Consumer confidence is at multi-year highs while personal income and wage levels for April were declining on a nominal basis. Without the boost of 0.2% “deflation”, disposable personal income actually declined 0.1% on a nominal basis. Personal spending fell 0.2% on a nominal basis.

The internals of the nominal decline related to three separate items – farm proprietor’s income fell $11.3 billion; government transfers, largely for social security and unemployment, dropped $13.7 billion; and personal current taxes increased $10.4 billion. Outside of these factors, wage income through DPI were slightly positive, but down compared to March.

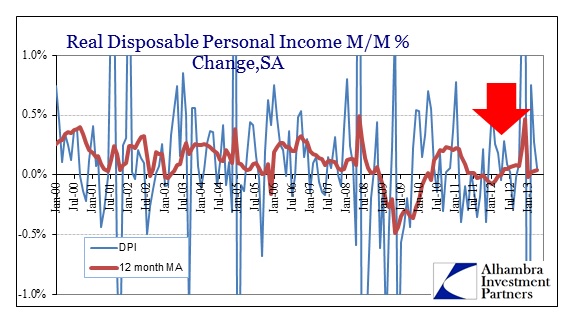

On a longer-term basis, personal income has been utterly weak since early 2011.

One possible explanation, aside from the drag of QE, is actual corporate earnings as estimated by the BEA. Corporate net income growth began to drag after 2010 in the BEA’s estimations, offering another explanation for the timing of the slowdown in personal income.

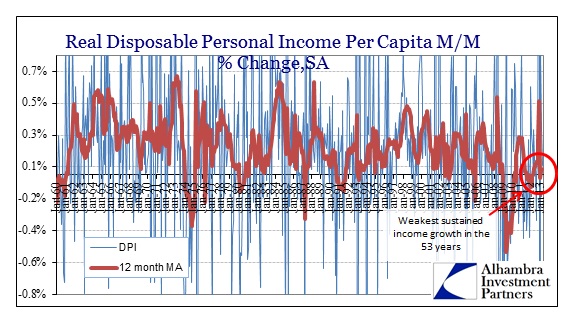

In the historical series going back to 1960, the current two-plus years of near zero income growth is the worst non-recession period. The US economy has not seen anything like this in its post-war history, and it remains the largest impediment to more robust growth. While there has been a clear break between corporate profits and productive investment that generates new jobs and incremental income, again, the BEA profit series seems to offer some explanation.

Lower wage and DPI growth has been something of a lingering issue for almost the entire 21st century, the housing bubble and consumer credit binge coming out of the 1990’s hid most of that weakness. The household accumulation of credit and debt acted as a wage supplement to boost spending levels, thus reducing the savings rate to almost zero.

However, despite a current savings rate very similar to that of the housing bubble, there is no such debt supplement for households and consumers now. The lack of wages and artificial boost through debt is the primary reason personal spending has remained constrained despite the massive dislocation in Q4 ’08-Q1 ’09.

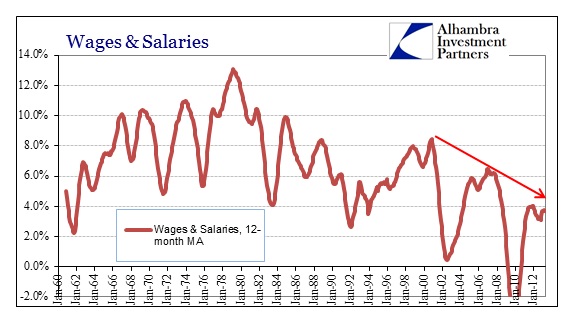

In fact, despite various markets’ interpretations of BLS counts in headline job growth, we know that wage rates have been sinking for some time. That has translated into weak wage receipts at the household level, again reinforcing the data above.

Even before the creation of the consumer economy out of the debt binged Great “Moderation”, wage growth has been an indicator of economic or cyclical trend. In each previous recession, wage growth peaks just before falling into contraction – in some case nearly coincident to the dislocation.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch