With the optimistic rhetoric of the beginning of the year fading, retailers are beginning to react to falling expectations while simultaneously hoping that even those will actually be met and not further downgraded. I could use any number of economic statistics to demonstrate this depressing the consumer impulse, and the timing of it, but it all really comes down to household income.

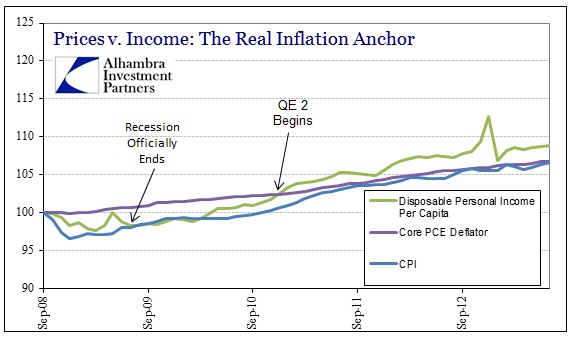

Measuring from the peak of the income cycle in the middle of 2008, incomes have barely kept pace with official measures of inflation.

It isn’t easy to tell from the chart above, but there are actually two distinct problems here. The first is more obvious, as incomes were drastically set back in the worst quarters of the Great Depression. But beginning in the middle of 2009, disposable incomes began to rise (transfer payments and lower taxes played a key role). After the middle of 2011, however, that somewhat encouraging trend abruptly stopped.

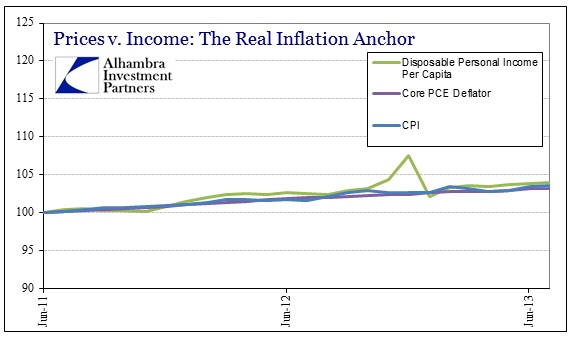

Measuring incomes and official inflation starting with the end of QE2, incomes have only grown nominally (and even then not much at all). That gives some appearance for recovery, but only insofar as atypical changes in the savings rate can fill in any shortcomings.

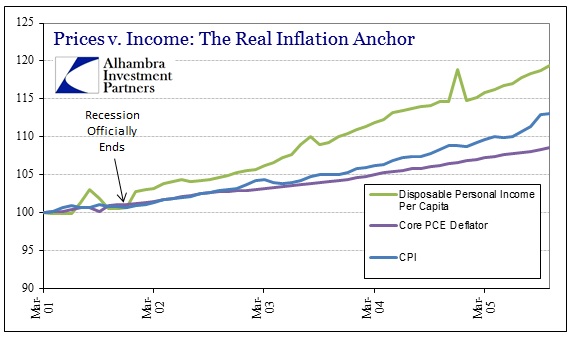

This is unprecedented in the economic series going back to the 1940’s. Every post-war recovery, including the very fragile recovery after the dot-com bust, has seen at least a stable and positive divergence between inflation and incomes.

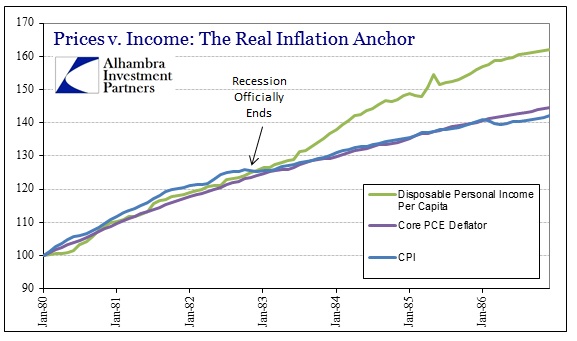

It is most clear in the period after the double-dip recessions of the early 1980’s, despite some lingering positive inflation.

It does not matter if inflation is “low” if incomes cannot even get slightly beyond it for a sustained period. If prices only rise 1.5% annually over a 2-year period but incomes only match it, that is a huge setback in the economic system. It explains a lot about not just retailers and their growing pessimism, but also why businesses would rather repurchase their stock than invest in real productive capacity. Without any hope of revenue growth there really isn’t any point in capex.

The timing of QE2 here, as I noted last week, is more than curious. It seems even a little dose of playing with inflation expectations set back business priorities. What was at least a lackluster but positive recovery was again reduced to (so close to the recession) cost cutting and profit management. Expansion was never really a consideration here.

It is little wonder, then, that the period after QE2 looks very much like the double dip recession period of the early 1980’s and nothing like the recovery that followed. Businesses, aside from occasional outbursts of monetary-driven optimism, are largely reacting accordingly. In light of that, falling below stall speed in the economy is not a surprise. K-Mart started the Christmas season around Labor day because of it.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch