Some things are not supposed to be innovative. It’s no surprise that given the high technology of our modern lives that modern humans tend to be drawn to the new and shiny. We’ve marked the advance of society along the lines of big leaps in understanding and doing. Quite easily, we can get lost equating the two, thinking every innovation is the same as progress.

Several counterexamples spring to mind, but more than those there are things that are just supposed to be simple. These tend to be more basic in function, such as turning on your computer in the morning. The machine itself is a marvel of advances, but the start button really doesn’t need to be among them. We just want it to work.

In economic terms, a lot of fundamental propositions are like that. One I’ve referred to recently is the debate over the labor shortage (or, more properly, LABOR SHORTAGE!!!). No creativity is required on the part of any business. You want workers, pay them the rate they want. Problem solved in the simplest possible terms, evolutionary thinking just not needed.

The same goes for central banks. Perhaps too many people view them as some sort of impenetrable black box, the wizards of mathematics who come up with beautifully complex equations to decipher the mysteries of the vast economic universe. In antiquity, the various Oracles scattered throughout the ancient peoples operated the same way under the same cloak of illusion. They were just getting high off the volcanic gases and spouting nonsense.

But it was, at least, interesting nonsense.

In September 2016, the Bank of Japan added three more letters to what was becoming a crowded scheme. The new plan was QQE with YCC, the meaning of each one inside this arrangement not really important. All that mattered was that everyone sit in awe of brand new genius.

Bloomberg, of course, dutifully went along as did many others, one author on that platform writing, “The first major central bank to adopt quantitative easing in the modern era has innovated again.” Somehow it escaped their notice (purposefully, I can only presume) that if quantitative easing had actually worked it wouldn’t have required further tinkering.

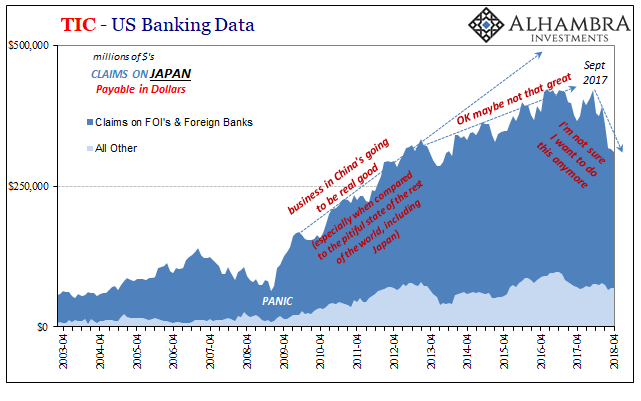

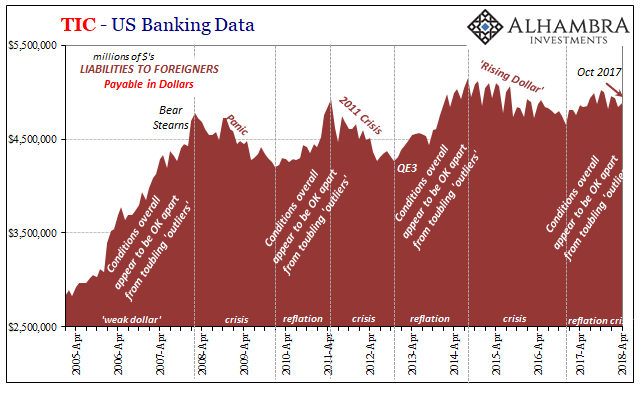

And that’s the whole point for pretty much everything since August 2007. We live in the age of almost constant central bank experimentation. Not just in Japan, either, as even now the Federal Reserve finds itself once more on the confusing end of reality only this time supposedly in its exit.

Japan’s QQE was itself widely hailed as just this kind of thing, another big leap in monetary policy progress. They added a second “Q”, qualitative, to the first “Q”, quantitative, neither of which have ever been shown to add up to “E”, easing.

That’s the point; if you have to do more than one QE, the Q wasn’t Q. If you have to add more letters, then what are really you doing? As it turns out, what central bankers are doing is the same thing ancient Oracles did to protect their turf. Pure showmanship.

