We have been following the potential inflection in housing data for nearly five months now, long before taper talk ever began. I still believe that the rapid rise in prices was both the initial cause for the turn in housing construction and the primary reason for talking taper in the first place. Where permits and construction data began to wobble a few months ago, homebuilder stocks and mortgage activity largely ignored that potential inflection. They have not ignored interest rates, however.

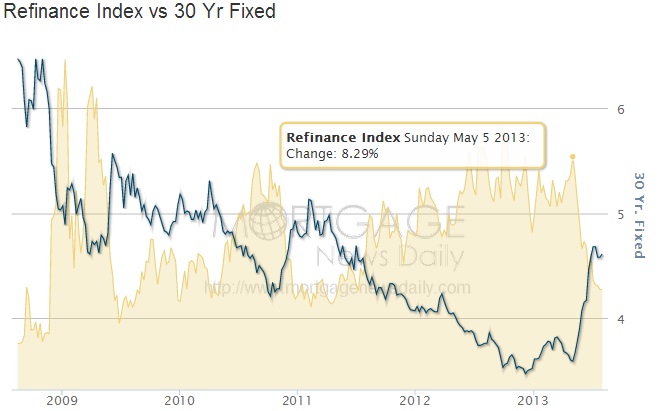

Mortgage refi applications are now down almost 60% from a year ago, falling all the way back to levels seen at the bottom of the housing market in the middle of 2011. Purchase applications have also declined since mid-May, but are still somewhat above what we saw a year ago.

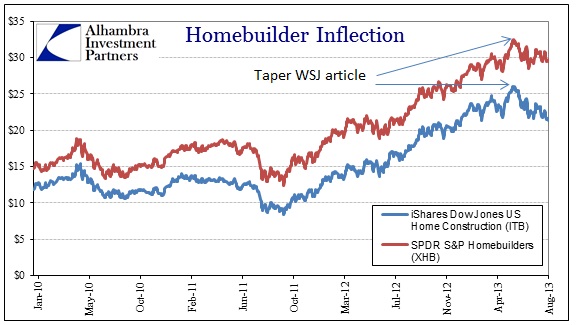

At nearly the same moment applications turned the “wrong” way, homebuilder stocks peaked.

Since May 15, the SPDR S&P Homebuilders Index is down 9.2%, while the iShares DJ US Home Index has fallen much further, -18.3%. Despite record or near record highs in broader stock indices, stock investors are moving out of home construction. That suggests complacency conspicuously does not extend into real estate proxies.

While the downturn in mortgage applications is much closer to the real economy (and certainly not supportive of any increase in spending activity), there is certainly a chance stock investors are starting to get a sense of a housing reversal as well. The caveat to analyzing anything out of stock prices more than applies here, as policy intervention makes interpretations much more difficult and less sound, but even if stock investors are avoiding home building stocks due solely to policy perceptions that does not bode well for housing either. If stock investors (the last to know) are moving out of financial vehicles for real estate, then the stories of institutional investors doing the same are far more plausible.

This is very problematic for those expecting a second half economic renaissance. Without the “tailwind” of an exponentially growing real estate sector (in activity, unfortunately not prices) the hit to GDP in a near-zero (or below-zero) “growth” environment would be significant.

More and more data seems to confirm that the rapid price appreciation anticipating QE 3 has so far outpaced incomes and true economic conditions as to be unsustainable beyond that short burst. The fact that investors have leveraged themselves to policy rather than fundamentals confirms much of the change in trend and the rapidity in which it appeared and manifested.

At this point there may be no going back to the halcyon days of 2012, let alone the utopia of 2006. Economic forecasts and expectations might be due for even more adjustments.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch