The FOMC hates the bond market. Hates everything about it, especially how it tells these Economists they don’t know what they are doing. Monetary policy being little more than a vanity project, that’s not going to work for the people practicing it.

OK, if you don’t like bonds then how about something else besides the stock market? Some independent corroboration of one side or the other.

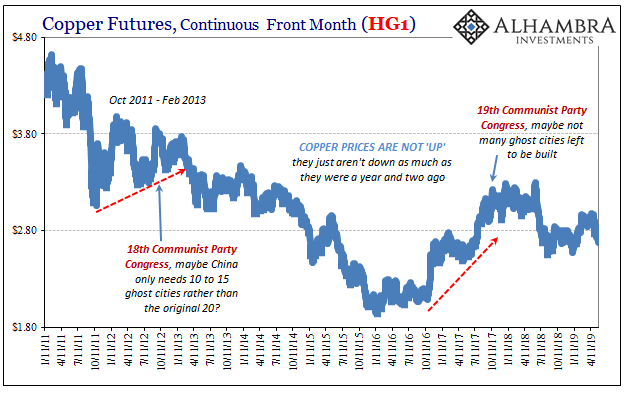

One of the first prices to sniff out the end of Reflation #3 was copper. When the Communist authorities of China got together in the middle of October 2017 to discuss economic prospects, primarily, commodities particularly this one took note. The rest of the world was afire with inflation hysteria, yet curiously copper wouldn’t really budge in the wake of the 19th Communist Party Congress.

The same gathering in which Xi Jinping was forced to try and sell “quality” growth. Copper, one of the few along with Japanese banks, was like, what did he just say?

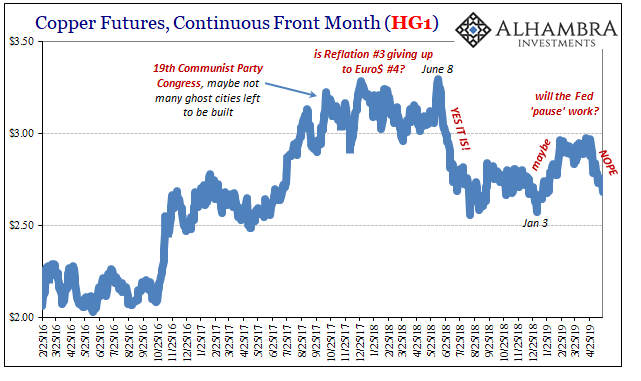

What followed was the tug-of-war in narrative format. Jay Powell took office more aggressive than Janet Yellen. There was more of a risk of inflation than anything, he said, which would be copper positive. He told that to Congress, and kept on saying as much everywhere he went. He wouldn’t stop until the upward slope of the S&P 500 did.

But Dr. Copper wasn’t buying. It wasn’t selling, either, at least not initially. Through the middle months of 2018, especially April and May, copper hung with a slightly lower bias. In early June last year, though, that’s when it tanked.

It finally came down in the UH OH column.

This was the same period when the eurodollar futures curve started its inversion. Copper and eurodollar futures confirming the completed transition out of Reflation #3 and unfortunately into Euro$ #4.

The FOMC today says that whatever “it” was last year, “it” is now over with. Transitory, by virtue of the NYSE. Powell and his bunch better hope that unlike last year copper is wrong this year.

It has been moving resolutely lower all month, along with, unsurprisingly, the eurodollar futures and UST curves. Like 2018, this might be a really solid signal of getting worse. In this context, another big one toward rate cuts.

The FOMC doesn’t like bonds. Never has. What about copper?

Stay In Touch