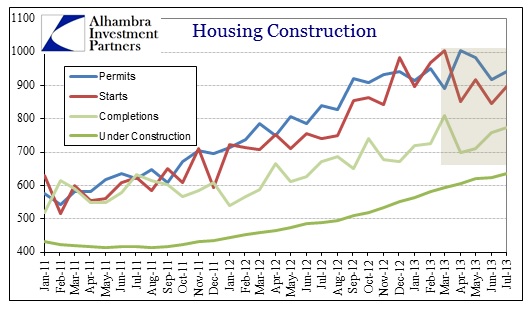

I have been more than a little reticent to proclaim the recent downward skew in housing data anything more than volatility. Though I suggested the apparent change looked like an inflection had been reached, and a new slowing tend established, given that volatility in the data it was wise to wait a few months to see if it was durable or just data collection artifacts.

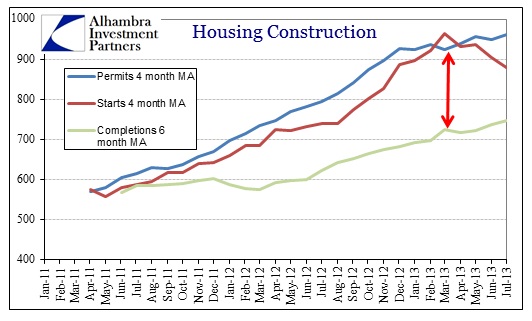

I think now that it has been maintained over more than a few months, and given the corroboration in homebuilder stocks, that slowdown in housing is a real trend. It’s apparent in the seasonally adjusted data that the growth momentum stopped sometime in the last two months of 2012. While there was noise and volatility in January and February, it appears that between then and March 2013 housing construction growth has significantly receded.

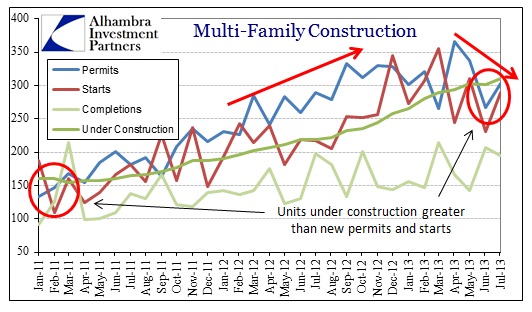

The same is true of the flood of “investment” money into multi-family projects. Anecdotal evidence suggested that the institutional appetite for real estate had become very price sensitive this year, and that activity might follow enthusiasm lower.

For the first time since 2011, the level of multi-family structures under construction exceeds both that of permits and starts. That indicates future activity is likely to wane.

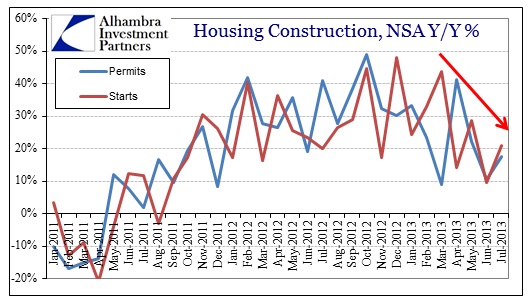

While there is a relatively clear trend in the seasonally adjusted data, the unadjusted series shows the inflection with even more clarity.

The growth rate in recent months has fallen below every month of 2012, indicating that construction growth will not be anywhere near what it was even last year. In terms of GDP and the economy, given the fact that housing activity is still languishing despite last year’s huge burst, this slowing is not going add as much of a boost as expected.

Even though the data is still subject to volatility, I think there have been enough months to overcome that limitation and reasonably project that this is, in fact, a new trend for housing activity.

That does not necessarily mean the housing market will contract in activity, or prices, but that returning to the “good ol’ days” of 2006 is becoming much less likely. I have no doubt that is actually a positive aspect in the long run, but it means NGDP and real economy targeting proponents will likely have to find their marginal activity elsewhere.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch