On Friday, February, 2, 2001, the BLS reported stellar headline numbers for its Employment Situation release. Preliminary estimates for the Establishment Survey suggested US payrolls had gained +268k in the month of January. To put it in perspective, that would equate to +324k in today’s population, or a bit better than the latest figure.

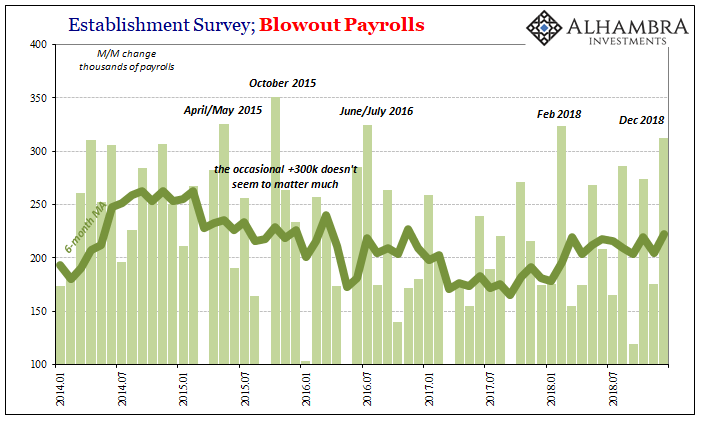

The economic climate of the time was one of great uncertainty. Over the previous months, it appeared as if the US economy had begun exhibiting symptoms consistent with a downturn, maybe recession. The BLS had reported a blowout number for September 2000, and then several months in the 100s.

January 2001’s +268k coming out in early February was somewhat reassuring that weakness might just be noise. But in the age of the maestro, what would that mean? Good news was bad news, as CNNMoney anchor Stuart Varney told his TV audience after what was a chaotic Friday of stock trading.

Our top story tonight: the most damaging session on Wall Street since the first tumultuous days of this year. Stocks retreated all across the board, investors haunted by tech profit fears and a report on jobs that defied really easy analysis. The unemployment rate did rise in January, but far more jobs were added to payrolls than expected. The upshot: some fear the Federal Reserve may not slash interest rates as aggressively in the coming months.

If you go looking in the current data set for the Establishment Survey series, you won’t find that +268k for January 2001. What you will see instead is -25k. Wall Street had every reason to be worried about the jobs report, just not in the way it was presented. The big problem wasn’t Greenspan’s Fed being reassured by blowout labor numbers, it was that they, and he, had it all wrong.

The NBER would declare seven months into it that the dot-com recession began in March 2001 – just a month after that last huge BLS report. The estimates the government agency presented fell apart due to something called trend-cycle. This is the reason why there is a -25k where +268k used to be.

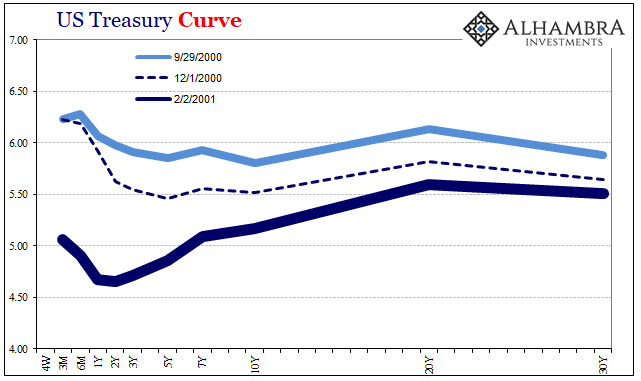

We shouldn’t expect statistics gathering agencies to be mindful of real-time markets and prices, economic indicators like the UST curve – but it would be nice if they were occasionally. The curve had inverted the year before, telling everyone (especially FOMC officials) that the cycle was already a long time in danger.

Bureaucracies being what they are, that would never be enough for the BLS to alter its trend-cycle underneath, therefore to them it was initially +268k no matter how many markets were exhibiting straight chaos at the time. Economists move for no one, except other Economists.

