In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it.

From the general public to politicians, don’t screw up housing.

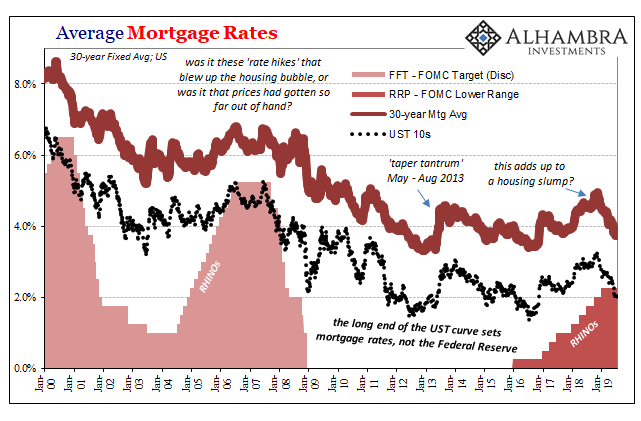

It’s also the one asset class which seems to point the arrow right back at the FOMC. Rate hikes and housing busts have historically been clustered together. Right or wrong, most people see it as causation, and even though it isn’t the perception does matter.

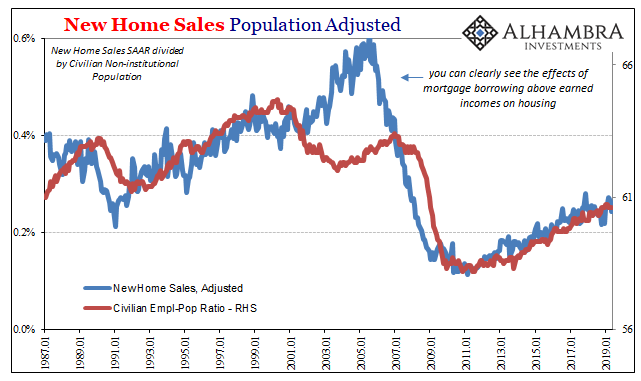

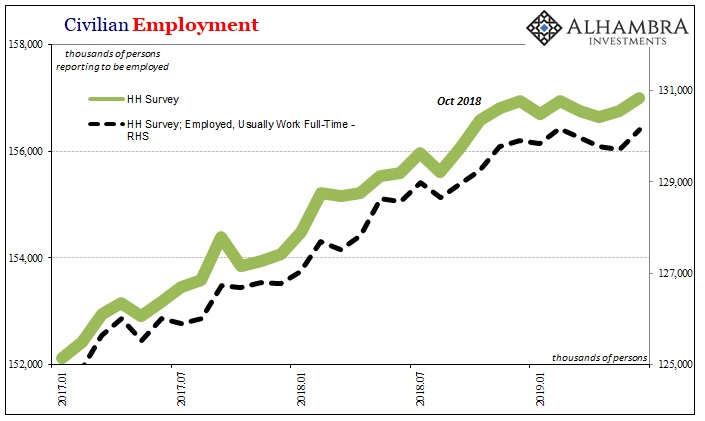

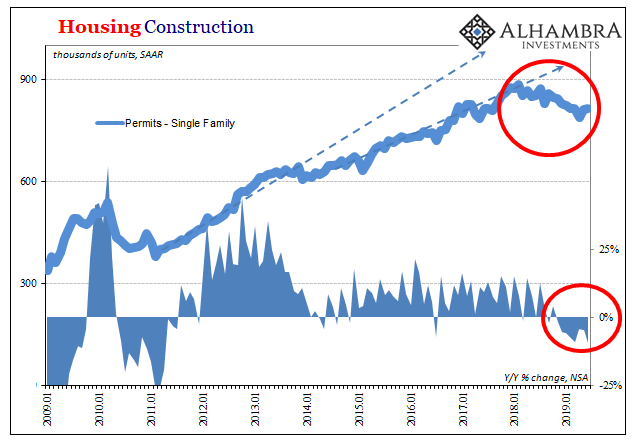

The latest data all suggest a real problem here. From resales to construction, it has become a bust. It’s not nearly what the last one was; how could it be? The housing market has never recovered from it despite all the MBS purchases buried in three of the four QE’s. It’s not more people/more new houses, it’s fewer jobs/fewer new houses. There’s a direct connection between employment and homes.

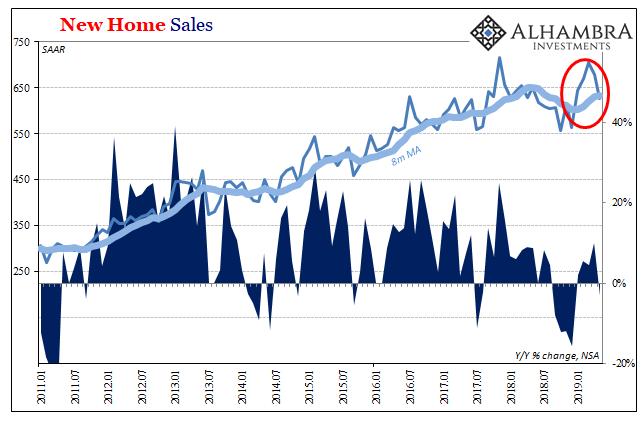

The Fed resumed its “rate hikes” in December 2016. It was in November 2017 when things started to go wrong. New home sales peaked in that month which may seem like it was due to higher mortgage rates. But so many global dollar indications peaked right then, too.

