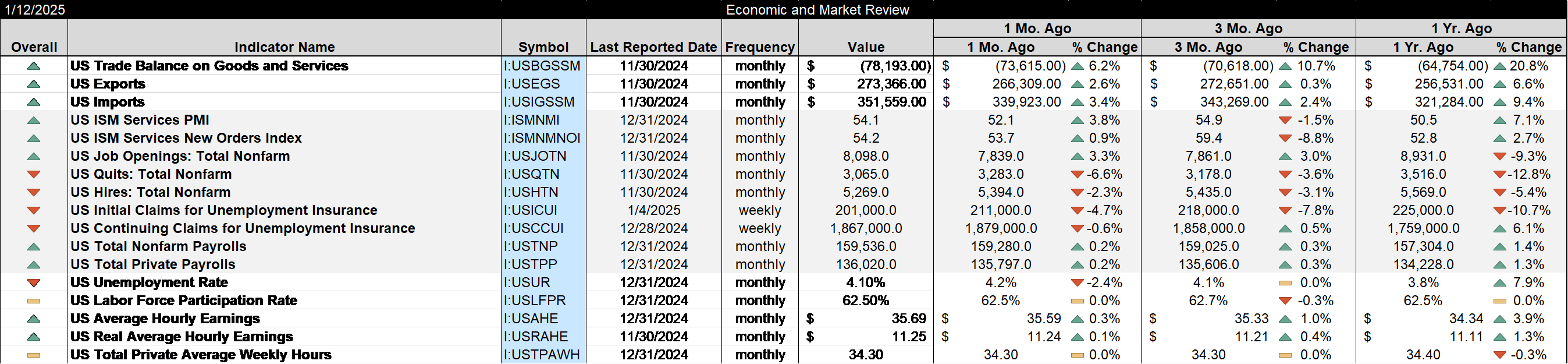

The December employment report was released last Friday and it was quite a bit better than expected. Expectations were for payrolls to rise by 160,000 on the month but instead 256,000 people found a job and started working. For reference, the 3-month average is a gain of 170,000 so there was a significant acceleration in December. The unemployment rate fell from 4.2% to 4.1% and average hourly earnings rose by 0.3% (3.9% over the last year). Private payrolls rose by 223,000 while government rolls rose by 33,000. The U-6 unemployment rate, which uses a broader definition of unemployed, fell from 7.7% to 7.5%. The household report, from which the unemployment rate is calculated, was even more positive. The civilian labor force expanded by 243,000 while the number of employed rose by 478,000 and the number of unemployed fell by 235,000. The employment to population ratio rose by 0.2 to 60%. The same ratio for prime working age (25-54 years) is 80%. In short, the employment situation is strong and it improved in December.

The employment report wasn’t the only good economic data released recently. The Atlanta GDPNow tracker’s estimate of Q4 growth is currently 2.7% and there are indications that growth is starting to reaccelerate. The ISM manufacturing PMI continues its rise toward the 50 level marking expansion, the December reading at 49.3 with new orders at 52.5. The services version also rose in December from 52.1 to 54.1. Jobless claims are falling again, clocking in at 201k last week. Job openings rose in November (reported last week). Inflation continues to moderate with the last six months annualizing right at the Fed’s target (2.1% for CPI and 1.9% for PCE). There are still some weak spots in the economy, housing the obvious candidate. But existing home sales and pending home sales over the last three months (through November) were up 7% and 11.9% respectively – despite higher mortgage rates. Overall, though, the US economy is performing pretty good (it can always be better).

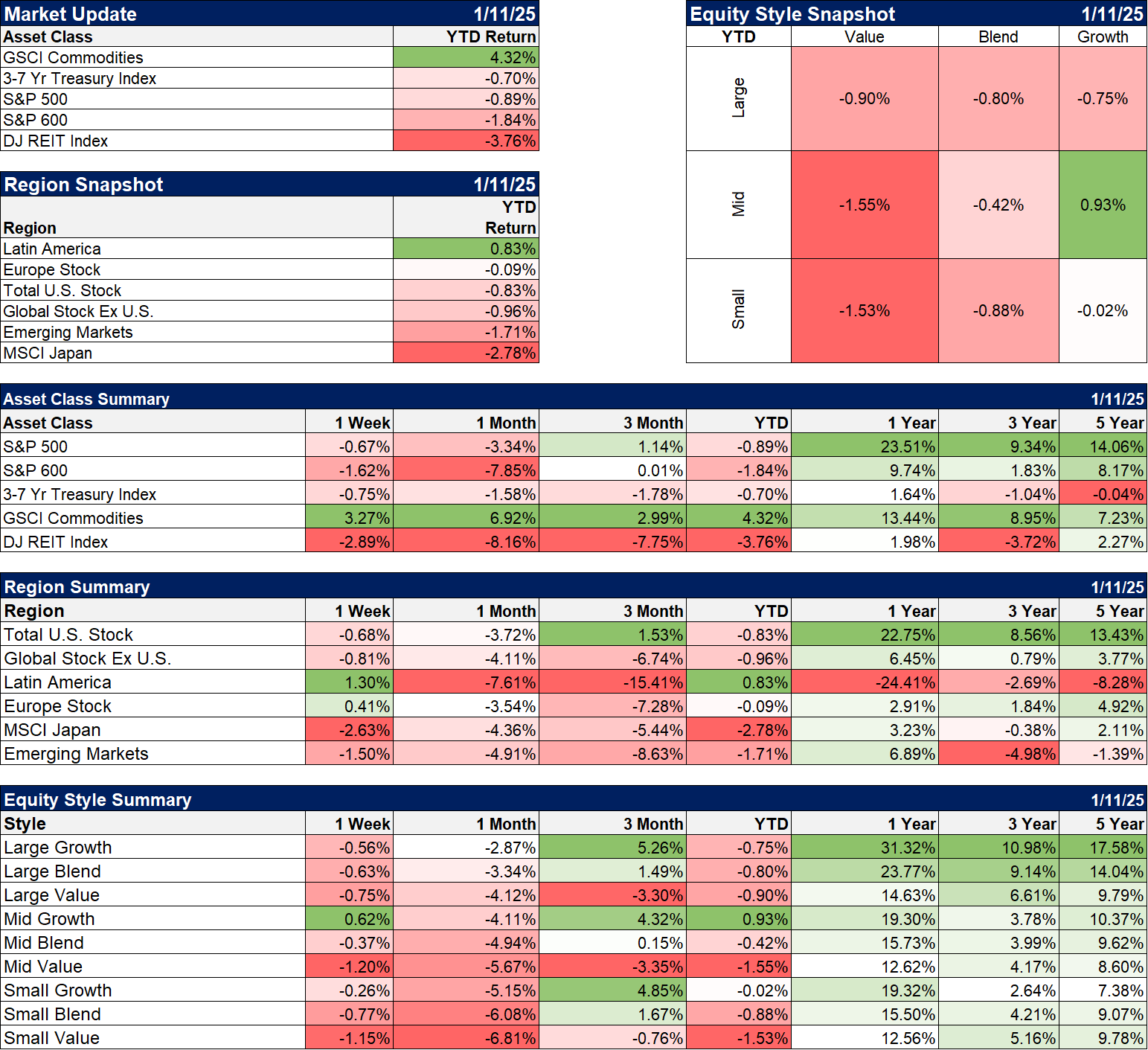

Stocks are not taking the good news well. Large cap, mid-cap, small-cap, and European stocks all finished lower Friday after the employment report. Of the eleven stock sectors, only one, energy, managed to finish in the green Friday and only 4 for the week. Over the last 3 months, the only broad stock index that has managed a gain is Large Cap Growth and only 3 sectors are up (consumer discretionary which is mostly Tesla, communications services, and financials). Bonds were down with interest rates rising, with longer term bonds performing the worst. REITs also responded negatively to rising rates. The only bright spots for the multi-asset, diversified investor were commodities and gold, both up for the day, the week, and the last three months.

