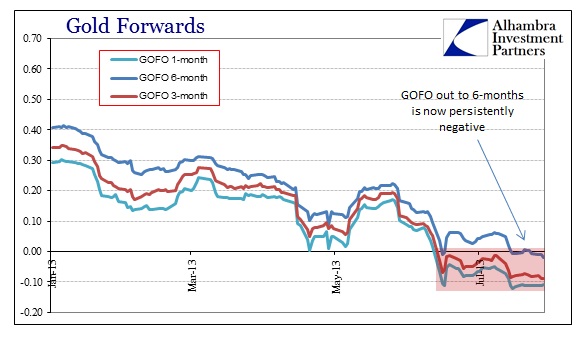

We have noted the negative forward rates for gold on several occasions, particularly as they relate to our thesis about gold being used in collateral funding arrangements. The negative forwards have persisted uninterrupted since July 8. That was true for tenors up to three months, with the six-month falling below zero on several occasions now.  Six-month GOFO has now been negative for seven of the past ten trading days, including the last four. That seems to indicate ongoing and serious physical consideration for gold as far out as six months into the future.

Six-month GOFO has now been negative for seven of the past ten trading days, including the last four. That seems to indicate ongoing and serious physical consideration for gold as far out as six months into the future.

However, there is a new complication to that interpretation. As I have also mentioned on several occasions, GOFO is not a market rate. It is a survey of LBMA “contributors” based on what rate they believe their clients (or the bullion banks themselves) would hypothetically pay in a gold lending situation. In that very important way, GOFO is a twin to LIBOR.

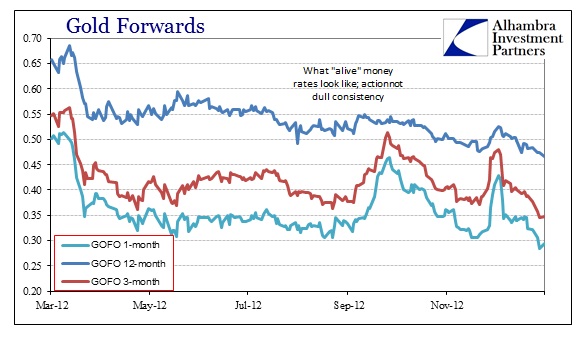

Unsecured eurodollar lending at LIBOR has been a joke for some time now. The survey of the British Bankers Association members showcases a “dead” money rate; there is very little action conducted in unsecured interbank lending. LIBOR barely moves, lacking the distinct “action” that takes place in robust markets. This is as much about bank fragmentation as monetary conditions or managing perceptions.

For example, in six of the last eleven trading days, 1-month GOFO has been exactly -11bps. In five of the last ten, 2-month GOFO has been -9.667bps. This kind of consistency is a hallmark of the dead-money LIBOR fixes.  The only real action in GOFO takes place in small trading windows where rates make a sudden downward changes before settling in again. An active market indication for GOFO looks much different, such as 2012.

The only real action in GOFO takes place in small trading windows where rates make a sudden downward changes before settling in again. An active market indication for GOFO looks much different, such as 2012.  The implications here run the gamut from rigged markets to massive fragmentation. I’m inclined to believe more the latter, though the former is par for the course in gold (where central bank leasing is concerned). What this suggests is that banks and gold participants are paying rates different than those publicly acknowledged. This is something that we have seen before in financial markets, though not specifically in gold. I noted some of this as a possibility several months back.

The implications here run the gamut from rigged markets to massive fragmentation. I’m inclined to believe more the latter, though the former is par for the course in gold (where central bank leasing is concerned). What this suggests is that banks and gold participants are paying rates different than those publicly acknowledged. This is something that we have seen before in financial markets, though not specifically in gold. I noted some of this as a possibility several months back.

This kind of fragmentation, if that is the correct interpretation, is important as gold markets fill in the void as currency problems manifest in unpredictable fashion. As dollar liquidity problems continue to play hell with other markets globally (and internally, as the bond market keeps proclaiming to anyone listening) the potential for currency issues increases; that would be very gold positive.

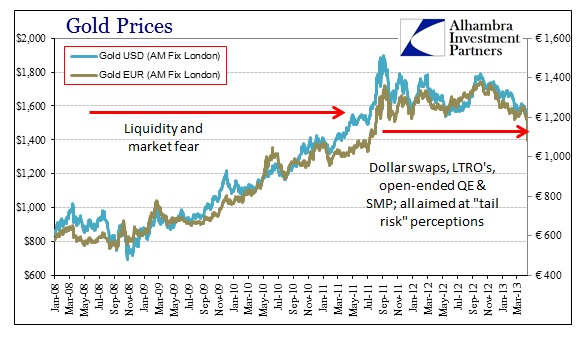

Despite three distinct gold smashes in 2008, related to liquidity and gold as collateral, the price in dollars, euros and pounds rebounded sharply every single time. Where US treasury bonds were sold in the panic months (contrary to conventional perceptions, it was only treasury bills that were bid and that was due to collateral shortages more than anything else) of that year, gold was heavily sought. In times of liquidity stress and currency crisis, gold is the only real “flight to safety”.  In that way, the price of gold is proportional to perceptions of “tail risks”. The central bank action to artificially suppress “tail risks” has reduced the bid for this safety post-September 2011 (coupled with the collateral issues I highlighted in April), but the recent uncovering of risk in the bond/funding market turmoil should reverse that trend. The problem of potential “dead” money GOFO rates is that we have even fewer indications about what is going on in an already opaque market.

In that way, the price of gold is proportional to perceptions of “tail risks”. The central bank action to artificially suppress “tail risks” has reduced the bid for this safety post-September 2011 (coupled with the collateral issues I highlighted in April), but the recent uncovering of risk in the bond/funding market turmoil should reverse that trend. The problem of potential “dead” money GOFO rates is that we have even fewer indications about what is going on in an already opaque market.

That means the potential for more gold smashes will be hidden as gold leasing demand occurs in that fragmented section, making timing and trading that much more difficult. However, if I am right about the re-emergence of “tail risks” outside the QE umbrella, it may not matter in the longer run.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch