Note: This will be my last commentary this year. I plan to spend December thinking about next year and spending some much-needed time with family. Here’s wishing you all a Happy Holiday season. Joe Calhoun

Two years ago, I wrote a weekly commentary titled Who’s The Sucker, in which I made the case that the S&P 500 was not a prudent investment. The use of the word prudent was intentional as investment advisors are held to a fiduciary standard. We follow the prudent (wo)man rule which requires us “to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.”

In late 2021, with the Fed still keeping interest rates pegged to zero on the short end and the 10-year Treasury yield less than 1.5%, being prudent was hard. In that commentary, I noted that there were signs of rampant speculation with some assets trading at ridiculous valuations.

How about Rivian that recently went public and now has a market capitalization of $115 billion despite not having sold a single car? Or Lucid with a market cap of $90 billion and the same sales record as Rivian. Or QuantumScape, a research stage battery company with a $15 billion market cap and no revenue. NFTs? What about this “art” that recently sold for $3.4 million? Cryptocurrencies? Dogecoin, meant as a joke, has a market cap of $40 billion. Or Shiba Inu, a spinoff of the joke, has a market cap of $29 billion. No one is buying these things because they have some intrinsic value. They are only buying them because they think someone will come along and pay them more than they paid. The supply of greater fools is finite or at least I think so, but we obviously haven’t found the limit yet.

Today Rivian’s market cap is $17 billion, Lucid’s is $10 billion and Quantumscape is worth $3.3 billion. The buyers of Bored Ape Yacht club NFTs are suing anyone they can plausibly blame for their stupidity, Dogecoin is worth $12 billion and Shiba Inu is down to $5 billion. The most amazing part of this, frankly, is that all of these still have values greater than zero. Rivian is the most successful with revenue of $3.8 billion, while Lucid’s top line is still stuck south of a billion and Quantumscape has yet to produce a nickel of sales. And Rivian is burning cash at a prodigious rate to the tune of a tad over $6 billion in the last year. A prudent investor might note that they’re down to their last $9 billion in cash.

These things were obviously speculative and easy to justify excluding from client portfolios. But the S&P 500? I mean, that’s “the market” to most people. How could you justify not investing in “the market”? Well, I think I made a pretty good case and by the end of 2021, we had sold almost all of our client’s S&P 500 holdings (the index is still part of some of our passive models). That looked like a brilliant move in 2021 when the S&P 500 fell over 25% at its low but hasn’t looked so good this year with the index up 21.5%.

On the other hand, since I wrote that article, the S&P 500 is up only 1%. It has been a tough market for other assets too, not just the large-cap stocks, but there have also been some exceptions. The S&P 500 value index is up nearly 15% and international value stocks are up nearly 10%. Gold and commodities are also both up over that time but small and midcap stocks and REITs are all down.

Given all that has happened over the last two years, I thought it might be useful to return to the S&P 500 and its investmentworthiness. Is it still imprudent to invest in the S&P 500? Consider:

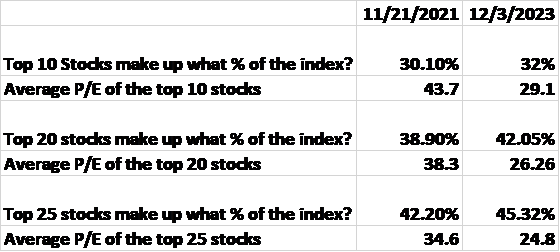

Over the last two years, the valuation of the index has come down some and that certainly makes it a better investment, although I’m not sure it makes it a good investment. Of more concern, is the concentration of the index which has become even more extreme over the last two years. When you buy this index of 503 stocks, you get a whole lot of the top 25 and not a lot of the bottom 478.

