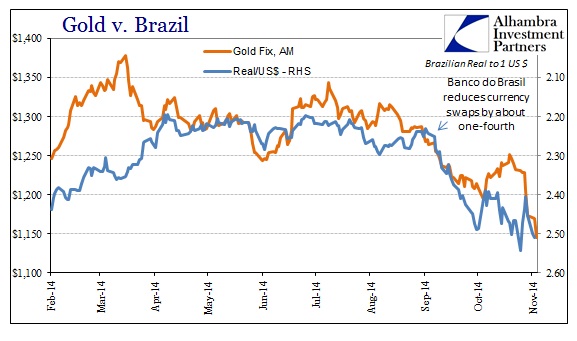

As the “dollar” runs somewhat “tighter” again, it is not surprising to see the various global dollar short proxies struggle under the weight of what I think is a very serious transition. The Brazilian real and gold are related in that respect, so lower prices in each are intertwined and significant toward that interpretation.

However, the severity of the real’s recent descent can be somewhat explained by local factors like the recent “disappointing” election. Undoubtedly, that contributed to not just the large drop toward 2.50 but also the volatility in the cross currency “value” since that point.

That leaves gold’s latest smash as a bit of a puzzle, though it could just as much be related to Brazil’s travails in the “dollar” world (as Russia’s). To that end, it was not surprising to see our old “friend” GOFO turn negative once more on October 27, just as this latest downdraft in gold prices was forming.

As of this morning, 1-month GOFO is historically low at -18.5 bps, with the 6-month tenor now negative at -1.7 bps. Gold has always had a tangled and tortured relationship with the “modern dollar” due in full part to the inner plumbing of interbank methodology. A negative GOFO rate outwardly implies a significant shortage of physical metal, which intuitively should mean a surge in prices or at least serious upward pressure in that direction. Yet, time and again negative GOFO coincides with the opposite, as I noted last December during what was the last negative forward episode:

In truth, the physical squeeze never disappeared it was only buried under the much larger needs of the interbank cash markets. The size disparity in terms of actual dollars is why an uptick in gold collateralized lending can overwhelm even the most blatant (and continuous) shortage.

In other words, interbank mechanisms that are normally hidden or at least severely opaque are somewhat revealed by this gold/GOFO behavior. The occurrence of what looks like a shortage of physical gold alongside a serious decline in gold’s price is the telltale sign of the dollar short growing problematic. That would, finally, seem to join 2013 with 2014 as a matter of similar problems in global finance.

With central banks likely now reactivated in leasing gold (and the pathology certainly fits) there is the next step of trying to figure out who is having liquidity problems and why. