Those were the days. The minivan was king, a relatively new phenomenon that domestic automakers were hoping would help them stave off increasing import pressure. In 1990, Chrysler, for example, had used the success of its Dodge Caravan and Plymouth Voyager, along with the introduction of its Town & Country luxury (I suppose) model, to maintain its number three spot in the US barely holding off Toyota.

Overall, though, 1990 was a horrible year for the auto industry. The economy plunged into recession so it wasn’t any surprise that Detroit was struggling. Chrysler had sold 1.69 million vehicles worldwide during the year compared to 2 million in 1989. A 16% drop in sales is a vacuum, forcing managers to rethink a lot of things.

It had been standard industry practice before 1991 to report sales in 10-day increments. With nothing good to say, Chrysler officials notified the media they would no longer do so. Sales would be tabulated and released on a monthly schedule.

The company’s top management claimed a rounded monthly figure would lead to greater transparency. After all, every OEM had been gaming the system, channel stuffing especially in the last of each monthly reporting third. It was Chrysler who had pioneered the technique, so to speak, with its infamous 1970’s “sales bank” which led it to the doorstep of ruin.

With a monthly sales number, it was believed, perhaps merely hoped that there would be less pressure to so regularly stuff the sales channel. I suppose that’s transparency, but more likely than not managers simply wanted to avoid having to report three really bad numbers every month; no need to constantly remind people, mainly the financial press and those who follow it, and reinforce any stock harming message.

GM would eventually follow suit in 1994, effectively ending the 10-day report for the industry. And it was the same company who last year pioneered the switch to a quarterly format, though, it should be noted, its management in 2013 changed its production releases to every three months.

The same justification is used each and every time. Companies are doing this in the name of transparency. Just three months ago, in January 2019, Ford Motor announced that it, too, would stop producing monthly sales numbers. Mark LaNeve, that company’s VP of Marketing, Sales, and Service said:

We think the intense focus on month-to-month numbers is just not how we want to run the business. We believe quarterly will provide great transparency.

He also said back in April 2018 when GM announced its change how Ford was already quite sympathetic. “There [sic] comment that there’s a lot of volatility in month-to-month sales, I believe there is some validity to that.” This will provide greater transparency by raising more questions about transparency?

Analysts have cautioned that moving to quarterly reporting could lead to less transparency and more speculation and errors, especially if some automakers follow suit and others do not.

In fact, that is what happened in the eighties. American Motors, or AMC, had attempted to ditch the 10-day report period long before Chrysler. It didn’t work out so well because analyst extrapolations, trying to keep consistent with the rest of the industry’s 10-day cycle, often failed to match AMC’s monthly numbers.

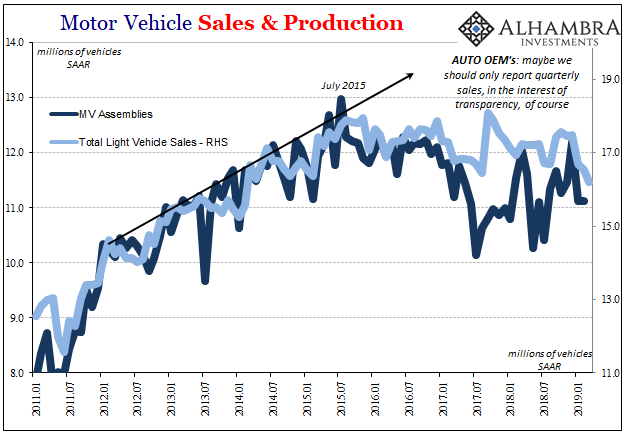

Like Chrysler in 1991, we are forced to wonder, why now?

This year hasn’t started out well for manufacturers, sort of like last year. January’s sales figures were chalked up to, what else, the crippling cold of winter. Volatility, you might say if you worked at Ford, GM, or the new Chrysler under Fiat. The common theme prevailed, as Reid Bigland, Fiat’s head of US sales, said:

In spite of some frigid January weather, we remain bullish on 2019 given the continued underlying strength of the U.S. economy.

“Underlying strength of the US economy.” That’s what they said for the one month at the start of the year. How about now as an entire quarter of sales has been booked?

Nearly every major automaker reported weak U.S. sales for March and the first quarter of 2019, citing a rough start to the year, but said a robust economy and strong labor market should encourage consumers to buy more vehicles as 2019 rolls on.

Mr. Bigland remains steadfastly undeterred (it is his job, after all):

The industry had a tough first quarter, but with spring finally starting to show its face and continued strong economic indicators … we are confident that new vehicle sales demand will strengthen going forward.

Two things have been uniformly constant the past four years: the weather warms up each and every spring and the unemployment rate stays unbelievably low. Neither has helped the US auto industry, and it seems to be getting a bit worse of late.

Why report three bad numbers every quarter when you can report just one? If you really thought “underlying strength in the US economy” you would jump at the chance to remind everyone three times as often. And if the unemployment rate were anywhere close to accurate, if I worked for Chrysler I’d even consider bringing back the 10-day cycle for the additional opportunities. It’s all very transparent.

Stay In Touch