With an election looming it is no surprise that efforts to sway voters via economic framing have been heightened. There are, however, the usual and predictable responses, and then there is what can only be called epic trolling (as the kids say). Publishing in Forbes, of all places, Adam Hartung quotes somebody named Bob Deitrick:

President Obama has achieved a 6.1% unemployment rate in his sixth year, fully one year faster than President Reagan did. At this point in his presidency, President Reagan was still struggling with 7.1% unemployment, and he did not reach into the mid-low 6% range for another full year. So, despite today’s number, the Obama administration has still done considerably better at job creating and reducing unemployment than did the Reagan administration. [emphasis in original]

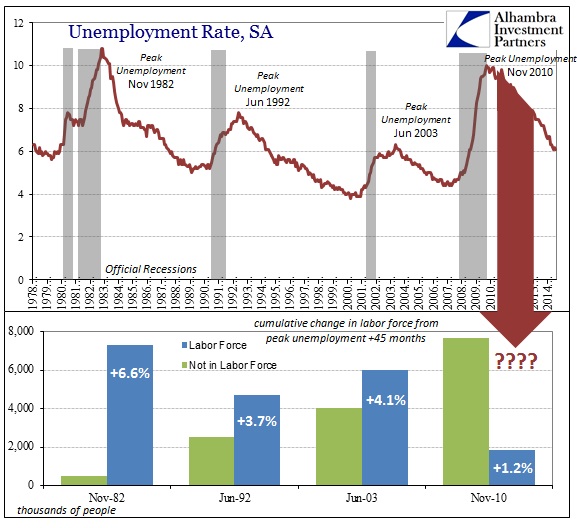

Using the unemployment rate as a raw measure of achievement is downright dishonest, as even the Federal Reserve has publicly admitted. Deitrick does “address” the participation problem insofar as dismissing it as purely demographics.

Now that ‘Boomers’ are retiring we are seeing the percentage of those seeking employment decline. This has nothing to do with job availability, and everything to do with a highly predictable aging demographic.

Undoubtedly some of that is true, but as the BLS notes (in a study Deitrick himself links) they are unsure the proportion though they “guess” it might be more demographics. Other “studies” are not so sure, as even several undertaken by Federal Reserve economists are more than a little uneasy about making such claims.

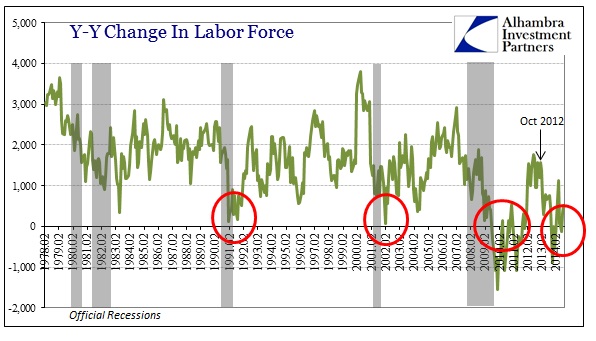

You don’t need to undertake a study just to see it in action. Labor participation dropped precipitously during the Great Recession and has never come back. That hardly counts as demographics, as it surely relates to “cyclical” changes of late; those that look far less cyclical through the course of time and thus confuse traditional studies in that the deficiency of the upturn confounds expectations for “cycles.” In other words, because there is no symmetry on the upswing these studies are more likely to dismiss what is really a structural economic problem for whatever reason might be slightly plausible, in this case Baby Boomers.

Participation in the labor force is very much related to economic cycle, just that this latest cycle is quite elongated without as much rebound. The mini-cycles thereafter more than suggest continued languishing rather than this outperformance suggested by these Forbes framers. That is made all the more compelling by the “confounding” behavior of consumers via income (or lack of it; shown below).

Taking all that away and just judging by pure job creation is no contest – the current state of the labor market is nothing like what we saw in the early 1980’s.

Given that the downturn was far deeper in the Great Recession, restarting the point of comparison to each respective employment trough does no favors to the current trend either.

On pure job creation alone, ignoring the very much relevant participation problems, the early 1980’s recovery was far and away more like a recovery than anything seen of the past six years.

But job count alone should not even be the primary benchmark, as job growth should be tied to income gains. Without income the pure number of jobs is as meaningless as the effort it took to put together such obviously misleading analysis.

The gap in terms of income is actually far wider with the 1980’s than the simplistic payroll count, as what was a significant gap becomes a full chasm. The “cycle” three decades ago actually produced more than a fair amount of it, and this “recovery” conspicuously showing very little. In the chart immediately above, however, this disparity was non-existent until around the 14th month after the trough. That dates to about March 2011, just when QE2 was kicking to its highest gears, and the effects on the dollar in trade and commodity prices were reaching their unfortunate zenith.

That, more than anything, tells us more about the difference in recoveries than any changing political alignments. Obviously, the Forbes writer and his “source” have a political axe to grind which misses the far bigger problem. In other words, what matters is not who is in the White House or which party “controls” Congress, but rather both “sides’” embrace of the epic shift that began during the “Reagan” recovery.

What has changed since the early 1980’s is the very degree to which central banks around the world have taken to economic “management” through soft central planning. Not only were there several “currency accords” in the middle 1980’s, by the end of that decade the Federal Reserve had shifted totally to interest rate targeting (though they still, a quarter of a century or more later, will not say or confirm exactly when that occurred) and rational expectations theory. Actual money had been fully banished from “monetary” policy in favor of this top-down approach to “fooling” investors and agents.

What we are comparing is not either political proclivity toward “better” economic stewardship, but rather the very stark change in “monetary” (without money) behavior – that, in fact, totally changed economic behavior during recoveries themselves.

Turning this into a partisan discussion is beyond unhelpful, at least until one or the other starts to see through the orthodox edifice for what it really is.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch