If the government shutdown ends in the near future, there will be a data dump unlike anything we have seen before. The September jobs report at the end of October the same time as retail sales and US imports/exports, etc. The backup in data crunching to fit survey results into seasonally adjusted output may delay the timing of the more “infrequent” economic accounts, such as GDP.

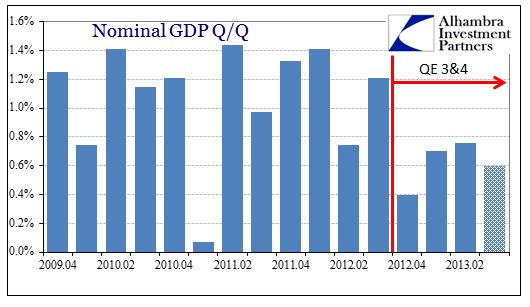

Until the advance estimate for the main measure of economic growth comes out, we are left with private conjecture. If current estimates are anywhere near correct (and they may well be off by a large amount given the lack of confirmation), currently expecting 1.3% to 1.8% for the quarter, the economy will have failed to achieve any noticeable breakout post QE3.

Looking at the chart above, one is very tempted to conclude that QE has had a negative impact on economic activity. That is bolstered by the near zero growth in Q1 2011 that occurred during QE2. However, to be charitable, the economy was clearly slowing in the middle of 2012 before QE was announced and implemented in Q4. I believe that was a significant factor in the FOMC decision in September 2012 to re-appeal to balance sheet psychology “stimulus” (rather than simple interest rate manipulation through Twist).

Even if QE was not the cause of the decline in economic momentum and growth, we can fairly and unambiguously conclude it has not in any way helped (unless you want to get into a “saved vs. created”-type discussion, which may occur if recession leads to intellectual retributions). To put it bluntly, QE has plainly failed its primary objective.

Now that housing may be turning back toward an economic drag, through both direct construction activity and the indirect, nefarious “wealth effect” of refi/home equity withdrawals, the economy lacks even a single marginal driver for growth. That would suggest, as so many other indications do, moving in the wrong direction rather decisively.

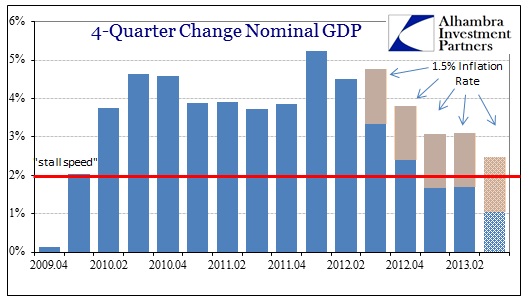

This is a topic I raised over the summer, namely the academic assignment of 2% real growth (4-Quarter) as a stall speed indication. Again, assuming Q3 estimates for GDP are in the ballpark, 4-Q growth for Q3 should end up at around 2.5%. But that is nominal GDP growth. Assuming an official inflation rate of around 1.5%, which is the average annual rate in the CPI for 2013, that means real growth of 1%.

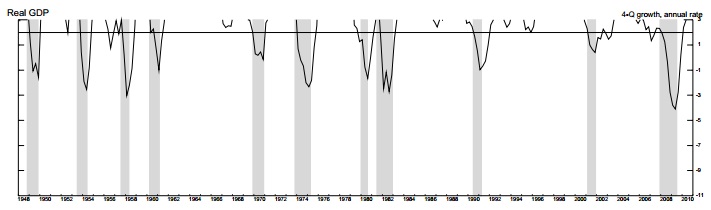

Where there was a clear deceleration at the end of 2012, this year has been spent entirely below stall speed. There has never been a period of avoiding recession once stall speed has been breached. The current case shows potentially three consecutive quarters below that threshold.

Even if GDP growth accelerates slightly in Q4, as currently expected (though expectations are again being downgraded) that will still remain below stall speed on a 4-Q basis. Current expectations for the entire calendar year, the year of such purported QE promise, show in historical context economic growth consistent with very serious declining fortunes.

I often argue against economic empiricism being turned into durable and universal rules or “laws”, but there are cases where it makes intuitive sense. Businesses and individuals react differently when they sense an economy has begun to shift toward recession, changing behavior into what more closely resembles the fabled “bunker mentality.” If that is its essence or the quantification into the stall speed metric, then it certainly seems applicable given the broad section of data confirming as much.

We have never seen the economy under conditions of such monetary intrusion, though, so that may be something to factor. But given the results, or the distinct lack of them, in anything but stock prices, intuitive rules may still apply even in 2013.

It is the lack of intuition that plagues the entire recovery period. On January 8, 2011, bathed in the full glory of QE2, Fed Vice Chair Janet Yellen, now inline for the Chairmanship, detailed her expectations for monetary policy in the wake of what was then underway. It was her expectation that the FOMC would be exiting prior balance sheet measures by mid-2012. In her simulations of QE2’s successful impacts on the real economy, the Fed would be, beginning in June 2012, running off (selling) $80 billion in UST’s and MBS to fully normalize by 2017. And 2013 GDP would be growing 3.5% to 4.2%, in real terms.

That the Fed is instead still adding $85 billion a month a full year after that exit projection, and the economy cannot even manage 3.5% in nominal growth, I would say there is something decidedly wrong with monetary models, and further that monetary intrusion simply does not have the effects that orthodox economists believe. They keep expecting a recovery that is just around the corner because the Fed did something; meanwhile stall speed is now the ceiling rather than the floor.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch