Japanese exports continue to rise, but as we have seen in actual results elsewhere, both anecdotal and empirical, it’s a mirage driven by changes in the unit of measure (yen). Total exports from Japan rose 18.6% in yen terms, the highest growth rate since the middle of 2010. The problem was that imports also rose, by 26.1% as energy importation is killing the Japanese economy.

Japanese policymakers were not unaware of this problem when they crafted the QE/debasement strategy. However, they were counting on a simplistic relationship to offset this downside. Since every economic policy is essentially redistribution, it was expected that they could engineer redistribution in Japan’s favor.

You hear it all the time from mainstream economists – that devaluing a currency makes exports cheaper for trade partners to buy. That kickstarts real economic activity that feeds on itself (through aggregate demand, of course) leading to utopian fortunes. But it all starts with that simple idea – cheaper exports lead to real growth.

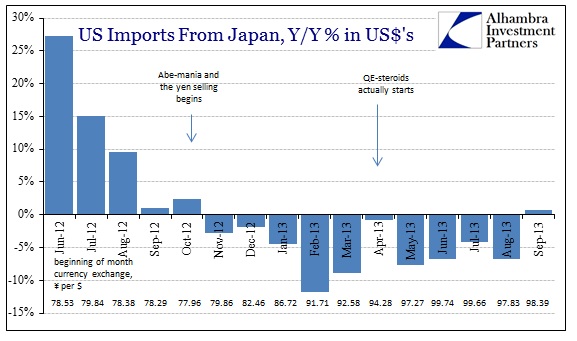

If we take the trade activity between Japan and the US as a test case, the revenue is most certainly increasing for Japanese exporters and companies. However, that yen viewpoint is not matched by dollars on the other side.

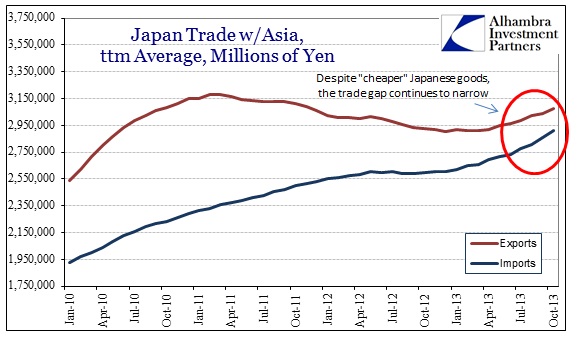

From the dollar perspective, the simple expectation is nowhere to be found. Japanese goods are clearly “cheaper” in terms of currency translation, yet American demand has not moved or adjusted in the manner expected. Japan Inc. is not gaining market share. The same is true for Japanese activity with the rest of Asia.

While there is undoubtedly energy in the import portion of the Asian trade balance, it also largely reflects the trend to offshore manufacturing activity that has grown worse as currency instability has gained favor.

In fact, if we carve out trade activity with China, we see that yen devaluation has done absolutely nothing to change the import/export equation. Absolute levels of trade have changed, of course, as exports to China were up 21.3% in October, but imports from China also rose 22%. In other words, neither country is really producing and trading more goods (since Japan derives little energy or commodity imports from China, it is mostly a goods relationship).

But that isn’t supposed to be the case. The cheap yen is supposed to change that balance back in Japan’s favor. As we have seen in so many cases, economic theory is woefully behind the evolution of real economic and financial systems. It’s not enough just to believe you can create a functioning economy by “making exports cheaper”, the real world is far more complex. In Japan’s case, as the yen devalues and makes Japanese goods cheaper, Japanese companies move more and more production overseas. On net, the situation gets worse not better as there is no incentive (in fact, active disincentives) for Japanese firms to increase wages to offset that energy problem.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch