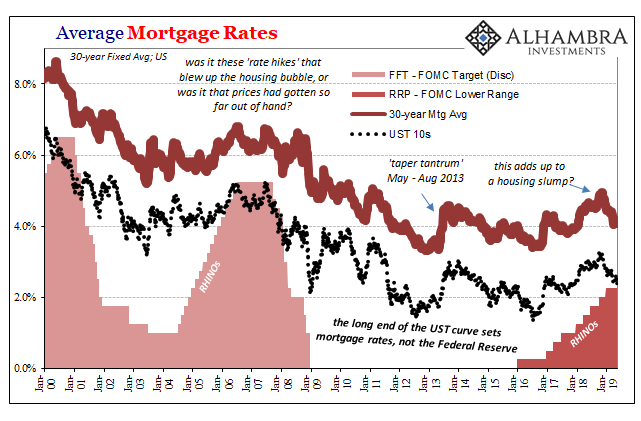

We all know the shorthand. The Federal Reserve influences if not controls economic activity by raising and lowering the federal funds apparatus. Reducing the monetary policy targets is stimulus because everyone loves lower interest costs. Raising them therefore has the opposite effect.

More direct and visible consequences are supposed to be observed first in the interest rate sensitive sectors of the economy. Wherever borrowing is a substantial input, meaning borrowing costs, monetary policy is believed to work most in these places. Things like capex and housing.

For much of the past year or so, the US housing market has become a growing area of real concern. What was a housing slump is in danger of transforming into a very real economic drag. Real estate isn’t what it used to be as far as contributing to overall output, meaning it would take a considerable reverse in this sector to register economywide.

That’s just the Fed, they say. Though Janet Yellen aborted her initial takeoff, beginning (a second time) in December 2016 the central bank has been raising the federal funds “stuff” for over two years. Tightening, higher interest costs, therefore larger payments for prospective home buyers. Perhaps they went just little too far.

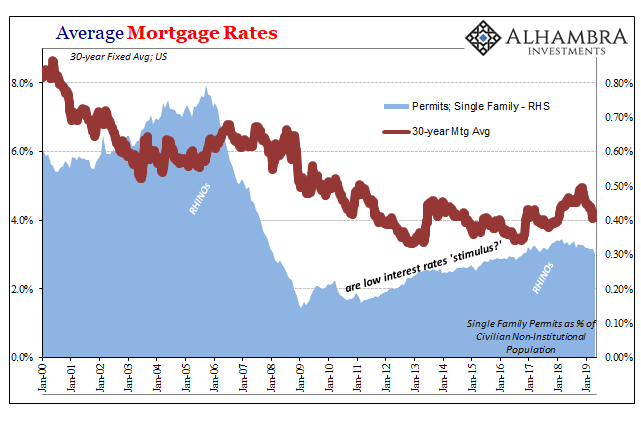

The week of November 8, 2018, the average 30-year fixed mortgage was just a little less than 5%. As of last week, the average was just above 4%. In between, while the Fed raised its rate one more time, mortgage rates dropped by a pretty substantial amount all over the country.

Early November wasn’t yesterday, either. That was more than six months ago, half a year of what is supposed to be “stimulus.” Instead, two myths debunked at the same time. Maybe three if we go back far enough.

The bond market not the Federal Reserve sets the mortgage rate. Interest rates never did rise all that much going back to 2016. The Fed has been hiking, that’s true, but the bond market never really thought much of it. Mortgage rates aren’t really that much different than they’ve been since 2011.

Over the last half year, bonds haven’t just been betting the Fed is wrong on the upside, they are now actively betting Jay Powell and company have it all wrong everywhere. Rate cuts are coming.

The reason they would be, if or when Powell is forced to concede to this very different economic reality, is an economy in serious trouble starting with workers as consumers as home buyers. That’s not something 240 bps federal funds did. It is certainly not what caused the housing market to head toward a growing tailspin.

After all, again, mortgage rates have been falling for more than six months. More than enough time that if higher rates were the problem lower rates would’ve begun to cure it. That’s the second myth.

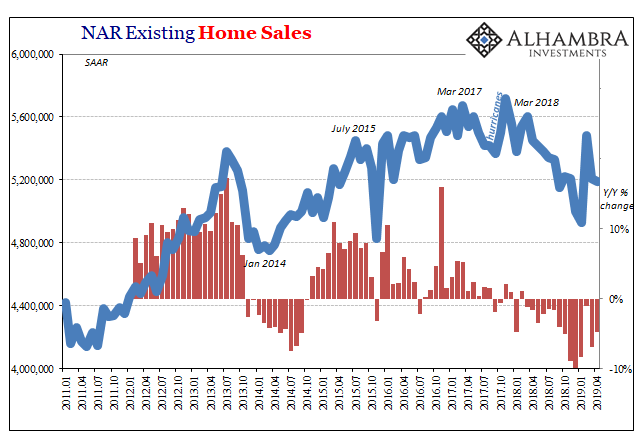

According to the National Association of Realtors (NAR), sales of existing homes rebounded in February 2019 from a huge drop in January. Some attributed that to weather changes (less snow), others as the expected return of homebuyers still supported by what Economists and politicians all say is a booming economy. Lower mortgage rates plus an even lower unemployment rate is supposed to equal resuming the march toward 6mm resales per month (SAAR).

While mortgage rates fell further in March and stayed that way in April, home sales fell back again in each. February’s housing “green shoot” died too quickly with no interest rate explanation for that. The latest data for April 2019, released today, shows resales at just 5.19mm, the 14th straight month of year-over-year declines.

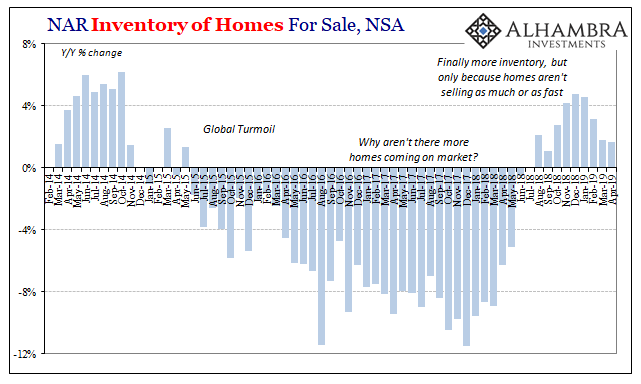

As a result of a substantially slowed sales pace, which wasn’t all that robust to begin with, our third myth, the inventory of homes available for sale has started to rise. Like GDP inventory, piling up isn’t the same as getting ready for acceleration.

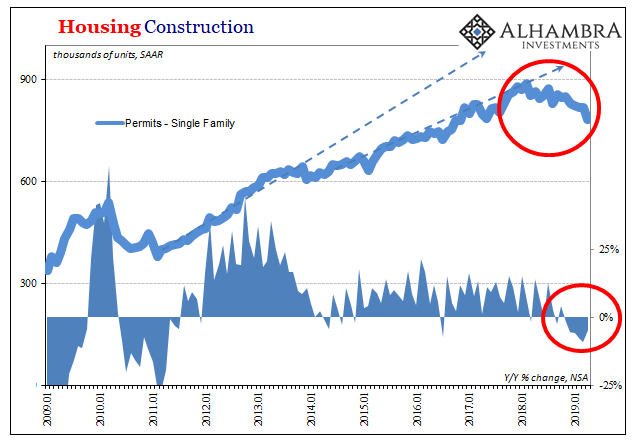

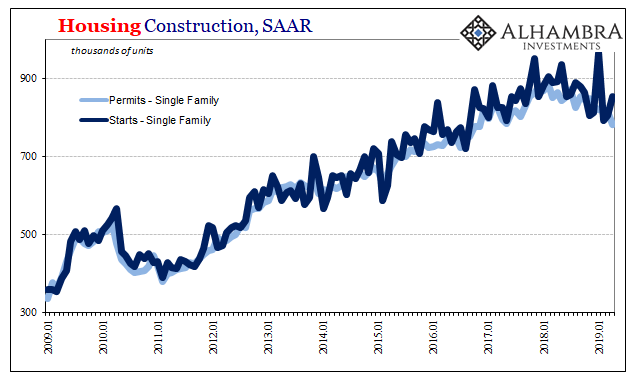

It gets even worse in terms of home construction.

Homebuilders are increasingly pessimistic especially in the single family space. This is, by far, the biggest housing slump since the last true bust (discounting the aftermath following the tax credit “stimulus” in 2010).

Rather than seeing any improvement as mortgage rates have come back down, the number of permits to build new single family homes has only declined faster. The Census Bureau reported last week that the level for them was 782k (SAAR) in April. That’s down from 816k in March and 848k back in November when mortgage costs peaked.

The last time permits were less than 800k was May 2017. April’s was the lowest level since November 2016.

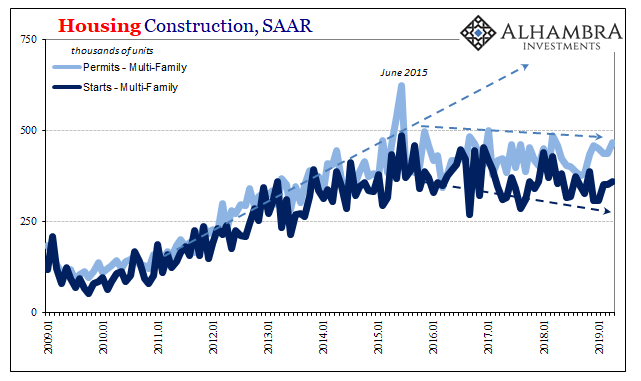

There hasn’t been any offset in the construction of multi-family units, either. If the economy is booming and mortgage rates are to blame for the drop off in home buying, it stands to reason there would be some material offset as new households turned to rental space. To fill what should have been significant demand, apartment construction should be accelerating.

The multi-family segment continues its multi-year reverse. Though only a slight decline, it nevertheless defies the mainstream real estate narrative – as well as the booming economy one.

The entire point of low interest rates, as conventionally understood, is stimulus. Low rates = good.

Is that really true?

Historically low interest rates have defined the last decade. And yet, in the interest rate sectors of the economy what we see isn’t successful policy execution we find instead very good evidence the theories behind the policy are all wrong. The reason the upturn in housing never really contributed much to the economy is simply because that upturn wasn’t anything more than positive numbers.

This wasn’t a housing recovery so much as an end to the decline. There’s a huge difference. And now we are seeing an end to the end of the decline.

This is true of much more than housing. We’ve spent the last decade with the bond market dictating those low interest rates based on a more honest assessment of rebounds and recoveries. Therefore, interest rates have only gyrated between really low and less really low. Hardly the kind of swings which would cause the renewed trouble illustrated by a broad survey of real estate conditions.

The Fed does not control interest rates; in many cases and at many more times than you might think it doesn’t even influence them. Rate hikes didn’t break the housing recovery and therefore the economic boom. There was no recovery nor boom. Low interest rates don’t mean what the Economics textbook says.

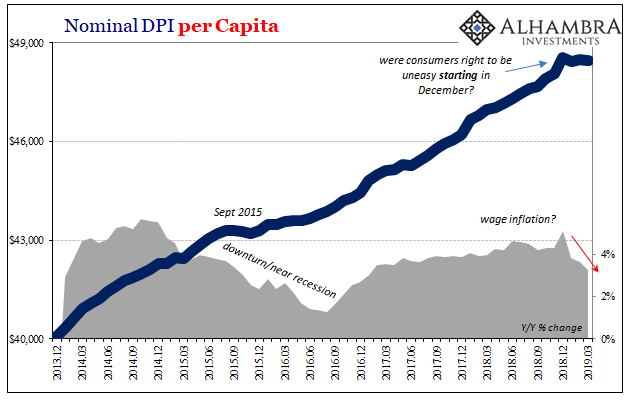

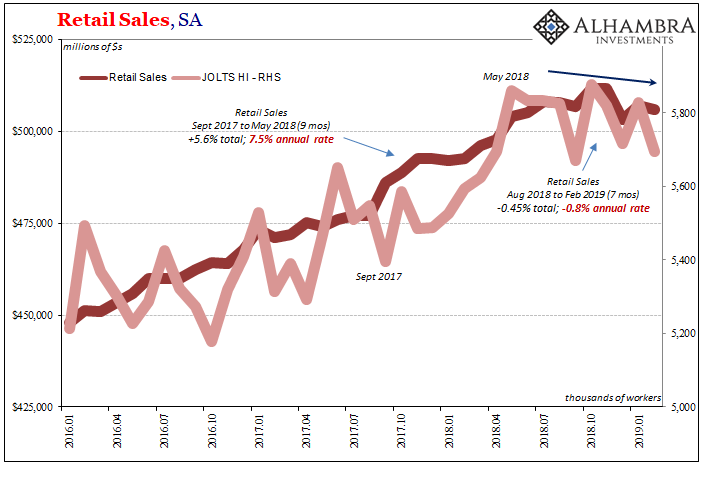

If the housing market is heading toward something more than a slump, it is because the overall economy remains weak and is therefore susceptible to any number of potential negative factors. Things like Euro$ #4 creating not just overseas turmoil but also domestic labor market uncertainty which may have already eroded income growth, creating serious uncertainty among workers – the people who would be buying homes if the unemployment rate were anywhere close to accurate.

Fewer people being hired and those already hired working and making less would surely overwhelm six months of significantly greater mortgage “stimulus.”

Stay In Touch