As an alternate member of the FOMC, Lorretta Mester has been sounding off on inflation. When the payroll report for the month of August 2018 was released early in September, Mester as President of the Cleveland Fed was widely quoted for her “hawkish” stance. Referencing the highest wage growth in a decade, speaking in Boston she said, “Today’s [jobs] report is a strong one, this gradual path we’re on, I’ve been a supporter of that and I continue to be a supporter of that.”

According to the BLS, wage growth in December would eclipse August, thus becoming the newest highest in a decade. By the time that report was released, though, no one would be left at the Fed to support “this gradual path we’re on” – not even Chairman Powell. Everything had changed.

Or maybe nothing had?

There is so much emphasis on inflation especially at the monetary policy level because that’s the ultimate outcome. Inflation is a monetary phenomenon and if central bankers are doing their job, it should conform in general terms to their policies. Not each and every month, but over time far more often than not prices should remain in the vicinity of what’s expected.

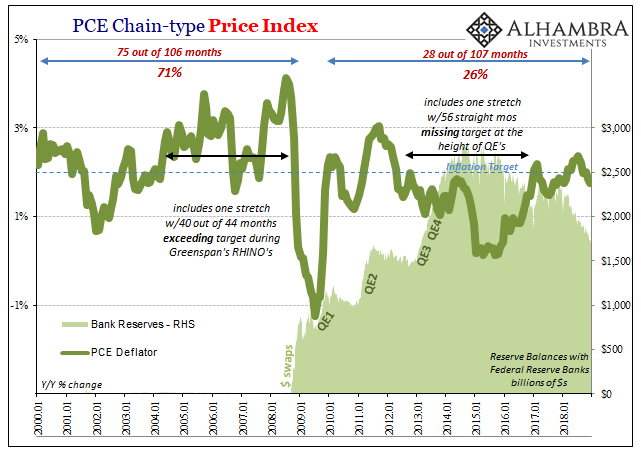

If that isn’t what is happening, then something drastic needs to change. The Federal Reserve under Bernanke confronted one “something” in 2008 only to meet it with QE and ZIRP. The monetary textbook said these were powerful stimulus tools and here was the chance to prove it.

Repeating QE instead three more times, leaving some even on the inside to wonder if all that was accomplished was a gigantic monetary head fake, there was enormous pressure for success.

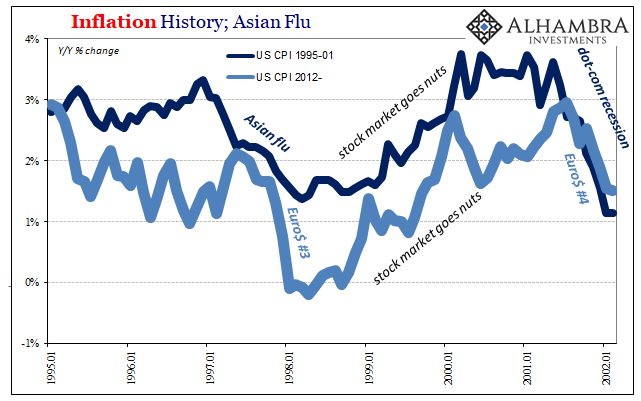

When 2014 rolled around, they believed they had finally achieved it; only to suffer the clear setback of 2015. Euro$ #3, then, should have been the game-changer, the final proof that conventional policy even conventional thinking has it all wrong. It really was enough of both time and sample size to have shown how in practice the world just doesn’t work the way officials believe it does.

Instead, Reflation #3 showed up and the few who began to express doubts in 2016 quickly went back to sleep. A small chance at vindication was apparently preferable to honest inquiry. Even in 2017 there were warning signs things still weren’t progressing the right way. The unemployment rate kept falling but inflation failed to materialize.

This wasn’t just an academic issue, nor purely an economic one. The bond market, for example, is in a precarious state. Interest rates being as low as they are, continuously, should an inflationary recovery finally breakout (a real one, not an imaginary one) the result would be a true massacre. And it would be a violent, chaotic market spasm the whole world would righteously celebrate.