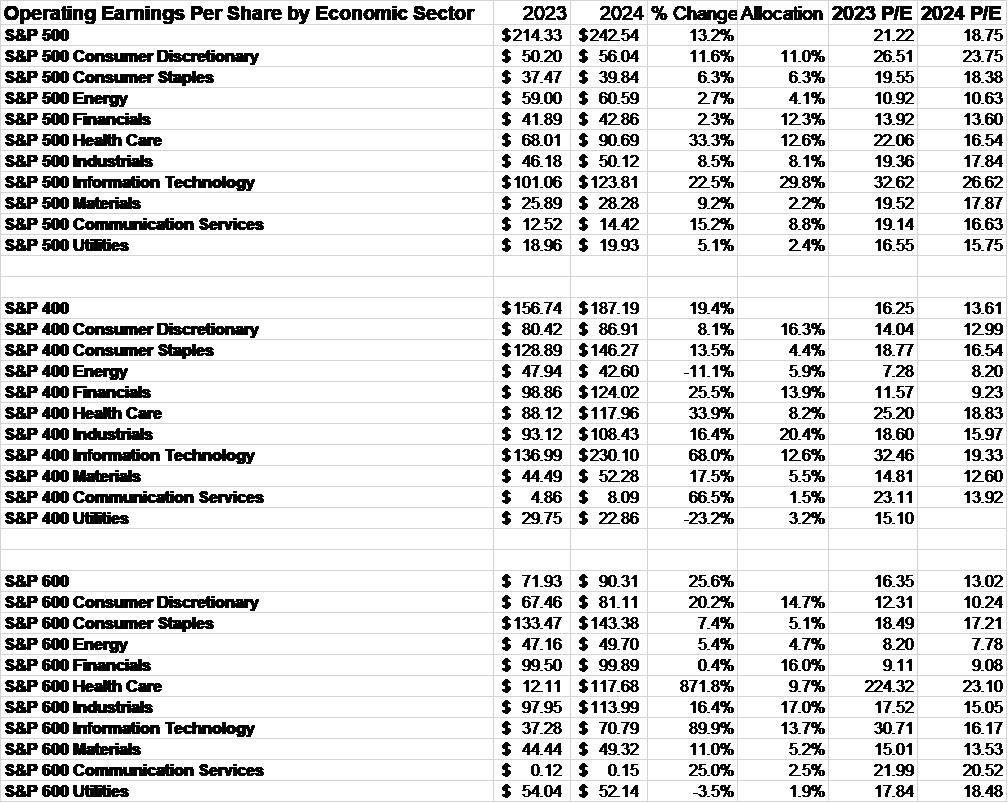

There are, as there were in late 2021, alternatives to the S&P 500. The equal-weight version of the index owns the same stocks but weights them the same, the result being a lower P/E of about 15.5 for the index. Small and midcap stocks are cheaper and offer better growth prospects. Here’s a comparison of the S&P 500, 400 (mid), and 600 (small) overall and by sector:

The S&P 500 equal weight index and the S&P 400 and 600 have all outperformed the S&P 500 over the long term. That’s nothing more than a real-life demonstration of the size factor – smaller company stocks outperform large companies over the long term. Of course, smaller also means riskier in some sense and so the volatility of those indexes is greater than the S&P 500.

A lot of the speculative excesses of the post-financial crisis period and the aftermath of COVID have been purged. But it is far from all, as evidenced by the continued existence of Doge Coin, other useless crypto coins, and now, a host of speculative AI vehicles. It should be a warning that many of the same shills for crypto have just pivoted to AI but investors seem to be ignoring that inconvenient fact for now. At least a lot of the crypto thieves are finally getting their comeuppance.

The excessive valuation of the S&P 500 has been reduced slightly but its concentration has worsened. To me, that is the greater concern and one that must be mitigated. There are other ways to do that without avoiding the index entirely but as a fiduciary, I find it hard to justify an investment in the index.

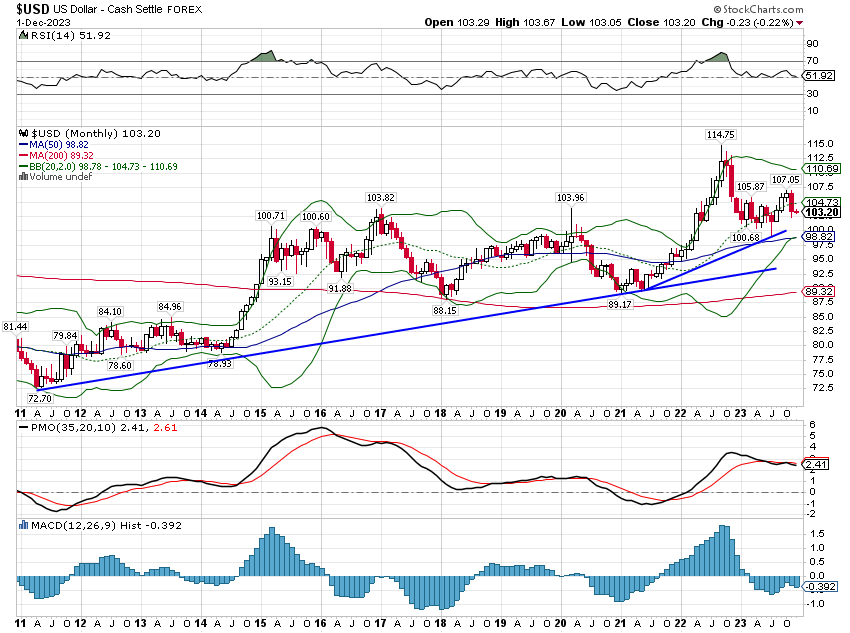

Environment

The dollar remains in a short-term downtrend as inflation and growth expectations in the US continue to wane relative to the rest of the world. The falling dollar would seem to indicate that investors believe US real growth will slow more – at a faster rate – than the rest of the world. The global economy is out of sync, with US growth much better than the rest of the world, so investors may be betting that Europe, for instance, having slowed first will also recover first. Maybe, but that has rarely proved true in the past.

However, there can be a bit of a self-fulfilling prophecy nature to these currency movements. A dollar falling relative to the Euro would also imply a flow of capital from the US back to Europe. That inflow of capital, all else equal, is positive for European growth. Of course, all things are rarely equal so we’ll see.

This is also a short-term trend and it should be seen in that light. The intermediate and long-term trend for the dollar is still up.

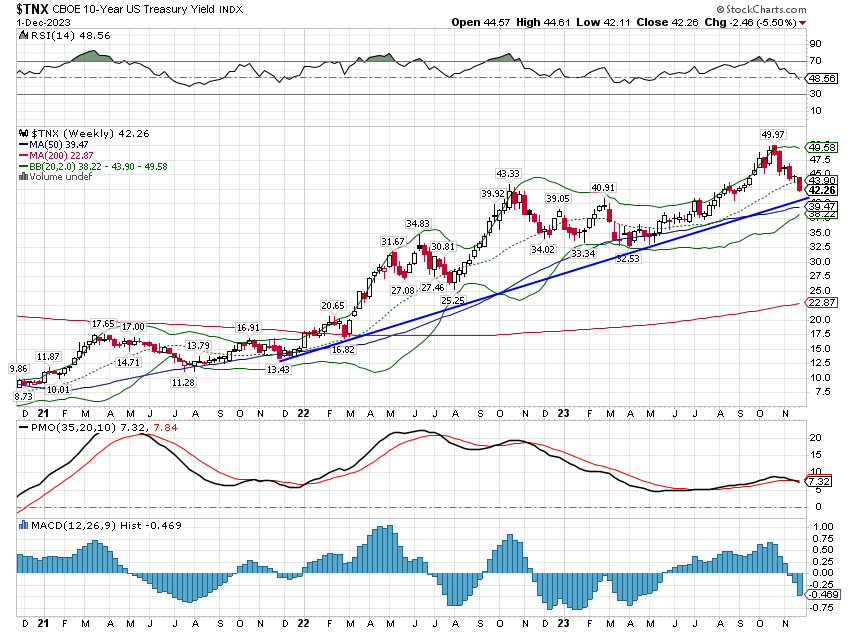

The 10-year Treasury yield is also in a short-term downtrend and yields fell last week. The intermediate-term trend remains up and our short-term target of 4% is coming into view. Rates peaked last year and this year in late October so today’s rate is essentially the same as it was 13 months ago. I’ve said before and I still believe rates have likely peaked for this cycle but I have a low conviction on that call. This has been the strangest business cycle anyone has ever encountered and I have no idea if it is nearing an end.

We’re in the midst of a mild slowdown right now and that isn’t surprising given the 5% growth surge in Q3. But if growth has softened because rates rose, what does the recent drop in rates mean for future growth? To me, the only sector of the economy that saw a significant hit from the rate hikes was housing, and mortgage rates are dropping fast. If housing activity picks up with lower rates it may well act as a growth cushion as some other part of the economy slows.

