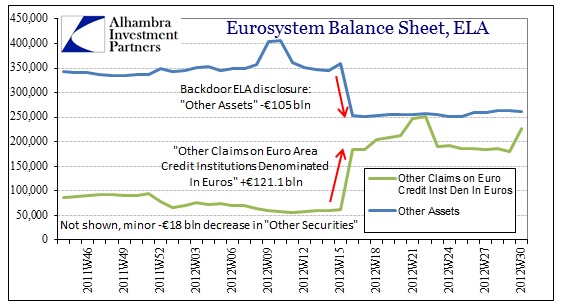

Following up on yesterday’s post about ECB interventions, I had noted the ELA accounting under the line item “Other Claims on Euro Area Credit Institutions Denominated in Euros”. For the most part, ELA usage has dropped since December 19, 2012, when the ECB reinstated Greek debt as eligible collateral for financing programs.

The ELA was supposed to be a last resort measure of emergency liquidity operated by individual National Central Banks, but with ECB overall authority. For banks that were short of eligible collateral and therefore couldn’t post anything in the various ECB schemes, they had at least had one more shot before total illiquidity and bankruptcy. They could take some of the junk collateral and post it to their NCB, who would then obtain “euros” (ledger money) from the ECB in their place. It was a risk transformation that put the NCB, not the ECB, on the hook for credit losses.

However, the ECB governing board ultimately decides both the timing and the quantity for individual banks even though these individual banks are effectively using their NCB. That makes the NCB a simple conduit, bereft of any individual management choices or allocation decisions.

That’s why the April 20, 2012, disclosure of €121 billion in ELA usage due to the accounting change was so damaging. It ran counter to the established narrative that the LTRO’s had “fixed” the euro problem. Instead, it proved the ineffectiveness of any central bank at instilling true liquidity (flow, rather than stock).

Moving to Cyprus, we have seen a €20 billion increase in “Other Claims on Euro Credit Institutions Denominated in Euros” on the ECB’s balance sheet since the week of March 15. We can draw a pretty straight line from Cyprus’ banking turmoil to the ELA here.

This is all relevant to news today that the “bailout” in Cyprus will be much greater than “anticipated” (read: always start with a lowball bailout estimate). Originally thought to be around €17 billion, it is now estimated that the total aid and assistance will be something higher than €23 billion. Cyprus GDP is only around €19 billion.

During the days when the Cypriot banks were closed, the deposit haircut program moved from Parliament to the troika. For banks, it meant funding through the ECB and its governing council, thus the ELA. So, despite the deposit haircuts and everything else, this bailout/bail-in scenario in Cyprus will be funded and controlled by the ECB, but all of the credit risk remains at the Bank of Cyprus (NCB).

There will be no Parliamentary discussions about who gets cut and what losses get recognized; from here on out, via the ELA, Cyprus is both under ECB control and responsible for everything. Remember, under the terms of the ELA, the ECB’s apparatus gets to decide exactly how much individual banks are allowed to receive. This is micromanagement writ small, bank managers must follow their given orders, no leeway or margin for individual exercise by either the bank or the Cypriot central bank. Perhaps that is the way it should be since these banks were ultimately terrible intermediaries, but, in terms of financial stability, this would be a counterproductive template for larger nations. Just in political terms, there is no way to keep out individual national authorities of the larger PIIGS, meaning the liquidity rules would have to be rewritten (again) to something more “accommodating” and thus creating even more confusion and uncertainty.

Of course, European officials deny that there is any template here (after affirming this idea at first), but given the scale of insolvency throughout Europe it is hard to see another realistic path.

Stay In Touch