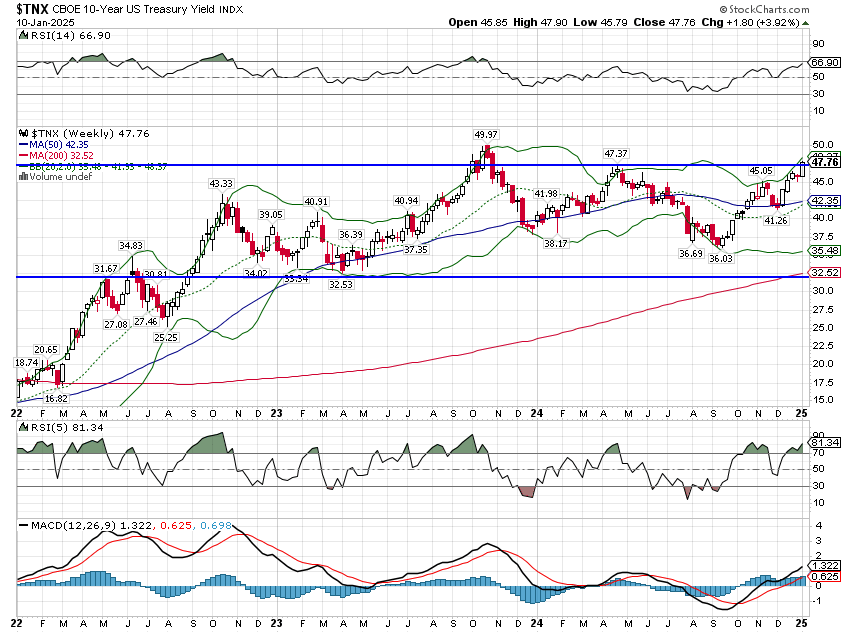

The obvious question is why? Why have stocks performed poorly over the last three months if the economy is performing well with no sign of recession in the markets or the data? The obvious answer is interest rates, with the 10-year Treasury yield rising 68 basis points over the last 3 months and 116 basis points since bottoming on September 16th. Rates bottomed right as the Fed cut rates, by 50 basis points, for the first time since starting their rate hiking cycle in the spring of 2022. The consensus seems to be that this is bad, that it means the Fed has made a mistake by cutting too much, too soon. In this view it is fear of inflation that is driving rates higher. But that isn’t exactly what markets are saying. Real rates have also risen since the Fed cut rates and inflation expectations, as determined by market prices, are only up slightly (11 basis points in the 5-year, 5-year forward rate). Most of the rise in rates is due to a rise in growth expectations.

There is an old saying on Wall Street that the market is not the economy and the economy is not the market. Indeed, that is true for the very short term but over the longer term, stocks do track the economy – and corporate earnings which are obviously related. Rising interest rates are generally a positive indicator of future nominal growth – and therefore, earnings – so we ought to expect stocks to rise right along with rates. And history confirms that. Long-term interest rates have risen in exactly half the 96 years since 1928 (that’s how far back my data goes on rates) but stocks have risen in 77% of those years vs 75% in all years over the same time period. Not surprisingly, stocks like it when the economy is good. Interest rates, obviously, have an impact on stock valuations but the dominant factor is earnings, not interest rates.

Another indicator to consider is the yield curve. As I discussed last week, the recent steepening of the yield curve is what is known as a bear steepener where long-term rates rise faster than short term rates. That type of steepening is not associated with recession or economic slowing. A steepening yield curve is associated with higher future growth and the steeper the curve, the better the future growth. The Cleveland Fed uses past yield curve data to predict future GDP growth one year out. In December, when the 10-year/3-month curve was still inverted (but steepening), the expected GDP growth one year out was 2.1% and the odds of recession were just 30% (down from 68% in May of last year). With the curve now in positive territory (+45 basis points), predicted future growth is higher and recession odds are lower. Maybe I’m missing something but what this looks like to me is the soft landing so many thought impossible.

Selling stocks because growth is better than expected and interest rates have risen modestly is very short sighted. I’m reminded of an acronym from my Navy days – KISS. Keep It Simple Stupid. Good news on the economy is good news for stocks.

