I believe if you were to ask most people their definition of the worst economic case, they would respond with some description of a crash. An exceedingly large contraction that spares practically no one, destroying much in its path. Like what followed 1929, that would seem to qualify. It’s why we spend so much time going back to 2008.

That isn’t actually the worst, however, only partway to it. The real nightmare is not just the crash but being unable to ever come back from it.

In the mainstream, this is not a situation anyone ever contemplates seriously. An economic system, they believe, is predestined to grow. Authorities need only let it happen by clearing the way and given enough time it will. That’s why people fear the crash most because the real disaster is thought to be impossible.

There are so many reasons this could happen. And a very big one is this oscillating nature of the post-crisis global economy. As it starts into downturn, it leads to all sorts of denials and mischaracterizations (a strong dollar is good; a manufacturing recession doesn’t matter, it’s only 12% of the economy; etc.) that are anchored in orthodox understanding. Eventually it can’t be denied or mischaracterized without great comedy and absurdity.

That then leads to the beginning of reflection and admission, some people start to really doubt the orthodox standpoint – but it never goes anywhere. Just as there appear some serious discussions about all that might be wrong, the economy oscillates back to the upswing and everything that just happened is set aside in one big, inappropriate sigh of relief. All urgency disappears into the next overestimation of mere positive numbers.

I wrote in January last year that a crash, another major reset perhaps even greater than 2008, would be a better option at this point than going through yet another of these false recovery periods:

It is 2017 and the last time the word normal could be most realistically used to describe the global monetary condition was in early 2007 ten years ago, meaning that in every way crash is not the worst case. The nightmare scenario is repeating the same malfunction over and over and over without the possibility of resolution. No matter what you do, nothing will work; and by and large what you do do only makes it incrementally worse. At this point, a crash is a welcome reprieve, for it is likely the only way to recommend sufficient urgency so as to consider and allow the radical steps necessary to actually get out of the nightmare.

That’s all these upturns ultimately accomplish, to destroy the urgency that just starts to gestate upon the lows of the last downturn. Just as everyone finally got to understand CNY DOWN = BAD, after shaking off orthodox doctrine in favor of using their own eyes to do it, all that essential energy dissipated as the world so easily fell back into default optimism thinking recovery and some pathway to normal again.

There is no memory or attention span of what just happened no matter how bad it gets, it’s all forgotten the very first moment the plus signs reappear. And it’s always the mainstream out in front misleading everyone into believing it is happening this time for sure (well, we claimed global growth in 2014 was happening and it didn’t, but in 2017 it’s synchronized!).

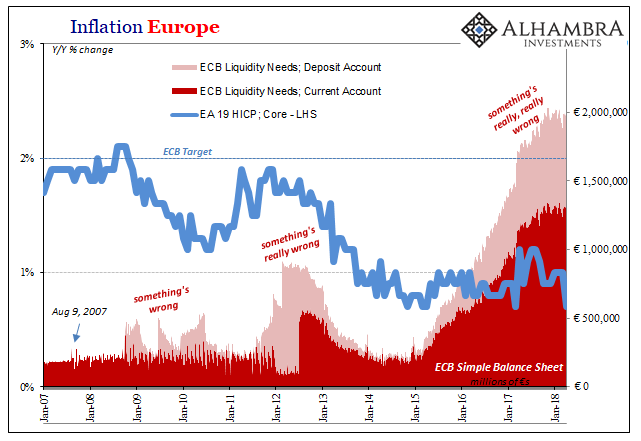

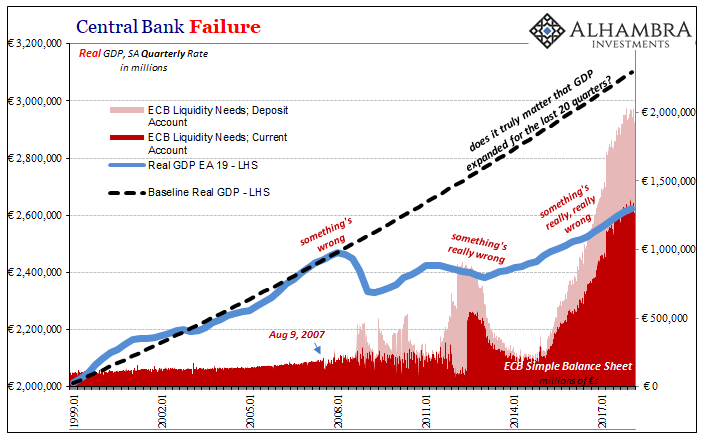

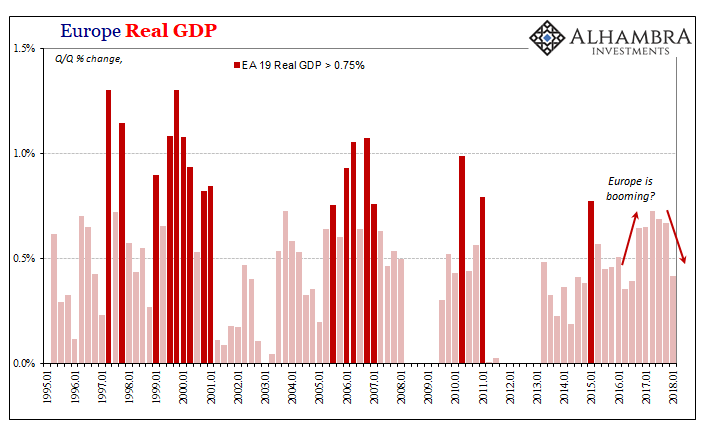

To really make that case, Europe and Japan were crucial. What two examples of breaking out positively would have had more effect than them? Europe has been the worst performing and most disastrous of the Western economies. Japan, well, it’s the original modern tragedy. For one or both to escape the so-called deflationary mindset wouldn’t just be big, it would be everything.

