It’s becoming fashionable again to dismiss manufacturing. In 2015, we heard repeatedly how it represented only 12% of overall economic output. Any minor problems affecting such a small slice would surely be nothing much for the other seven-eights of the economy to overcome. There was no way Yellen’s rate hikes and the booming recovery they would anticipate would be derailed by such a trivial segment.

The idea has been given new life now that one rate cut has been undertaken. Last year, the downplaying had been more straightforward; there’s absolutely nothing wrong and nothing to stop a hawkish Powell. This year, maybe there is something wrong, but it’s only manufacturing. One-and-done rate cut should be sufficient.

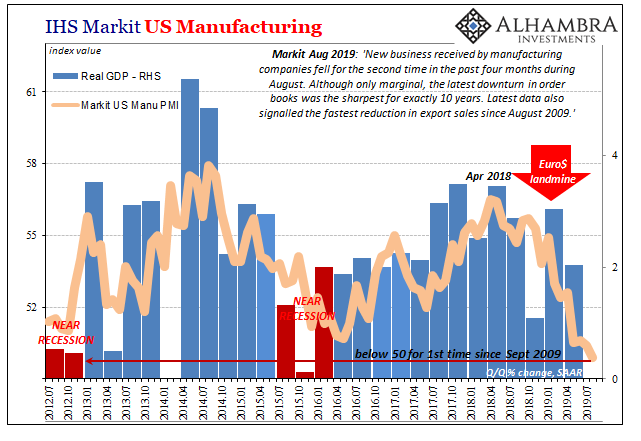

IHS Markit reported today its flash PMI numbers for the US economy in August. Sure enough, right off the top the manufacturing PMI dropped below 50 confirming continued weakness in the sector.

While it might be easy to dismiss this as just one problem, ever if you do you have to acknowledge that it’s becoming a very big one even if it is only 12% of the economy. According to Markit, US manufacturing hasn’t been this bad off (below 50) since September 2009. We keep comparing the latest figure to that one month because each successive update drops a little more than the last one.

So, even if you don’t believe manufacturing accounts for much on its own you have to at least consider what must be going on in the other 88% which might leave the sector in such bad shape – without sight of a turnaround.

And it’s not the below 50 that should concern you. It’s more so that the trend keeps going after having confirmed (with other similar indications) that at least the goods economy smashed into a landmine back during the last quarter of 2018 absolutely must have suffered some substantial damage from doing so.

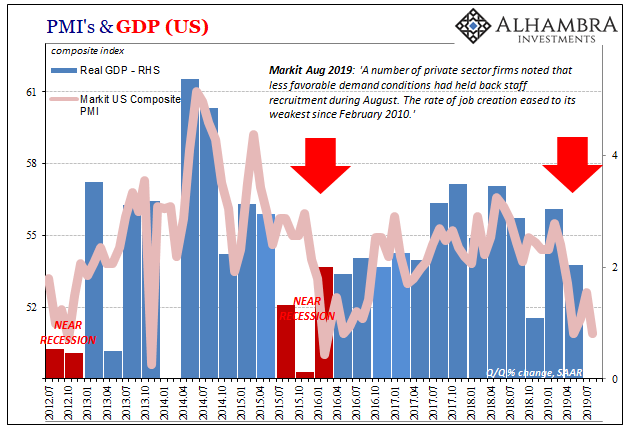

So, manufacturing is in really rough shape, but what about the larger maybe more pivotal service sector? That’s where the real bad news comes in. Markit’s Services PMI dropped from 53.0 in July to 50.9 August. It had rebounded last month which many believed would continue since it was, purportedly, the US economy finally showing its employment-based strength.

If not a second half rebound, then at least a second half stabilizing.

The flash August estimates pour a heavy dose of cold water on already tepid optimism. The composite PMI for August was just 50.9, matching May’s lowest in three years.

Should these estimates prove anywhere close to accurate, alongside the BLS’ benchmark revisions (which just subtracted one-fifth of the previously figured payroll gains between March 2018 and March 2019), the balance of risks are all wrong for either of those.

One Markit representative commented:

The most concerning aspect of the latest data is a slowdown in new business growth to its weakest in a decade, driven by a sharp loss of momentum across the service sector. Survey respondents commented on a headwind from subdued corporate spending as softer growth expectations at home and internationally encouraged tighter budget setting. [emphasis added]

What it suggests is quite apart from the idea of a narrow pocket of trouble due to trade wars and protectionist sentiment. There’s already broad-based weakness spreading throughout all of the US economy (not to mention everywhere else in the world). It may not yet add up to a full-scale recession, but all the signs keep pointing that way as does a wide array of indications which month after month continue inching closer and closer to a prospective date with one.

The longer it goes like this the greater the risk something just gives.

Jay Powell can declare “mid-cycle adjustment” all he wants. The data, including the revised labor data, just isn’t consistent with a one-and-done. Nor does it lead one to believe this is a limited 12% scenario. If nothing else, the downside risks keep rising and they were already substantial to start this month.

Stay In Touch