The curious case of the jobs survey dichotomy continues. While the mainstream focus on the Establishment Survey’s “steady growth” trend provides cover for the FOMC to contemplate scaling back their interventions (and thus the frothy/bubbly foundation), it is fully alone in its interpretation of the jobs situation. The Household Survey has diverged both in quantity and, more importantly, quality.

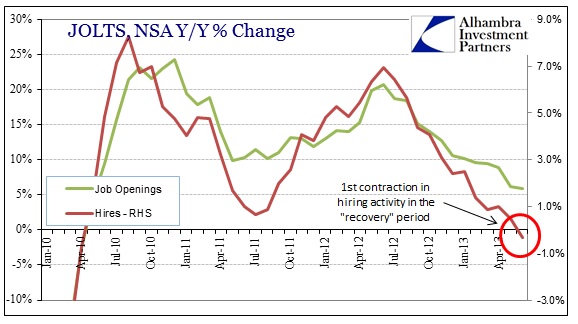

Now we have a third survey that again sides against that optimistic interpretation. In both hiring and job openings, the trend is clearly lower.

In terms of actual hiring, we have seen the first decline (Y/Y) since 2010. That stands in stark contrast to what the BLS is producing through the Establishment Survey statistical analysis.

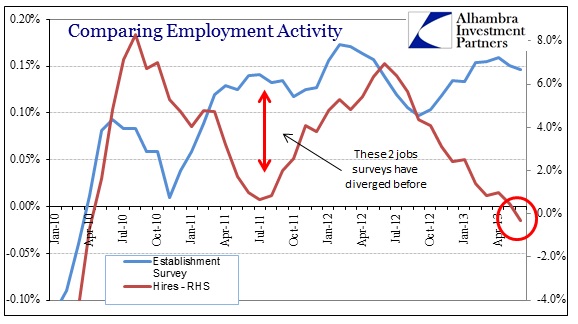

Again, the timing of the divergence absolutely conforms to the Household Survey’s measurement of this divergence. Since September/October 2012, these views on the job markets have moved in exact opposite directions – Household and JOLTS continued lower, while the Establishment Survey suddenly reversed toward the optimistic view.

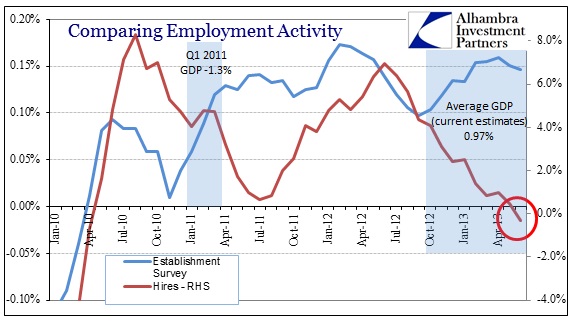

We have seen this divergence before, where hiring activity fell into the first half of 2011, while the Establishment Survey showed again the opposite (sharply rising employment). The timing of that divergence is also curious, given the latest revisions to GDP estimates.

In both cases (highlighted in blue above) where GDP growth has been estimate to be declining or contracting, it is interesting that the JOLTS suggestion of declining employment growth is far more conforming to the economic picture represented in GDP estimates (as they currently stand). The same is true for the last three quarters where GDP has been near zero (Q4 ’12) or below the 2% “stall speed”.

If that interpretation is correct, then you have to wonder what exactly the Establishment Survey is measuring? I think the answer lies in trend-cycle analysis adjustments that are being driven by distortions in modeling due to QE.

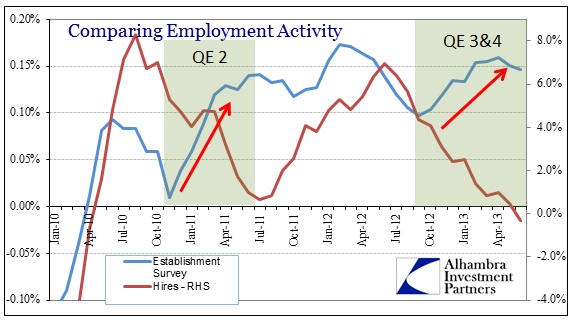

Both times these divergences appeared coincide exactly with Federal Reserve “balance sheet expansions”. We know full well just how economic modeling becomes self-reinforcing to the point of circular logic, so it probably should not be such a big surprise that QE is creating distortions not just in markets but in economic accounts (go here for a side explanation of how modeling and trend cycle rely on prediction and expectations as much as real data).

While I don’t think this data is robust enough to be dispositive, it does offer, in my mind, compelling evidence that the Establishment Survey is modeling conventional economic predictions of what the economy looks like when you expect QE to work. Almost every other economic series, stripped of their adjustments, shows what the economy is actually doing under QE. Given the fact that this “recovery” still hasn’t appeared more than four full years after the end of the Great Recession, this kind of divergence between expectations and modeling is now commonplace. And it adds to the volatility in the data and confusion over interpretations.

To go back to what I highlighted about trend-cycle analysis last year, Clive Granger wrote back in 1979 just how “seasonal adjustments” and statistical data analysis play a huge role in economic accounts:

“It can certainly be stated that, when considering the level of an economic variable, the low frequency components, often incorrectly labeled ‘trend-cycle components,’ are usually both statistically and economically important. They are statistically important, because they contribute the major part of the total variance, as the typical spectral results and the usefulness of integrated (ARIMA) models indicates. The economic importance arises from the difficulty found in predicting at least the turning points in the low-frequency components and the continual attempts by central governments to control this component, at least for GNP, employment, price, and similar series.” [emphasis added]

If QE is believed to prevent such “turning points”, and conventional economic models all assume that monetary policy always works, that gets reflected in the adjusted economic data; to the point now that it is circular.

Strip the expectations of QE on trend-cycle and you are left with the unadjusted data and far different views of the economy.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch