I think that the initial impulse driving FOMC concerns over “too much” monetary stimulus tied closely to three factors: repo markets, junk bonds and housing. Home prices in previous bubble markets have been on fire again, and in no way do those prices reflect actual supply and demand factors (they very much ignore basics like demographic trends). Prices reflected and fed back into the construction activity we saw particularly throughout 2012.

Housing has always been near and dear to the FOMC and orthodox economists as the primary direct channel for monetary policy. Whether it was home equity loans or new construction, real estate has a little bit of access in multiple economic conduits. In terms of policy hierarchy, I would rate only the notorious “wealth effect” as more important in considerations.

This primary relationship with monetary policy and thus economic forecasting puts real estate markets at the front of the line in determining policy course. The inflection in construction activity may have played a role in yesterday’s policy discussions, though I am more and more leaning toward the “tightening plus falling inflation” narrative as the primary FOMC consideration. In that sense, any policy “boost” (psychology of markets means a surprise to get an effect) that might arrest the construction decline would simply be a policy bonus at this point since there are much bigger fish to fry in policy terms.

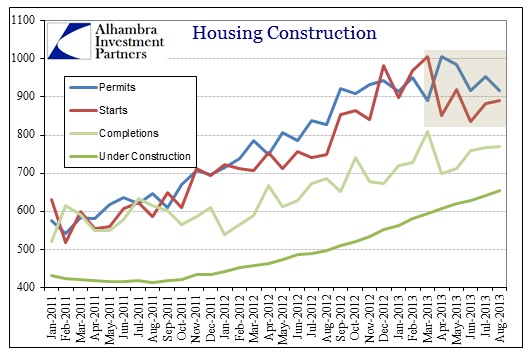

The inflection is apparent enough in the seasonally adjusted data, but the full data “frown” is extremely clear in the unadjusted series.

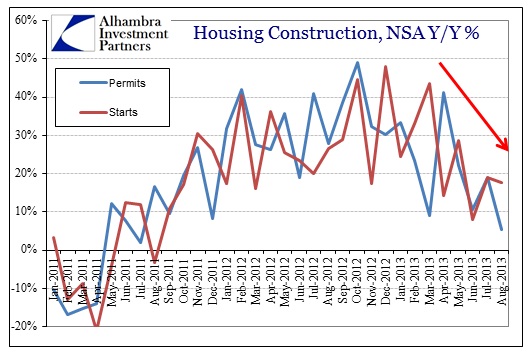

The gain in new permits in August 2013 was just over 5% above August 2012 – the lowest Y/Y growth since July 2011. It is hard to date exactly when this inflection took place, likely over more than a single month, but it is almost certain that construction peaked before taper became a mainstream word and interest rates rose. In my analysis, I pegged that as a function of real estate prices blowing out profit margins for institutional REO-to-rental models. On the construction side, the rental theme has been most evident in the primary driver of the sector, multi-family structures.

The number of structures under construction has been above the new permits and starts levels for a few months now, meaning that if the trend holds at some point activity will have to adjust lower. While the raw numbers of employment gains are mixed (specialty trade contractors) to unenthusiastic (labor for actual construction), this is not a good sign for future gains or even maintaining the current disappointing pace.

Once again, however, there is absolutely no evidence that QE has had any discernible and positive impact on construction. Based on timing alone, it actually appears as if QE 3 marked the top in the process, with interest rates and price action finishing it off fully.

To this point, funding markets have been somewhat muted in their reaction to yesterday’s “surprise”, and that may mean interest rates aren’t yet ready to turn significantly lower again. I think that is likely due to the realization that the Fed will have to taper sooner rather than later as the trap gets sprung. I don’t think there will be much reaction from the institutional investment group either, as profitability isn’t directly related to monetary policy. That is, unless this current trend in housing leads to another price retrenchment, but that would mean some really nasty side effects on the whole market as the economy would have to process another large-scale bust.

Again, I don’t think that was the primary motivation for the current policy stance, but from the perspective of the FOMC it doesn’t necessarily hurt. From the economy’s perspective, it’s just more wasted resources that will end up costing big in the longer run.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch