Banco Popolare, one of the 25 largest banks in Europe and one of Italy’s largest, was forced to inject “capital” into a subsidiary joint venture, Agos Ducato SpA. Losses have been mounting at Agos, a consumer lending conduit in Italy, for more than a year. The company is joint venture between Banco and French megabank, Credit Agricole.

Banco had already tried to negotiate a full sale of its ownership to CA toward the end of 2011 but was unable to close any deal. CA, like so many French banks, at the time was looking to extricate itself from bad Greek subsidiary and joint arrangements and had no spare “capital” to invest. As it is, the Agos losses are forcing both banks to sink another €450 million (€300 million in equity) into the Italian black hole.

The ongoing and worsening depression in Europe is only just beginning to take its toll on European banking operations. While nonperforming loans have been an issue in Spain, SAREB, funded by the ESM and other Eurozone conduit measures, has taken at least some of the pressure off the Spanish banks. No such policy action exists in Italy which is now the epicenter of economic disaster.

The close ties between French and Italian loan markets pull the French megabanks into the crosshairs. In fact, it was the growing Italian sovereign debt issue that nearly bankrupted Credit Agricole in November/December 2011, leading to the LTRO’s and Federal Reserve dollar swap arrangements.

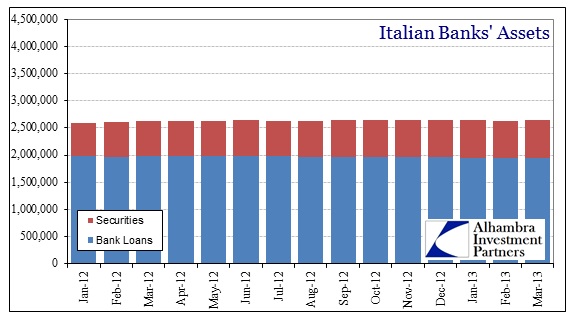

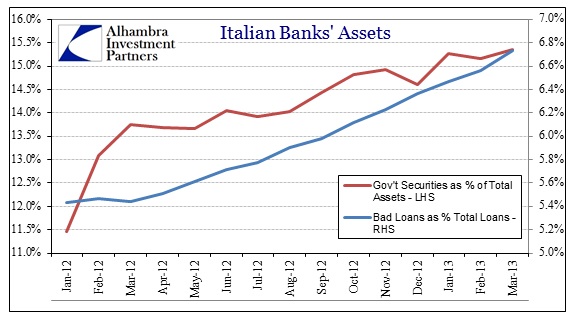

That is why rising bad loans is a warning to banks not just in Italy, but across Europe. The bad loan issue has forced the Italian banking system to largely suspend any kind of credit growth, which only further entrenches the economic depression. Loans to businesses and individuals roll off as they mature or get charged off and are simply replaced by purchases of Italian government bonds.

The proportion of government securities in Italian bank books matches closely to the rising tide of bad debt in the private loan market.

The exposure to Italian and Greek banks has forced the French financial industry to restructure heavily to avoid further capital losses. All three of the French megabanks have announced restructuring plans to cut costs, both in the name of new banking standards and economic reality:

“While both banks suffered from shrinking group revenues, rising French loan losses and market jitters over Cyprus and Italy in the quarter, they also cut overall expenses and booked gains from selling business units in a bid to shore up solvency.”

The true warning in all of this comes from just how far off projections the economic turn in Europe has taken these banks (for a second time, they never foresaw their Greek investments souring either). We need only go back a few years, to August 2011, to see such bad management at work:

“To help meet the 2014 profit goal, the bank said March 17 it plans to post earnings of more than 900 million euros at the international-banking unit after a loss of 928 million euros last year, as it opens more branches in countries such as Italy.

“In Italy, Credit Agricole’s largest market by staff outside of France, the company plans to add 50 branches and 150,000 retail clients by 2014. It already has about 1.7 million customers and 960 branches in Italy.”

The management at CA intentionally began to offset huge losses in Greek ventures with a growing presence in Italy. Needless to say, it is very likely they were using same off-base economic forecasts that the ECB and mainstream economists were producing. Now that it’s Italy’s turn at economic ruin, where will French banks strike next?

The exposure to Italy is not the only problem facing the megabanks – they now have rising loan loss expectations for their home market, France. Indeed, as much as they blame new lending standards for their cost restructuring needs, the plain fact is French retail banking is but a few years behind the Italian loan market:

“With French economic growth stalled over the last two years and joblessness at a record high, the total retail-banking revenue at the country’s top five lenders — including Groupe BPCE and Credit Mutuel-CIC — last year declined for the first time in two decades, and 5 billion euros ($6.5 billion) in operating profit from such business may vanish by 2015, according to Munich-based Roland Berger Strategy Consultants.” [emphasis added]

There are warnings here that bank investors are willfully ignoring in the orgy of asset price inflation in Europe. In the end, the economy will eventually matter more than the ECB’s promises. Asset bubbles are the suspension of reality, not the replacement of it.

Stay In Touch