Only later when it proved the UST curve was correct (alongside the stock market drop) did that statistical reconstruction take place. There was outright recession the month following one of the best jobs reports during the best jobs market in American history.

For his part, Alan Greenspan (as we’ve chronicled several times recently) had changed his mind to begin 2001. The summer before he was still convinced inflation due to a strong labor market was the primary economic risk his central bank should focus its efforts upon.

He was wrong. The first trading day of 2001, he acquiesced to the inverted curves (UST and eurodollar futures) and cut the federal funds target. This was the bad news of why mainstream commentary was so unnerved by the apparent good news of January 2001’s initial payroll figures. People really wondered if it was “too good”, enough to dissuade the Fed from more than just the one or maybe two rate cuts.

In the end, neither rate cuts nor those fantastic jobs numbers mattered. The world just doesn’t work that way.

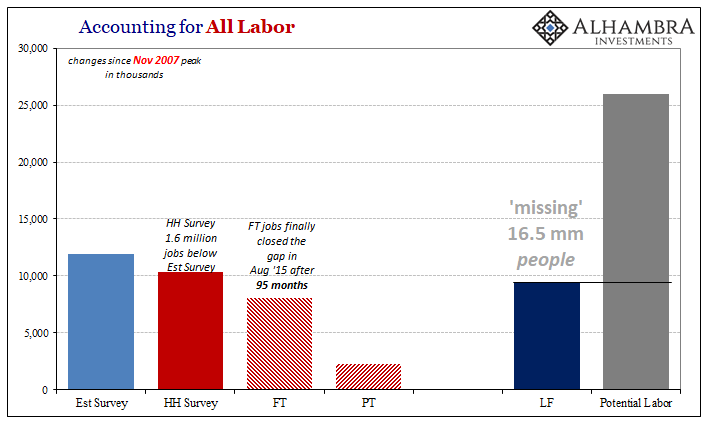

Today, we are treated to a specific reminder. The BLS again reports stellar numbers, well beyond expectations. As usual, they weren’t even good but in the context of the past decade they were going to be taken this way regardless.

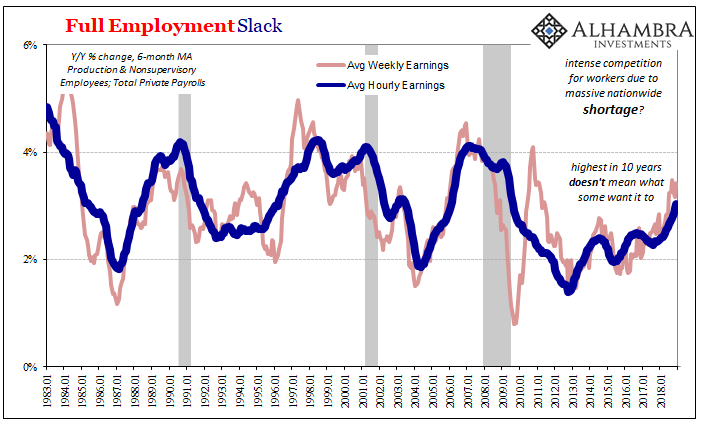

It was yet another perfect payroll report. The headline was +312k, the labor force gained more than 400k (which is why the unemployment rate rose slightly to 3.9% from 3.7%), and hourly wages rose by the most in ten years (+3.32%). What’s not to like?

Trend-cycle.

