With the latest update on wholesale trade, the October supply chain is almost fully in view. Unfortunately, the last piece, retail inventories, is the data series I want most to see but that will have to wait. Throughout 2013, the year of marginal inventory domination, it has been retail inventories driving these marginal changes.

If we start at the crudest level, manufacturers are running quite lean in terms of managing excess inventory. That is probably prudent since sales growth has been rather abysmal in the past eighteen months or so. If we were to strip out autos, it would be downright contractionary.

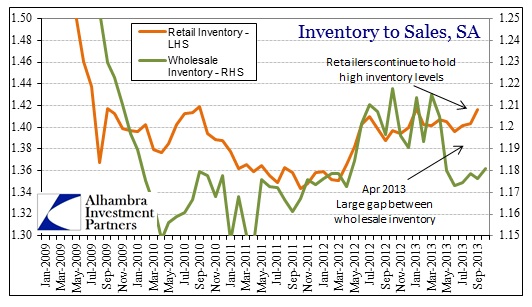

Moving up the supply chain to wholesalers, you can see that there was an inventory adjustment in the first half of 2013. Wholesalers saw sagging sales fortunes and were forced to respond – leading to the dismal sales results and outlook at the manufacturing level.

There has been an uptick in wholesale sales in July and September, but there was no corresponding upturn in wholesale inventories. That would suggest wholesalers are not expecting this increase to be sustained. Rather, inventory growth continues to decelerate unattached to retailer demand.

Finally, we see exactly where inventories are building – where we have been hearing for months. For some reason retailers appear unwilling to do what has been done in the lower levels of the supply chain and match inventory more closely with sales.

That has led to excessively high inventory levels in the retail part of the supply chain which, no doubt, wholesalers and manufacturers are very much aware. That offers at least a partial explanation as to why wholesalers are not following retailer demand with their own buildup of excess product.

In terms of relative results, inventories at the wholesale level diverged noticeably earlier this year. The problem, as it relates to potential future demand, is that retail inventories are again at a cycle peak level, but now at a lower overall sales rate.

It will be very interesting to see where retail inventories were in October. If they begin to trend lower with the lower wholesale sales growth, that might confirm the beginning of this latest inventory/GDP unwind.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch