

As of yesterday, EFF was…16 bps above RRP. It’s not at all the same, though. In between December 2017 and now, the Federal Reserve has instituted three “technical adjustments” to IOER. In other words, IOER has been reduced by 15 bps just to get EFF back to where it was when all this mess began.

This is no small thing.

Nor is yesterday’s move. IOER was reduced 5 bps while EFF dropped only 4. That means EFF would still have been above where IOER was Wednesday, and it’s now 6 bps ahead of it. There’s an inexplicable upward pull, some tightness-like gravity which has latched onto the federal funds market of all things.

Some are now trying to blame the Federal Home Loan Banks (FHLB); how quickly the tax refund/money market fund excuse meekly fades down the memory hole. These are practically all that’s left of the federal funds market so they make for an easy mark. The new thinking goes like this: FHLB’s are chasing repo rates. Since repo is higher than federal funds, the absence of what’s being used by the FHLB’s to chase repo means there’s not enough left in federal funds.

First of all, there is no law that states only the FHLB’s may offer liquidity in federal funds. They’re only there because they are prohibited from getting paid IOER. Any dealer can go into that market and provide the same thing – if it so desires. Why get paid IOER when there’s an entire range of federal funds offering fatter rates.

So, even if the FHLB’s are leaving federal funds dry, where are the other dealers who should pick up the slack?

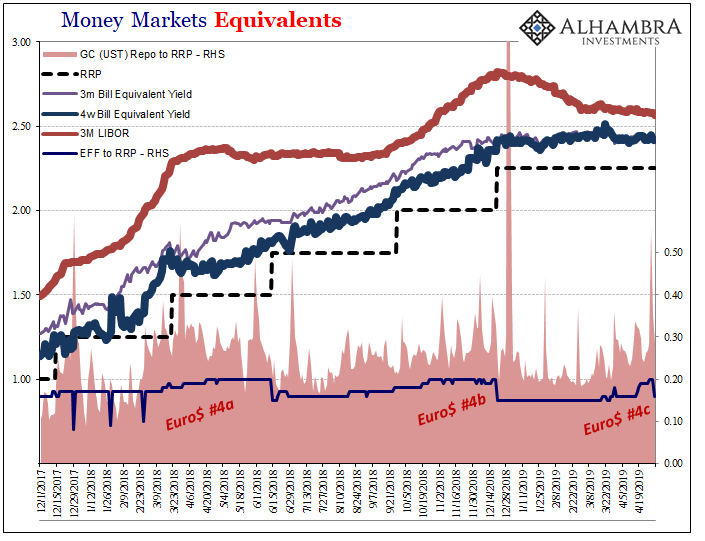

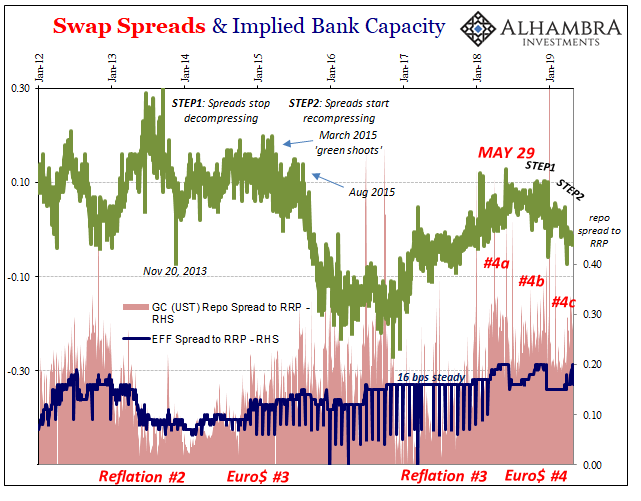

And that still leaves us with the supposed mystery surrounding repo. If FHLB’s are in pursuit of GC rates, why are GC rates where they are? Secured interbank interest should not be so much more than unsecured, let alone persist this way.

Back in March 2018, the FOMC finally spoke up about all this. They blamed, if you remember, Donald Trump. Not directly, but in the esteemed estimation of FOMC officials reckless tax reform had meant a bigger fiscal deficit which the Treasury Department would have to fund by issuing more T-bills. A deluge, many called it.

The FOMC minutes for that March 2018 meeting said:

In short-term funding markets, increased issuance of Treasury bills lifted Treasury bill yields above comparable-maturity OIS rates for the first time in almost a decade. The rise in bill yields was a factor that pushed up money market rates and widened the spreads of certificates of deposit and term London interbank offered rates relative to OIS rates.

And by making dealers have to absorb so much of the new bills at auction, there was less spare liquidity in repo, too. Convenient.

I’ve seen some pretty brazen lies over the years, but this was one of the most egregious. I wrote the day after the meeting minutes were released:

Understand what they are saying here. The FOMC is trying to claim that LIBOR is up because T-bill rates are; the latter are monetary equivalents. Bill rates are higher because of, purportedly, tax reform and the Trump budget. In other words, a heavier supply of bills at auction would lead to rising bill yields and therefore as money equivalents other money market rates would move up, too, including LIBOR.

That’s crap.

Indeed it is. That hasn’t stopped the bill lie from being perpetuated especially now in trying to explain repo in order to go backdoor to EFF. With federal funds being so publicly wayward, it can’t just be ignored.