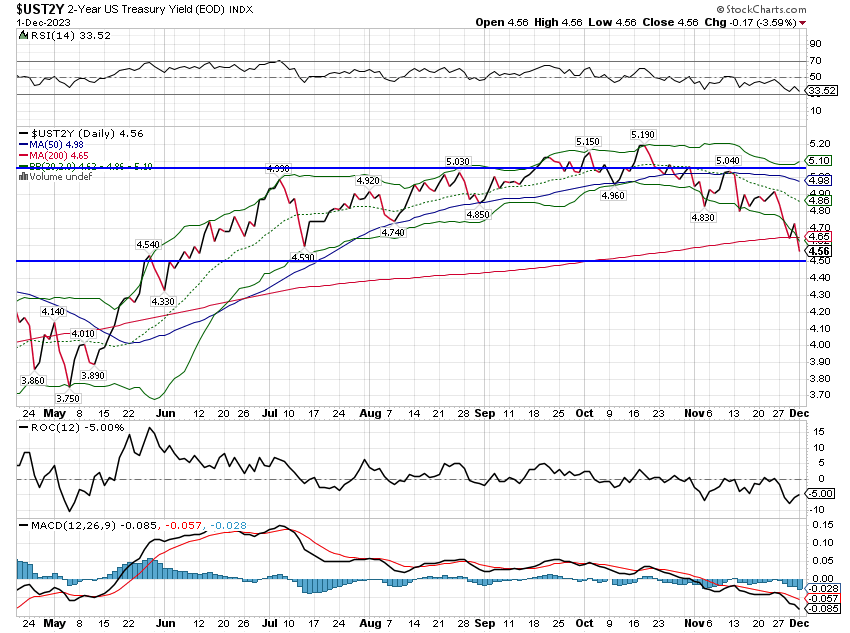

So, it will be interesting and important to see what happens to rates from here. Will rates resume their uptrend or fall below 4% and keep falling? The 2-year rate has fallen recently but only back to where it was in July. There’s been a lot of chatter recently that the market is pricing in rate cuts for next year but the odds on those cuts are not very high at this point. Odds on a quarter-point cut in March are barely better than a coin flip. There are fairly low probabilities of more cuts after that but these markets move around quite a lot so I wouldn’t put a lot of emphasis on it just yet. All we can really say is that market expectations for future Fed policy have softened some; higher for longer is losing some support.

For now, the intermediate-term trend for the 10-year rates is still up and until that changes, that’s how we’ll invest.