Monetary policy is not meant to be entertaining. If anything, we aren’t ever supposed to notice. It should work predictably, honestly, dependably. It never, ever does.

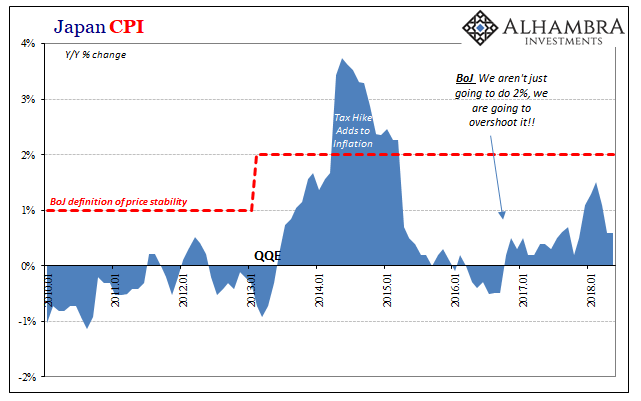

Coinciding with the laughable appearance of YCC in September 2016, Haruhiko Kuroda amusingly decreed that with this new “innovation” the Bank of Japan would not just achieve 2% inflation on a sustained basis, policymakers would let it “overshoot” to some considerable degree. Let there be no doubts, he said.

Even as late as April 2018, Kuroda was still talking about an inflation overshoot, though the giddiness and confidence of his earlier performance was transformed into more haggard pleading. As of last week, as noted this week, things are now quite different. The BoJ Governor hasn’t just yet thrown in the towel, but that’s only one step further along from blaming the Japanese people for his shortcomings.

The deflationary mindset that has become entrenched amongst people is quite tenacious and it will take time to completely dispel this mindset.

Time? Half a decade already spent, buddy.

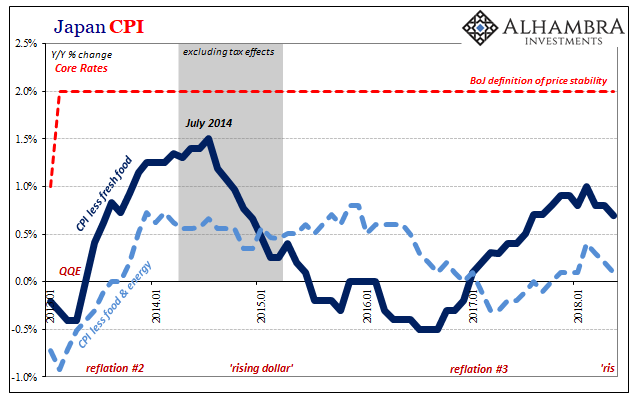

The latest inflation figures from Japan, previews of which were surely on hand for that last BoJ policy gathering, were not good for the likes of monetary policy innovations. The YCC hasn’t produced, in some measures of the CPI it’s been materially worse than just the second Q.

The headline inflation figure was 0.6% in May 2018 for the second month in a row. As always, the only thing that is ever transitory in this inflation context is the few months pointing in the right direction. Subtracting the prices of fresh food inflation registered just 0.7% in May, the lowest since last September. Removing energy, too, and there hasn’t been any significant movement at all since 2015.

This is a defeat not just for Kuroda, nor is it limited to the Bank of Japan. Inflation hysteria grew to such absurd proportions because some crucial mass of people (media) started to proclaim that not only was the US economy looking good, it might’ve seemed that if Europe and Japan could actually shake loose, too, and at the same time it would really, really be something.

It was always a big, enormous leap and one never grounded in intuition or analysis but of emotion (including the politics of anti-populism). There really wasn’t much evidence that anything small let alone big had changed. Even the reflation trend of this third one was skinny in comparison to its predecessors. Globally synchronized growth has depended way, way too much on the word synchronized; itself a marketing innovation very similar to adding YCC to an already failed QQE.

Central banks aren’t supposed to be groundbreaking. They are just supposed to work. They don’t. Not in this eurodollar age.

Stay In Touch