Mortgage rates never did get all that much higher in 2018 than they were at their lowest point. Since November 2018, they’ve come right back down because mortgage lenders follow the bond market not the Federal Reserve. In other data series, this hasn’t made a difference; the National Association of Realtors, for example, continues to estimate lower sales of existing homes even though rates peaked more than half a year ago.

The one housing data point which did suggest something to do with interest rates was the sale of new homes (above). Falling substantially after peaking in November 2017, they bottomed out in December 2018. For the first few months of 2019, the sales of new homes rebounded.

It may have been due to falling mortgage rates in combination with falling prices. Lower rates plus lower prices mean far more affordable debt payments.

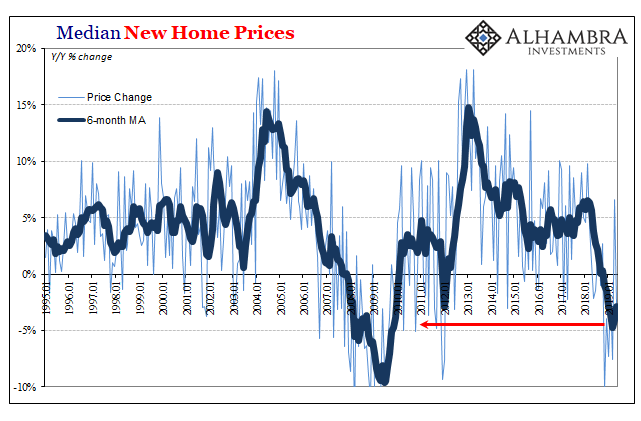

But that then raises still another issue. With the housing market never having recovered, what does it truly mean when prices have to be openly discounted for inventory to be moved? It also suggests significance in terms of timing, though not in the manner of interest rates.

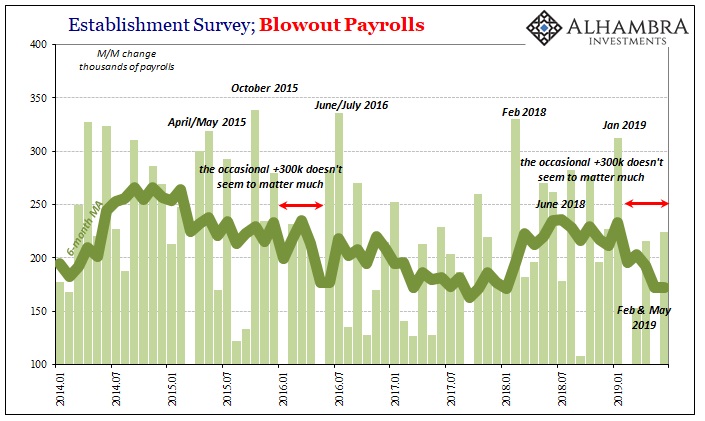

Despite the mainstream media claiming each and every payroll report as remarkably strong, the data actually shows a meaningful slowdown developing over the last third of last year. The average growth rate in the median price hit zero right around last September. It’s been lower ever since; so much so that the current general decline in housing prices is the worst since the big bust.

If this kind of general price decline were happening in the 1990’s or middle 2000’s, it would have been called a disaster.

Slowing economic growth plus rising labor market uncertainty, regardless of the unemployment rate, producing price declines way, way too much like 2007. Even though Powell and his gang talk up the employment numbers at every opportunity, they can’t be too thrilled about what would have to be a lot of consistent coincidences – if the rate hikes and mortgage rise are to blame.

Even if the FOMC is more likely to take the strong economy view, there’s far too much here to so easily dismiss. In the parlance of central banking, the balance of risks has tilted to the downside. While remaining optimistic that it won’t matter in the end, you can plainly see why monetary policymakers might be willing to err on the side of caution even though the S&P 500 sits above 3000.

The bigger concern is what this potential housing bust really means outside of the FOMC’s purview. Does it say anything important about the relative potential with Euro$ #4 versus #3 or even #2? If you think the bust is mortgage rates, then probably not.

It doesn’t seem homebuilders are buying this line of thinking. The data in construction has been quite consistent – permits and starts. The latest monthly estimate of new home sales casts further doubts, too. They were substantially lower in May 2019, and though it may be noise (the sales figures are notoriously noisy month to month) it might also be convergence with the rest of the real estate estimates elsewhere.

If not mortgage rates, then this is another serious headwind added to a growing list of them. Not in terms of housing itself, again the market has never recovered which means on its own real estate doesn’t contribute as much economic activity at the margins; and therefore wouldn’t subtract much.

Rather, what would a macro-driven housing bust at these levels and rates suggest about the real underlying condition of the US economy? Starting with the group of employed consumers who require very serious price markdowns to buy up a lot less supply. In the context of growing weakness elsewhere, it might propose that Euro$ #4 really is becoming one of the nastier siblings.

Stay In Touch