10-Year Treasury yield

2-Year Treasury yield

Markets

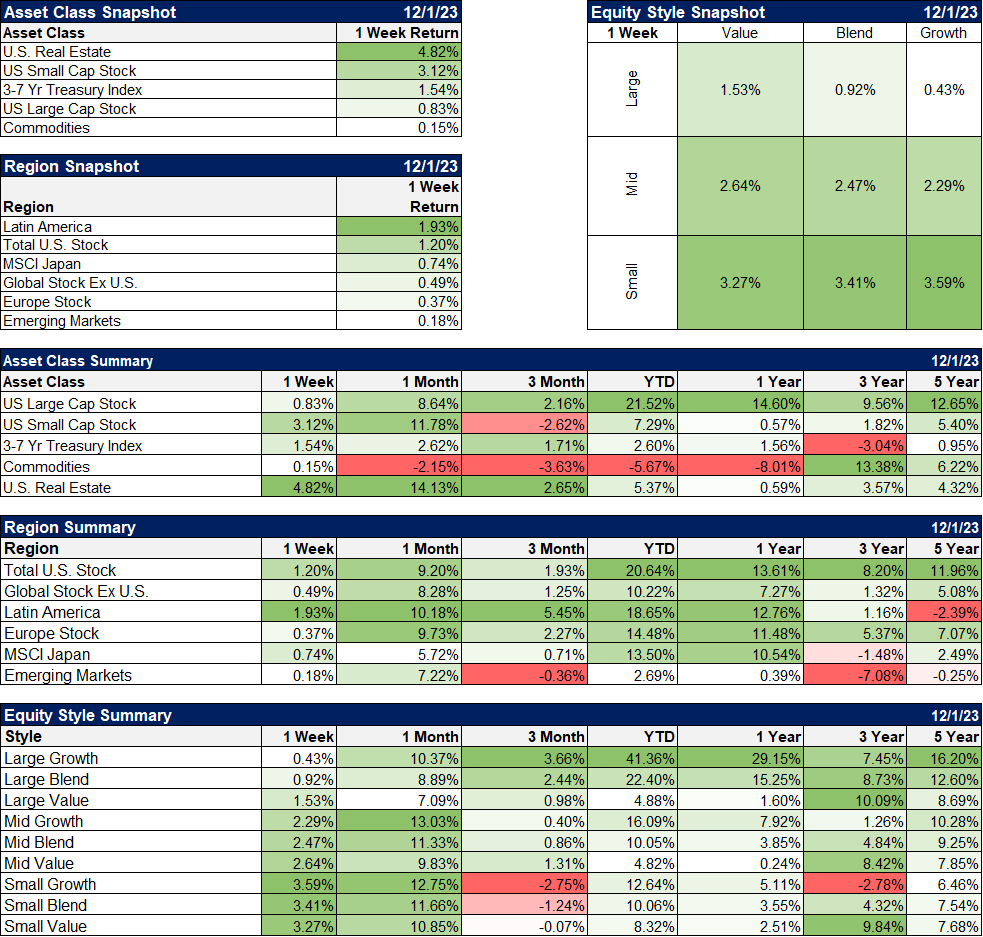

A client told me last week that I’m looking smarter over the last few weeks and for that, I can thank REITs, which led the markets higher again last week. REITs hit their nadir in late October, down about 11% for the year (slight differences between the available REIT ETFs). As of Friday, they are now up about 5%. That 16% swing in just over a month is just stunning and goes to show what can happen when consensus gets too extreme in one direction.

But no, alas, I’m no smarter now than I was in September. REITs are a strategic investment for us which means we’re always going to own them. Our allocation can vary some but it will never go to zero. We never saw much reason to sell or reduce our allocation after 2022; we thought the 25% drop had factored in the bad news. So all we’ve done this year is rebalance into the sell-off, buying more to get back up to our long-term strategic allocation. As I’ve said a couple of times over the last year, the performance of REITs never lived up to the negative hype anyway. Even down 11% was pretty mild considering the degree of negative sentiment toward the sector.

Another area that has taken off with falling rates is regional banks which are up over 20% since rates peaked. It’s another area that has elicited nothing but fear this year and they are still down after the spring mini-banking crisis. But as I said a few months ago in a weekly update I titled Where Are The Extremes?

When you think about the opposite, the things that would make people ask if you’re feeling okay, there are some good candidates. In the US, the obvious one is real estate, especially anything vaguely associated with office buildings. Regional banks are also pretty well hated although that particular fear seems confined to non-professional investors; hedge funds have been buying those pretty consistently. Interestingly, both of those sectors would be pretty well healed by lower interest rates, which a lot of people, me included, think are peaking or pretty close to it.

Small caps are also helping my IQ, with a turnaround almost as impressive as that of REITs. Small-cap stocks are up 13% to 17.6% since the October low depending on the index (Russell 2000, CRSP, and S&P 600).

Value generally outperformed last week but the difference outside of large cap wasn’t much. Value has underperformed this year but continues to lead over the 3-year time horizon. The start of that outperformance trend was actually right during the onset of COVID in March of 2020. If you’re still waiting for value to start outperforming, you’re almost 4 years late. And by the way, value and growth trends tend to last a long time so I don’t think this one is done.