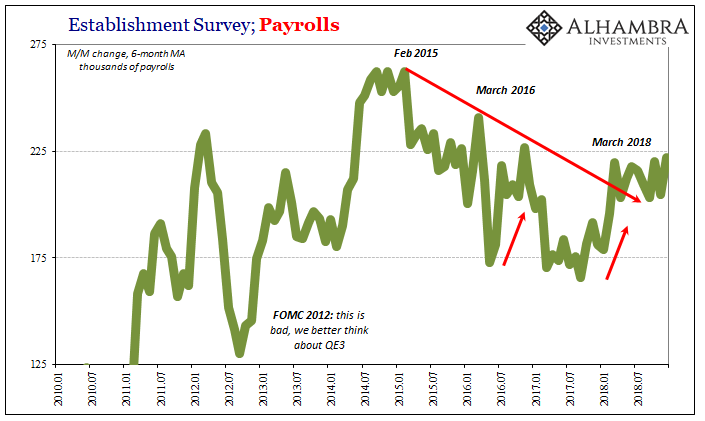

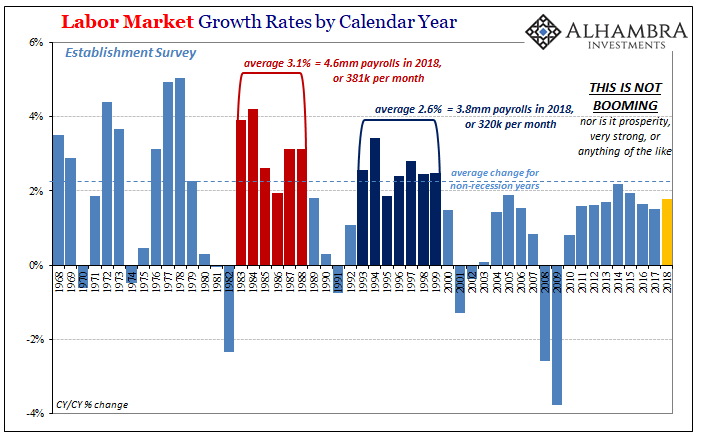

For the year, US businesses added 2.63 million payrolls. This is the number you’ll see highlighted throughout the next month (especially by political and policy types). As sure as day becomes night, it will be characterized as booming and emphasized repeatedly as the true picture of the US economy. Ignore curves, they’ll say, the BLS gives us a preliminary reassurance.

A more appropriate number, the Establishment Survey gained 1.78% last year. That’s only slightly above 2016 and 2017, less than 2015 and about the same as 2013. In other words, not much changed for US workers in 2018. Wage growth was better but the overall labor market really wasn’t (therefore, continued weak income growth).

The best that could be said about it was the payroll slowdown after the 2015 economic downturn seemed to have run its course. This wasn’t surprising given that jobs and labor are all lagging indications. If Reflation #3 was 2017, then 2018 in payrolls should’ve been an improvement. And since Reflation #3 wasn’t all that much, neither was the payroll improvement.

Since employment is a lagging indication, what matters for looking ahead is not a cheerful set of preliminary trend-cycle adjusted payroll figures. There were any number of perfect payroll reports in 2015 and 2016, and the economy nearly found recession anyway. They would only matter if payroll expansion was at least +320k consistently, and +312k at the low end of a constant range.

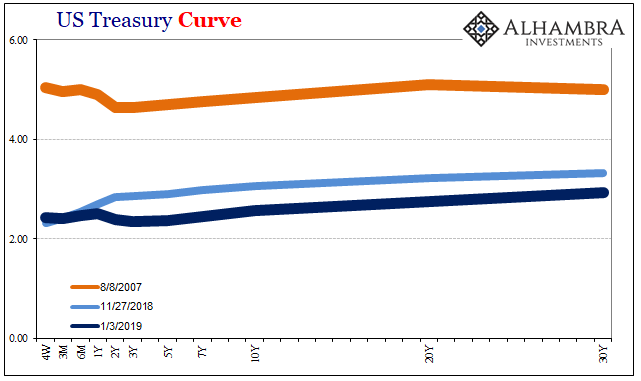

Not only is +312k an outlier to the high side in this economy, given what’s going on right now we really can’t know for how long it stays around there. All that’s left is for someone on CNBC to worry about how this perfect payroll report convinces Jay Powell to stay strong, as if that’s bad news. If there is bad news, and there is, it has and will have nothing to do with December’s payrolls or Jay Powell.

Stay In Touch