Yet, as the narrative for globally synchronized growth gained in strength yield curves continued to flatten – the bond market saying to Janet Yellen and Loretta Mester, you have to show me this inflation first before the slaughter can begin. The word of Economists and central bankers had become degraded. Officials noticed.

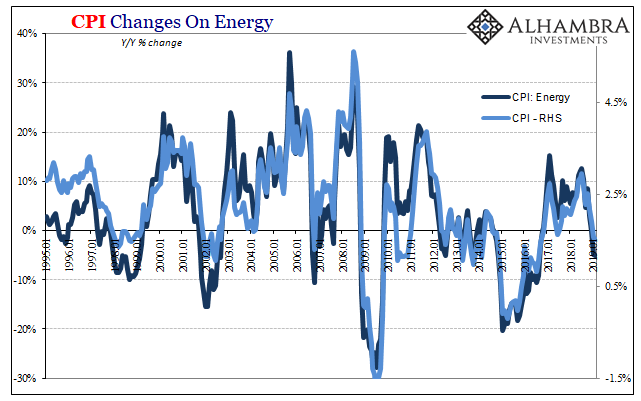

Except, their answer for the lack of inflation has been “transitory”; as in, idiosyncratic, temporary factors keep interrupting it. It’s there, this wage-driven recovery, we just can’t show it to you in the current data because it is hidden and obscured by things we believe don’t really matter. In 2015, Yellen said this about oil prices.

In 2017, they started to blame drug prices and Verizon. Appearing in Chicago in May that year, Cleveland’s Mester said:

In determining where inflation is relative to our goal, we need to look through transitory movements in the numbers, both those below and those above our goal, and focus on where inflation is headed and where it will be maintained on a sustained basis.

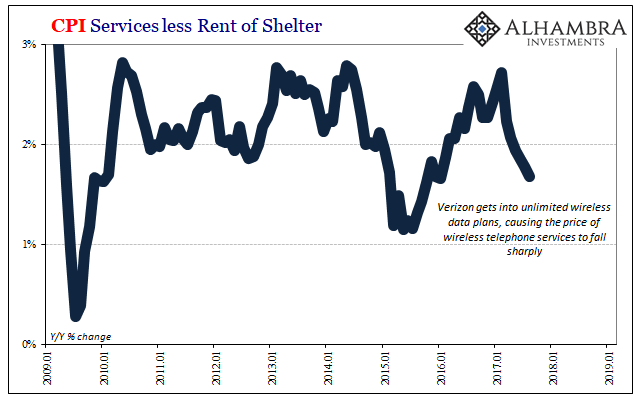

It was, in essence, the same old official pabulum – don’t worry about today’s CPI, trust us tomorrow’s is going be huge! Like Yellen, Mester singled out “the decline in prices for cell phone service plans.”

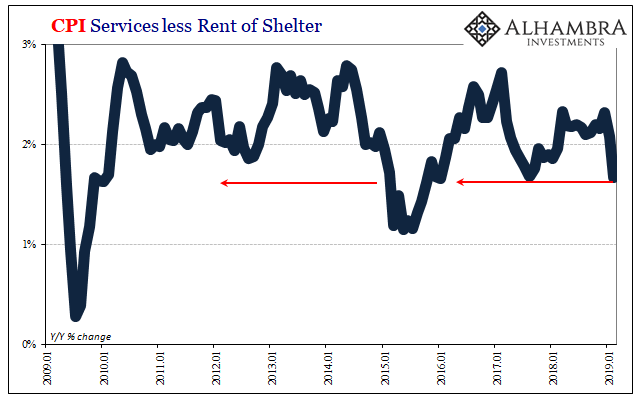

What she and Chairman Yellen were saying about the unlimited data plan “wars” was technically true. You could see Verizon’s imprint on the inflation indices, including the so-called core inflation versions such as CPI Services less Rent of Shelter. There was a substantial drop in them right when the CPI component for wireless telephone services tanked.