And so, both were persistently described that way all throughout last year, at least indirectly. There wasn’t any immediate evidence it was taking place at that moment, rather repeated conjecture about how in the “near future” both the ECB and BoJ were going to have to start thinking ahead to tapering and exiting their QE’s; perhaps considering so far as when they might begin raising rates. Extrapolations.

That was all it took – for a while. Just the idea that in Europe and Japan these beleaguered central banks were almost in sight of a well-earned rest.

Europe fell back into brutal reality, which upon closer inspection really proves it was never all that close to a breakout to begin with. The narrative in 2018 has been met with an audibly discouraging thud.

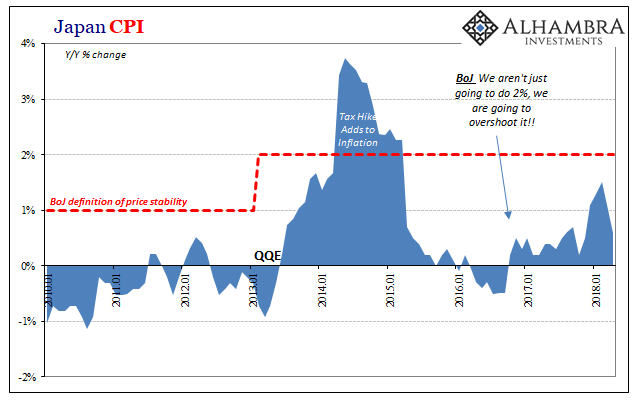

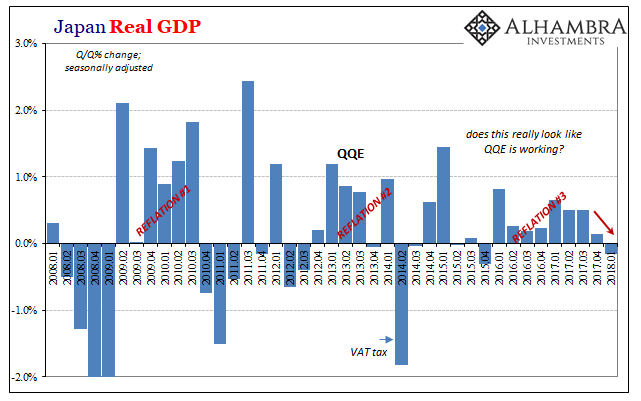

Japan this week has proved itself no different. Earlier, the Cabinet Office reported that Real GDP contracted in Q1 2018 for the first time in several years. More than that, Japan’s economy has struggled for two quarters in a row now, not just the one, both of those like Europe matched up to where “dollar” problems re-emerged globally.

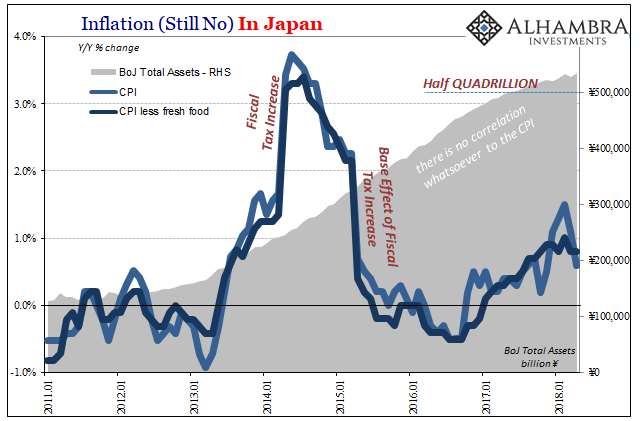

Yesterday, it was Japan’s Ministry of Internal Affairs and Communications’ turn to skewer the narrative. The country’s CPI, just a few months ago seemingly in sight of the official target, dropped considerably. Having accelerated to 1.5% year-over-year in February, the CPI advanced only 1.1% in March, and now just 0.6% in April.

The one month of a pretty substantial slowing could have been written off as heavier month-to-month noise. Two months reversing as far as 0.6% raises instead all the usual issues starting with the worst case – absolutely nothing has changed in Japan.

It’s embarrassing not just for the Bank of Japan and its half a quadrillion in assets, it’s a blow to globally synchronized growth as it has been all this time – nothing more than a fantastical idea predicated on a broken assumption. Time is dispositive, all right, meaning that in Japan more than anywhere else it should have been apparent by now that economic growth is never a given and it can be foregone by sustained gross incompetence.

What did “globally synchronized growth” actually accomplish? All it did was waste another year (closer to two) in pursuit of an economic trajectory that at best was unlikely and more realistically was never really possible. A year that, had the media been more honest, could have been far better spent covered in serious, deep self-examination starting with central banks rather than seeing these damn central bankers soaking up the unearned affection drawn from nothing but useless extrapolations.

Welcome back to the wasteland. You never left.

Stay In Touch