Note: Last week I promised to publish an update to our Dawn of a New Era and The Times They Are A-Changin’ research papers from the last two years. Turns out I was a little premature on that. The thesis hasn’t changed; we still think the era of free money is over. But incorporating the new Trump administration’s plans into our view of the future isn’t easy. The recent talk of Greenland, Canada, and the Panama Canal are a lot more interesting than the political chatter you hear on the news or in the press. The regionalization of trade, the formation of trade blocs, was part of our original thesis but I did not expect that to take this form. Anyway, I want to make sure we have thought this through as completely as possible before hitting the publish button. Please be patient and I promise to make it worth the wait.

Joe Calhoun

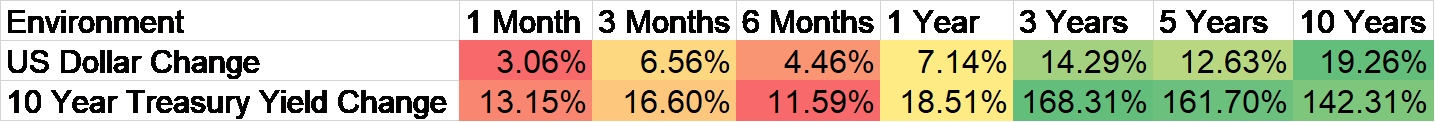

Environment

The 10-year Treasury yield is at the top the range that has prevailed over the last few 2+ years. The October 2023 high was 5% and it won’t take much more to get there. As discussed above, rising rates are not bad news for stocks in general but growth stocks underperform their long-term average return in that environment; value stocks outperform as do small and mid-cap stocks. Will the 10-year yield break out above the 5% threshold? If I had to guess I’d say yes and the short-term market performance will likely be affected if it does but is more likely a buying opportunity than a reason to sell.

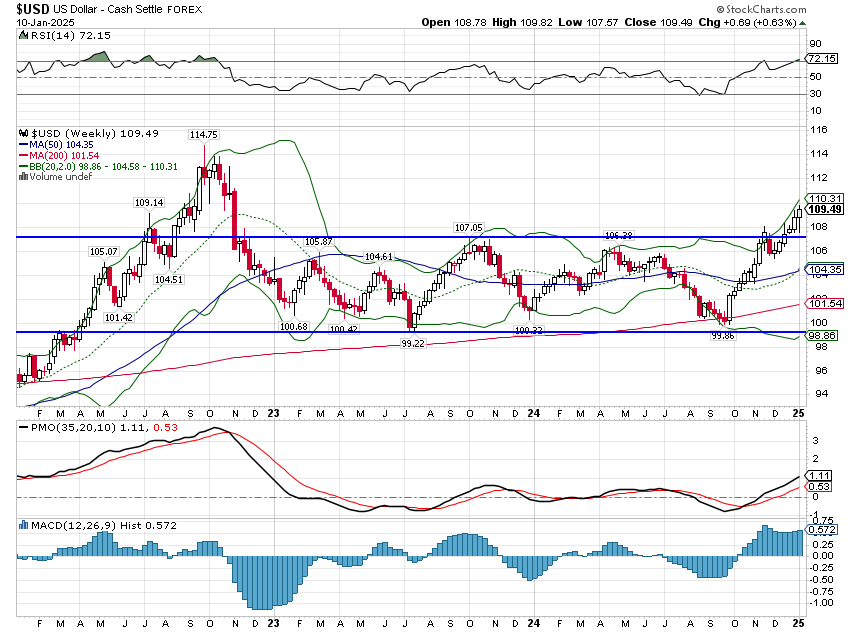

The dollar also rose last week and is now well above its previous range. If I had to pick one Trump-inspired market move that is likely to reverse, it is this one. There are a lot of people in the new administration who have talked openly about wanting a cheaper dollar – including the President – and I suspect they’ll get their way. But for now, the dollar is in a short-term uptrend.

Markets

The only major asset class up on the year is commodities, including gold. The obvious reason is the 10% rise in natural gas prices and the 6.8% rise in crude oil. But this rally is a lot more broad based than that. Copper, platinum, palladium, silver, and gold are all up on the year. This is consistent with history in a rising rate environment. The gains are more muted when the dollar is also rising but even in that environment, commodities are up 80% of the time and at nearly a double digit average return.

Everything else is down modestly except REITs which are struggling mightily with rising rates. Historically, REITs perform better when rates are falling but the returns with a strong dollar and rising rates are still very competitive. REITs sensitivity to interest rates works both ways though. If rates peak and start to pull back, REITs will lead the way back up. With a strong economy, buying the dip is probably the right move.

The most interesting data point below is the rise in Latin American stocks and the flat performance of European stocks. Consensus is that Trump administration will be bad for non-US economies and markets but maybe markets have already gone too far with that theme. It will certainly be interesting to see how these stocks respond if the dollar starts to fall.

The rising rate, rising dollar environment should favor value over growth but popping the bubble in large growth stocks is proving nearly impossible. The same is true of small and mid-cap stocks which should also benefit from a strong dollar. Roughly 40% of revenue for the Russell 1000 (a slightly broader measure of large cap stocks) is from outside the US while the comparable figure for small and midcaps is about half that.

Sectors

Energy has led the way this year for obvious reasons. Health care is also outperforming, a more surprising result. Even more surprising is that technology is down YTD. Such a short period of time means nothing obviously but these stocks will correct at some point, likely when least expected. Maybe it just started.

Economy: Market Indicators

After Friday, mortgage rates are well above 7% and I would expect that to impact sales. But rates are up over the last 3 months as well and sales have been rising. I don’t know that it matters a lot from a GDP standpoint because residential investment hasn’t added much over the last couple of years. Residential investment has added to GDP in only 7 of the last 15 quarters and most of those were small.

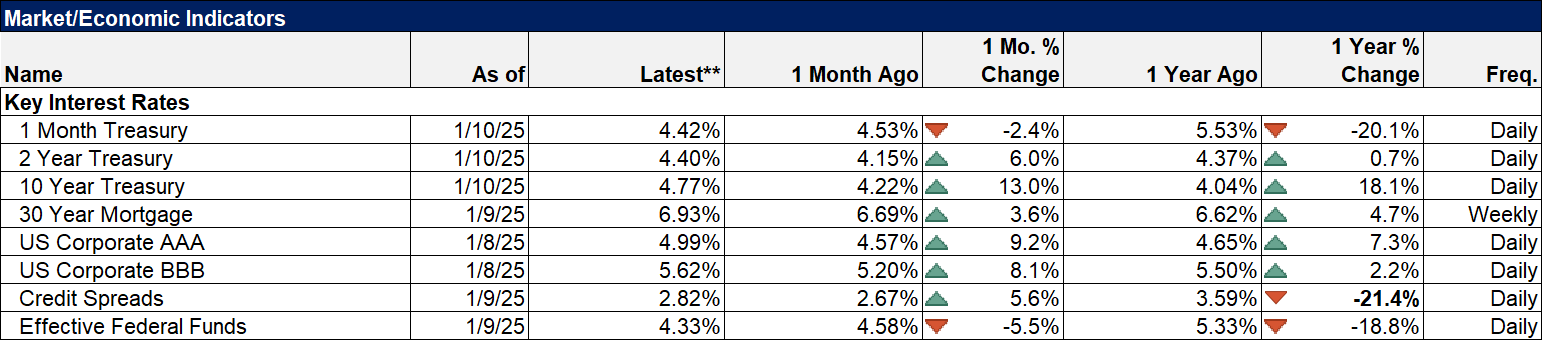

Credit spreads have risen off their lows but are still very low.

Economy: Economic Data

- Good recovery in trade in November but some of the surge in imports is likely due to companies stocking up in anticipation of tariffs

- Job openings were up but they are still well above the pre-COVID levels. Quits were down sharply which isn’t a good sign but that may be due to uncertainty about the new administration

- Jobless claims are trending lower again and at 201k are ridiculously low. You have to go back to the 1960s to find comparable numbers. The civilian labor force in 1970 was half what it is today

- Real average hourly earnings are up 1.3% over the last year which is a positive but frankly a little disappointing

Stay In Touch