Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand.

Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to discuss their lying eyes. The eurodollar futures market was, in the official view, so far off the rails as to be insane. As Open Market Desk chief Bill Dudley told the Committee:

MR. DUDLEY. A number of people that I’ve talked to in the markets have said that this is what they thought was going on, and they advised me not to take what was going on in the Eurodollar futures markets literally because they felt that some of them were putting on these positions in case of a bad scenario that led to significant reductions in shortterm interest rates. So I’m basically taking the explanation somewhat on the advice of market participants who told me that they were doing this. [emphasis added]

The eurodollar curve by then was already seriously inverted, implying that rates were going to be cut at some point during 2007. Dudley, as Bernanke, thought that was absurd, totally preposterous. None of the Fed models were predicting any such thing, let alone based on something so small and insignificant like subprime mortgages.

CHAIRMAN BERNANKE. I had been puzzled about the quantitative relationship between the subprime problems and the stock market. I think that the actual money at risk is on the order of $50 billion from defaults on subprimes, which is very small compared with the capitalization of the stock market. It looks as though a lot of the problem is coming from bad underwriting as opposed to some fundamentals in the economy. So I guess I’m a bit puzzled about whether it’s a signal about fundamentals or how it’s linked to the stock market.

I think it largely a myth the presumed relationship between the Fed and stocks. Most say that the central bank tries to manipulate share prices in order to game consumers. While that’s true to some extent, I believe the reality is policymakers view stocks as the only financial market available to them.

The purest form, the famous discounting mechanism as spoken in the fabled lore of Wall Street being the engine for, and reflection of, capitalism at its best. The free market.

The bond market? Well, though it’s much, much bigger and deeper, more directly connected to the real economy through more contacts than an Economist’s modeled covariance matrices would ever stand, they just don’t understand bonds. In this case, bond trading and the bond market include things like eurodollar futures.

After all, it was Alan Greenspan who just a few years before “subprime is contained” said long-term bond yields were nothing more than a series of one-year forwards stacked one on top of another. Therefore, the Fed controls the first in line of the series and the rest just fall as they are supposed to.

Stocks, in this view, are left to be the market signal. The only one for central bankers to watch.

In March 2007, what caught their attention wasn’t New Century or a highly inverted eurodollar futures curve. It was a sudden plummet in the S&P 500. That’s what Bernanke was talking about in the quoted passage above. Ignore all the rest, the NYSE just sniffed some contagion.

Rather than realize stocks are last in line to get it, authorities pressed ahead anyway. The contagion just hitting the NYSE tape in February 2007 was the same these other markets had been warning about for months and months beforehand.

The rest of 2007 and even 2008 would unfold under such determined ignorance. The stock market would rebound, officials would feel better, predict “transitory” and then things would get worse. The FOMC did, in fact, vote for a rate cut (50 bps in September 2007, the first of many) very much against their will – and share prices surged in the afterglow, setting record highs in early October 2007 not even two months before the Great “Recession” would officially begin.

Here we are again. Not that we are repeating 2007 and 2008. That will never repeat. Rather, we are standing witness to how Economics only stands still. It may be the only thing that does. Economists never learn.

The FOMC meeting minutes released today once again say “transitory.” Why do they say this? Because the S&P 500 shook them awake from October to Christmas Eve. Up until then, inverted eurodollar futures curve and flattening, repulsive UST action were ignored. All those immense and deep warnings echoing the past ones from eleven and twelve years ago meant nothing in the boardroom of Marriner Eccles.

The “strong worldwide demand for safe assets” was stupid investors overly pessimistic about trivialities. But a technical bear market on Wall Street? That got Powell’s attention. Therefore, Fed “pause.”

Now that the stock market has recovered again, “transitory.” Whatever it was, it no longer is. According to this one market.

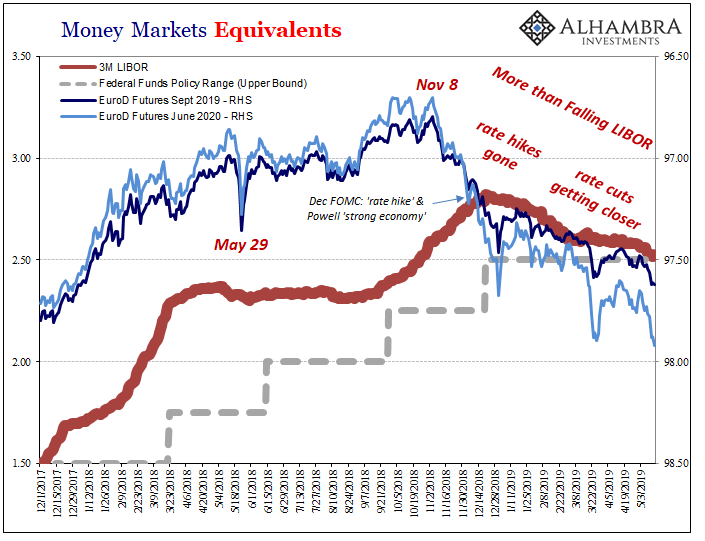

Obviously, also like 2007, this isn’t the view of those others. Eurodollar futures are still very inverted as is the UST curve. The “bond market” is even more resolute in predicting a rate cut at some point this year. Even federal funds futures suggest a substantial chance of the first one beginning in September 2019. Almost certainly by December.

The FOMC today, though:

Many participants viewed the recent dip in PCE inflation as likely to be transitory, and participants generally anticipated that a patient approach to policy adjustments was likely to be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective.

Even the supposed doves were willing to go along “if global economic and financial conditions continued to improve.” Which financial conditions, exactly? Not the bond market, or even federal funds (that’s another story, though related).

The world was globally synchronized growth until the S&P 500 stumbled. Once it did, the FOMC reacted only to that one market signal. It has rebounded, therefore more and more cautious hawkishness as the months go by.

Meanwhile, all the other markets, those instruments that don’t behave in any way like a series of one-year forwards (I say again, who but an Economist actually thinks about bonds like this?), the warnings keep escalating.

The rate cuts are coming, and like last time the FOMC will be forced kicking and screaming into them wondering the whole time how the NYSE and NASDAQ could have possibly led them astray. Again. No wonder they dislike markets as a general principle. Economists think that’s the only one.

This is the transitory story. We’ve heard it all before.

Stay In Touch