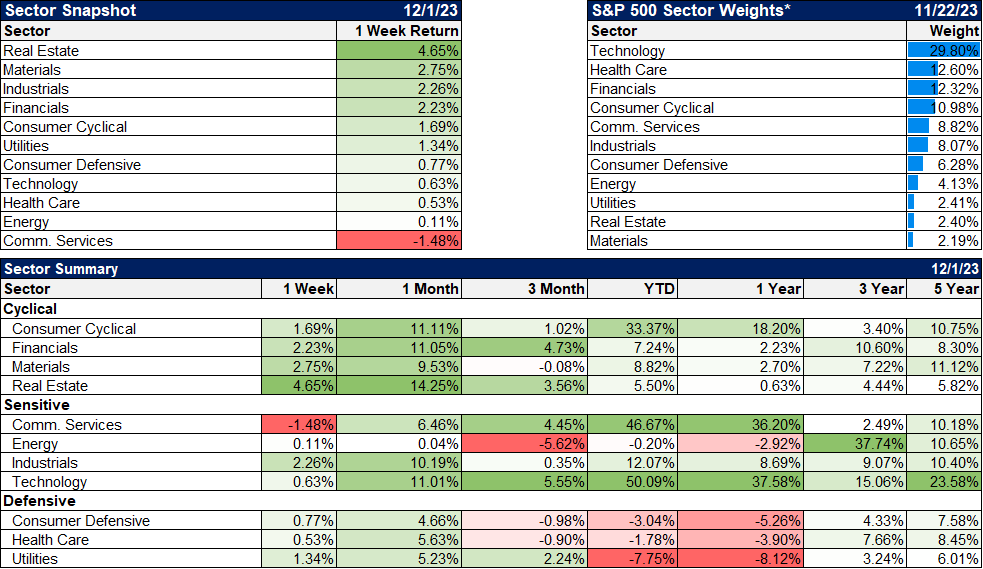

Real estate was the big winner for the week but materials, industrials, and financials weren’t far behind. Those aren’t areas that would seem logical if the economy is headed for recession soon. At the beginning of this year, the consensus was for a recession to start sometime this year and I suppose that could still prove true with a month to go, but when you look at that chart below notice that the only area in the YTD column with consistent red is under the defensive line. Just one more example of the market knowing better than any of the Wall Street gurus.

Market Indicators/Economics

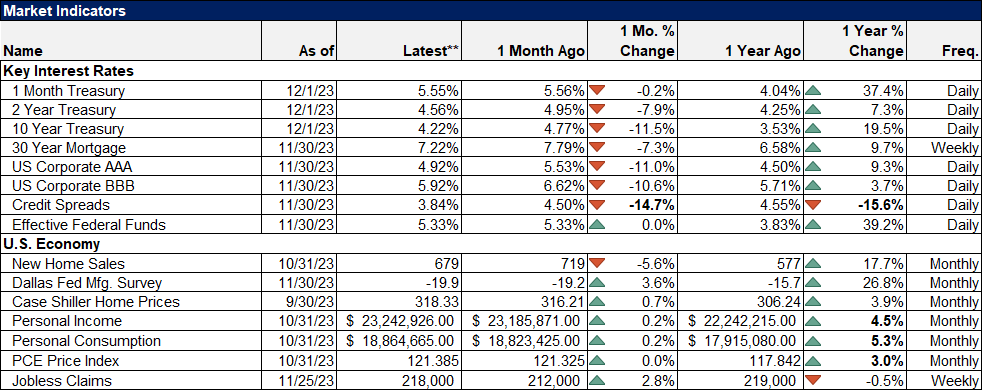

There are a lot of red arrows in the first section of the chart below but the only one that is really interesting is Credit Spreads which narrowed again last week. Spreads are essentially unchanged from the start of the Fed’s rate hiking campaign. The people who predicted that…are non-existent.

The economic data for the week was positive because of one report. PCE prices, the Fed’s preferred measure of inflation, were flat month to month and up 3% over the last year. Doug Terry makes the point that headline inflation has been helped – a lot – by falling energy prices and that may come to an end. I tend to agree with him on that, but that doesn’t mean I think oil prices are about to surge. Doug’s point is that they don’t have to; even if they just stay the same, headline inflation will have a tougher time continuing to improve.

Inflation rates are falling now and that’s what the market is focused on and why it’s starting to price in some probability of rate cuts next year. That’s part of my “rates have peaked for this cycle thesis” but I have to say that so many people agreeing with me makes me uncomfortable. It just seems too easy. But the question is, if the market is surprised by inflation in the coming months, in which direction will the surprise be? Did you know that durable goods prices are down for five months in a row? And yes, I mean prices actually falling, not just rising at a slower pace.

Dallas Fed Manufacturing Survey

The S&P 500 two years ago was concentrated and very expensive. Today the index isn’t outrageously expensive at nearly 19 times earnings but given the expected growth rate of earnings, it is far from cheap. But the index is more concentrated today than it was then and very dependent on the performance of the technology sector. The only time it has been more concentrated was just before the dot com bust when tech got as high as 30% of the index and we know what happened then. The long-term average tech weighting is around 19%.

That’s the bad news. The good news is that you don’t have to own the S&P 500 even if most people think of it as “the market”. It is an unsystematic risk, one that can be mitigated through diversification. If history is a guide, the allocation to tech will revert to the long-term mean and the top 10 holdings will turn over. Only one of the top 10 from 2003 is still in the index – Microsoft. Only 4 remain from 2013. And when we look back 10 years from now, I suspect you’ll see something similar. Plan accordingly.

Joe Calhoun

Stay In Touch