Maybe central bankers are just tired of being alone. In December 2008, for example, the FOMC members were practically celebrating how the NBER finally called recession an entire year after its start. Misery does love company, especially when you botch things that badly.

On Tuesday, KC Fed President Esther George admitted she and her fellow policymakers were confused. But, but they weren’t the only ones, she claimed.

The current level of inflation may perplex central bankers and financial market participants, but in the context of a growing economy and job gains, it doesn’t demand a Fed policy response in my view.

She really is trying to say everyone’s a bit confused, not just the FOMC or ECB’s Governing Council. I guess that’s one way to try and stay hawkish. Not a very rational one, though, is it? Another sign of the times.

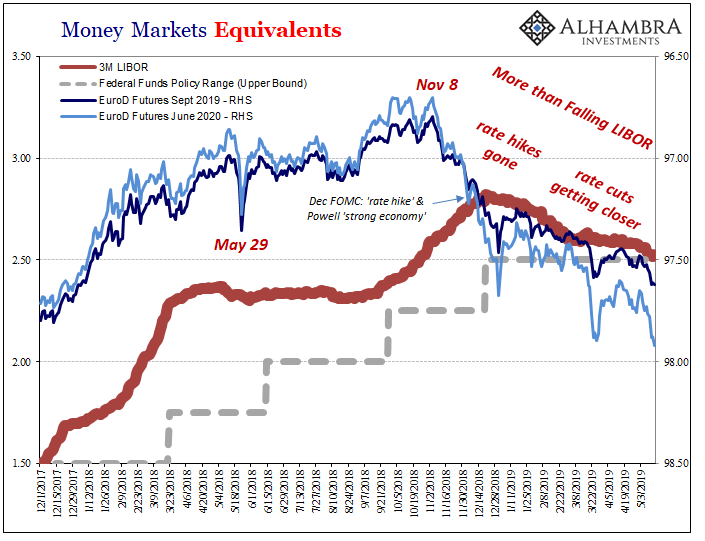

Sorry Esther, you and Jay Powell are the only ones who are baffled here. Unless you’re talking about stocks when you say “financial markets participants” the rest of the real markets which do matter are the opposite of confused.

Fed officials are going to be forced into these looming rate cuts kicking and screaming the whole way. The last shriek on the road to defeat will be, but the unemployment rate is still less than 4%!

The reason for Ms. George’s ongoing befuddlement is perfectly clear, too. Her context of a growing economy and job gains in 2018 was pretty fantastical. In 2019, it’s downright fiction.

More and more the data shows not just downturn but one that’s unusually harsh already. Small wonder, the squeeze and drag of a eurodollar system long since turned very sour. We’ve seen some eye-opening economic statistics of late, consistently much closer to recession than the unemployment rate.

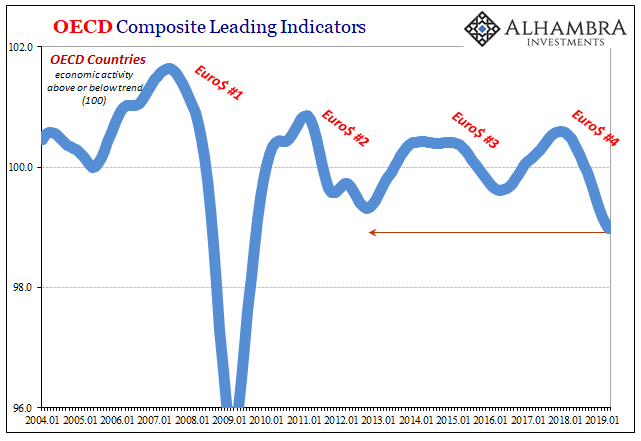

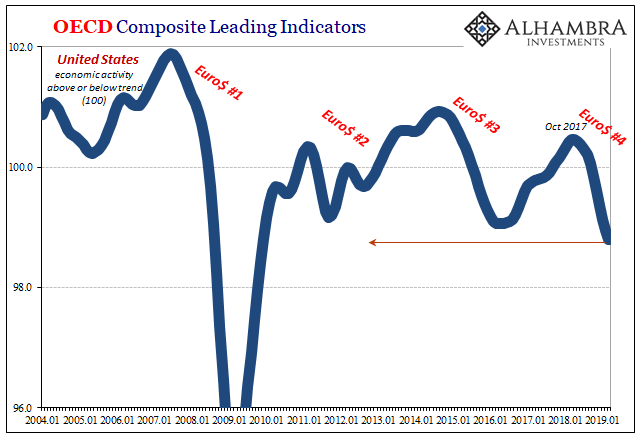

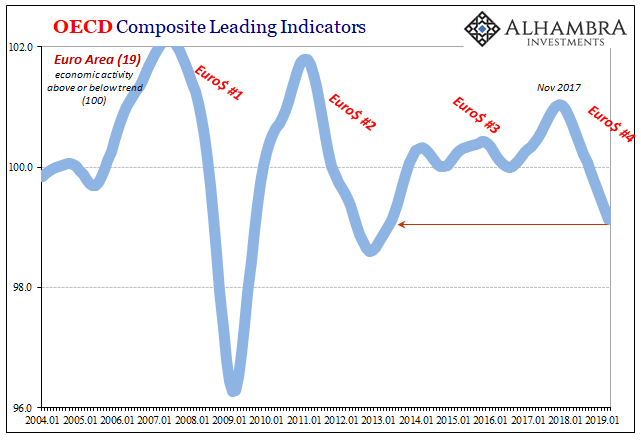

The OECD adds another level to the ongoing economic struggle. Its Composite Indices of Leading Indicators have dropped to lows not seen since past recessions. The CLI, supposedly, tells us when economic growth is either above or below trend. In several key places, through only March 2019 the OECD’s algorithm says growth hasn’t been this far below trend since 2009.

What will come as a complete surprise to Esther George, this is also true of the US economy.

In Europe, the CLI already compares (unfavorably) to the bottom of 2012’s full-scale, continent-wide re-recession. And that’s just up to March 2019.

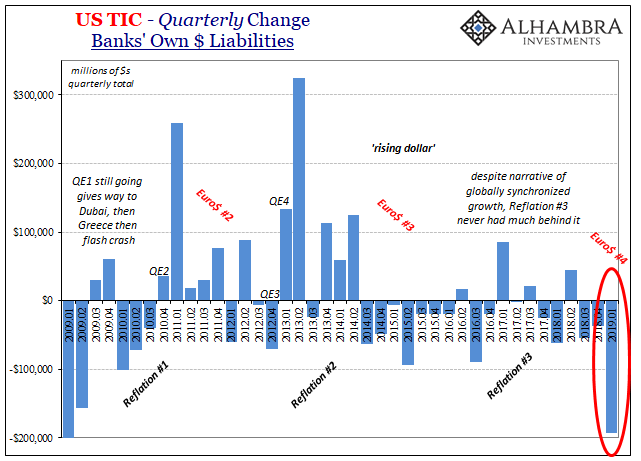

Perhaps more importantly, you can see when this weakness first began to develop: in the fourth quarter of 2017. That, too, is very consistent with the TIC banking data which turned negative in the very same period. Not trade wars, a few billion in American tariffs on Chinese goods.

Euro$ #4.

Maybe the US avoids a recession, perhaps the rest of the global economy does, as well. Given where things stand right now, though, Euro$ #4 is proving to be one of the nastier ones so in the end that might just be semantics. It’s also closer and closer to the base case the further into 2019 we go. We’re gonna need a lot more doves, and soon.

Stay In Touch