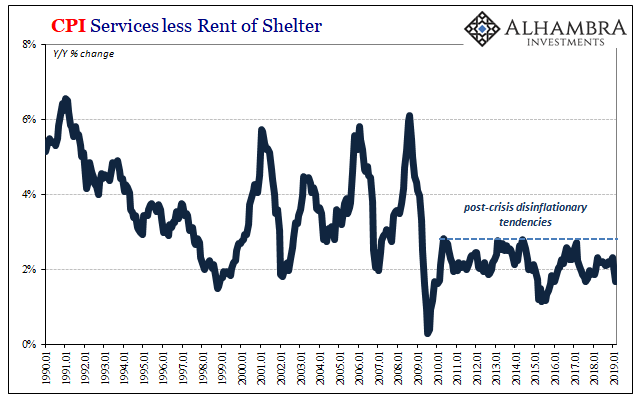

But this was missing the forest for the trees. It was attempting to explain small movements when what was being discussed was a major, categorical change in overall (global) circumstances. Long before Verizon’s decision, there wasn’t anything that suggested the US economy had begun the process of jumping out of what was by then almost a decade of economic hardship.

The unemployment rate wasn’t being corroborated by anything, least of all core inflation metrics.

Yellen and Mester, did they really, truly believe in the Verizon excuse? Is it possible they could have been so desperate for success they opted for a newer version of “data dependent.” Maybe they were just hoping to buy some more time, fingers crossed that given enough of it things would just work out on their own due to nothing more than random good fortune.

This isn’t the mainstream picture of how monetary policy is conducted, of course. But it should be. There is no Verizon in 2019, but there has appeared still another I’m sure “transitory” factor only awaiting its official citation.

This time, the CPI Services less Rent of Shelter has slowed to the lowest rate since January 2016, one of the lowest on record – lower even than the worst month (for Yellen and Mester) during 2017’s wireless wars. There is no oil price effect here, either.

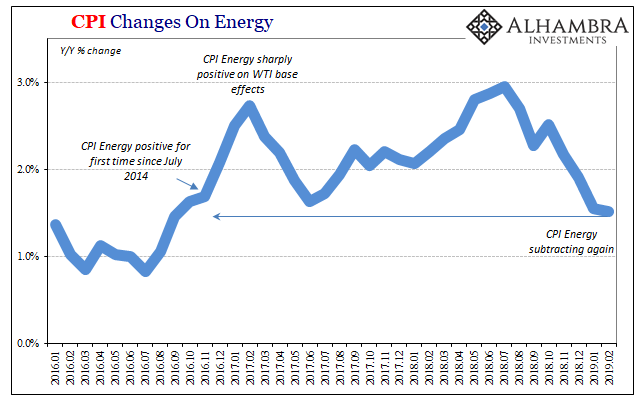

And right now energy prices aren’t slowing headline inflation more than they were. According to the BLS, the overall CPI index in February 2019 was just 1.52% above its level recorded for February 2018. The unemployment rate has been 4% or less in each of those twelve months.

The flat curves had it right. You don’t just take the word of central bankers because there is a much bigger issue here than specifically the CPI, or even bond yields. If something was wrong with the economy, it’s not just that policymakers haven’t been able to fix it, they don’t even know where to begin.

While Mester and Yellen were short run singing about out Verizon, in 2017 I wrote how this was a long time coming:

If the Fed and the rest of the central banks had little idea what was taking place with money demand, they had no idea what was going on for money supply. In fact, they really didn’t want to know, preferring instead to focus on what Ben Bernanke would later specify as the “aggregates”; things like income, GDP, and most especially inflation rates. If those aggregates were well-behaved, particularly inflation, then, once again, it was simply assumed monetary policy was the reason.

You can already see the conundrum for what it really was. If inflation or whatever other monetary characteristic was not well-behaved, where would the Fed even begin? That has been the history of the last ten years in particular, where once things started to go wrong none of the central banks had a real idea what it was that was wrong, let alone any further idea what to do about it.

It’s a very simple thing, having nothing whatsoever to do with wireless data plans. If you don’t understand money, you can’t understand inflation – nor recovery. It’s 2019 and nothing has changed.

Stay In Touch