The bill rate spread was nothing more than markets adjusting to Jay Powell’s expected rate increases. But let’s assume anyway that it was the deluge. That might account for what I’ve marked above as Euro$ #4a and Euro$ #4b, but how then does anyone explain Euro$ #4c; the very market conditions we are now discussing?

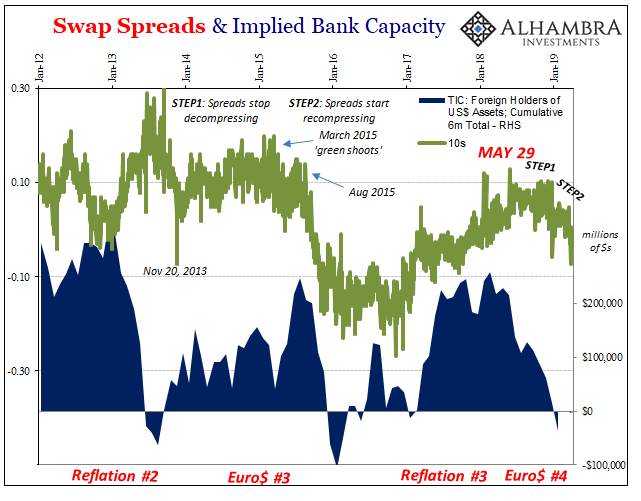

There is no unusual spread indicated by bill yields, and over the last four plus months LIBOR has fallen (vindicating, very importantly, the eurodollar futures curve and an entirely different interpretation of things). And yet, dating back to the end of February 2019, the repo rate is up again which so happens to coincide with EFF breaking above IOER and then really moving higher; leading to this third technical adjustment.

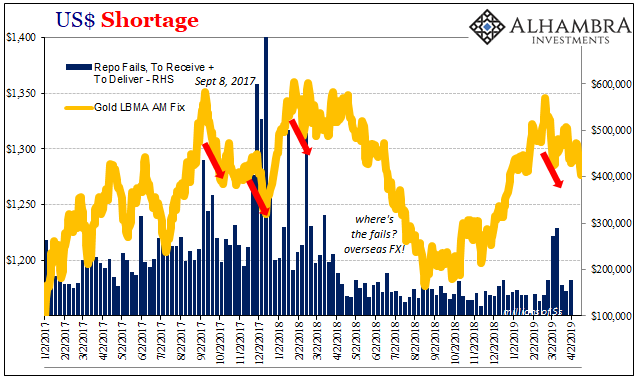

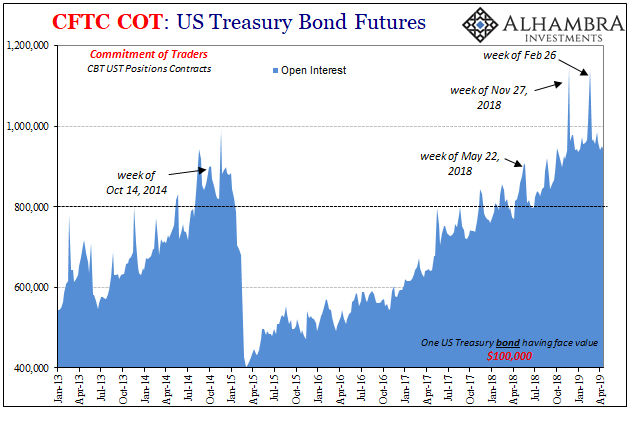

We should also note what was going on elsewhere in the last days and week of February, how broader funding/money markets were behaving as this Euro$ #4c/EFF kerfuffle developed:

In short, LIBOR not rising, T-bill rates not unusual, but a lot of the other stuff the FOMC and mainstream ignore which was screaming that something was coming (again). In UST futures, investors were running to the long bond to be hedged against illiquidity more broadly. In gold and repo, collateral breakdown which really doesn’t ever coincide with good working market conditions. Also illiquidity.

Getting back to where we were before this digression and review, if FHLB’s are leaving federal funds high and dry for the fatter, lower risk returns of repo, you still have to account for repo in the first place. Where are the dealers in both federal funds and repo?

It’s not the T-bill deluge keeping them on the sidelines, and it never really was. There was a lot of evidence before, and there’s even more now.

The Federal Reserve lied about it all along because they knew the lie would be repeated over and over and over. Recall the mainstream narrative: the Fed first fixed the financial system which then allowed them to heal the economy. It had to be in that order. Can’t have anything so glaring as federal funds raise questions about the first part lest people start to really ask questions about the second.

Back to what I wrote last year:

Instead, they deliberately throw out this seemingly nondescript reference because it will serve as a de facto official explanation (without appearing to make a big deal out of it) while at the same time they know it will never be challenged. Even though it is, again, demonstrably false, the mainstream media and almost every form of financial commentary is deathly afraid of something like OIS; they don’t understand it, they believe nobody else does, so therefore if the Fed says something about it, then it must be so.

Demonstrably false. It was that all the way back in March 2018 and I think in May 2019 it’s even more so. Where’s the money? Where are the dealers who are the money?

The financial system is not fixed and it never was. And without a monetary system in good working order you better believe the (global) economy is in danger. Again.

Stay In Touch