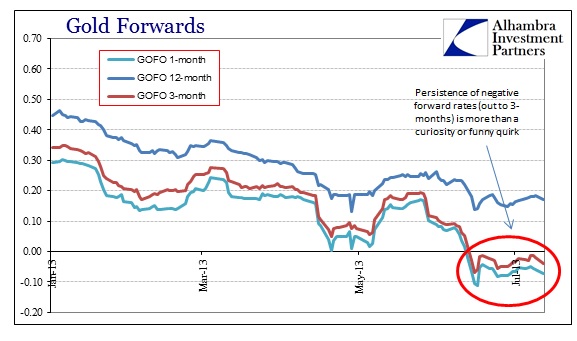

The only story for gold is the persistence of negative forward rates out to three months. That has not changed for three full weeks, an unprecedented string. To some, this is confirmation that gold is in short supply, while many others have been trying to rationalize negative GOFO as an unimportant victim of circumstance.

Again, it bears repeating that GOFO is not a market rate, set as a survey of LBMA “contributors”. That makes the persistence of negative forwards all the more compelling. But many observations make the connection between these negative rates and low short-term rates all over the money markets. In other words, since rates on money are so low, the drop into negative is actually relatively small in comparison – GOFO didn’t really have far to go to get negative.

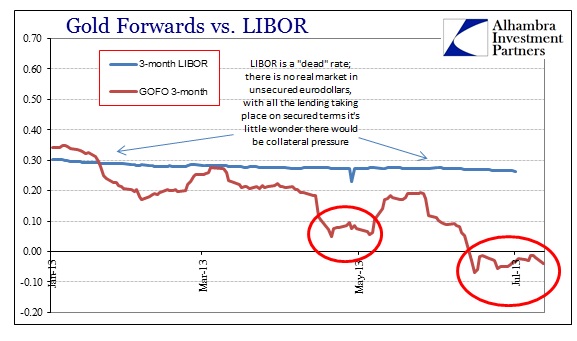

The relevant comparison is to LIBOR since that is the “natural” counterpart leg to gold leasing. A gold owner will obtain currency from a cash owner if the LIBOR-GOFO spread is favorable (the leasing rate). In the current case of negative GOFO, 3-month for example, a gold owner can borrow cash at -0.04% (3-month GOFO) and invest that cash at 0.26% (3-month LIBOR), for a positive spread of 0.30% (the lease rate).

The problem with that assumption is the nature of eurodollar (and even federal funds) lending and borrowing as it exists right now. That assumed gold/lease paradigm is appropriate for the wholesale markets as they existed before August 2007. The fact of the matter is, as evidenced by the zombie pattern of LIBOR rates, that very little “money” changes hands in unsecured overnight and term interbank markets.

A gold owner, then, might eschew such a relationship since the positive spread is nothing more than a mirage (remember that LIBOR, like GOFO, is not a market rate and is determined by a survey of “members”). If collateral demands grew in proportion, the decline in GOFO would not be enough to entice gold owners lend out their gold. They might, however, if they were getting paid to borrow cash and were therefore less concerned about finding a use for it.

In that respect, the issue of negative forwards is not about cash, LIBOR or low interest rates, but about getting more collateral into the marketplace. As collateral becomes scarcer, for various reasons, you would expect the cost of obtaining it to rise. In repo markets, this is collateral trading very special.

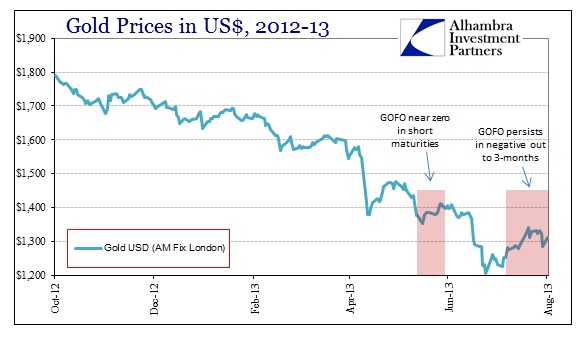

The relationship to price is more complex, but there does seem to be a direct relationship between these episodes of collateral demand and upward price movement.

The smash or decline in prices occur as financial firms scramble for liquidity, using unallocated gold as method to obtain dollar funding. Then the need for gold as collateral changes the supply characteristics in the gold market, as physical gold is demanded at a premium price (slight) to replenish unallocated gold previously used.

The fact that GOFO persists as a negative rate is highly suggestive of physical shortages. Since a negative forward rate offers an arbitrage opportunity that has not closed (sell spot and buy back that gold with futures at a slight discount), we can reasonably assume there does not exist enough physical or trust that it will be returned by the futures contract expiration. Or that markets, like LIBOR and eurodollars, do not function as they once did.

Perhaps our understanding of some of these investments and markets needs to further evolve in a world where ZIRP is permanent and QE distorts everything that much more.

Back in June 2003, the FOMC debated just these sorts of hypotheticals as they contemplated setting interest rates at then-record lows. Chairman Greenspan was unusually cautious, admitting,

“One is that I don’t think we know enough about how the private financial system works under these conditions. It’s really quite important to make a judgment as to whether, in fact, yield spreads off riskless instruments — which is what we have essentially been talking about — are independent of the level of the riskless rates themselves. The answer, I’m certain, is that they are not independent.”

What we have seen in the years since ZIRP and QE is that Greenspan’s cautious confidence about spreads being dependent on the risk-free rate was misplaced. He has been proven wrong in any number of markets and rates (including the appearance of negative swap spreads, something previously believed to be mathematically impossible). His qualification of the zero lower bound, that policymakers and participants don’t know enough about how the financial system works under extreme conditions, has been shown to be well-founded.

In so many ways, the financial system, led by public proclamations and projections of false confidence, is simply flying blind. That means there is a particular susceptibility to dysfunction and illiquidity that may not follow typical or past associations and assumptions.

Gold is a hedge against catastrophic risks, the kinds of risks that are now hidden in the course of monetary manipulation. The fact that we don’t and cannot know how the financial system is supposed to operate and evolve under such artificial constraints is an argument in favor of hedging against the catastrophic.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch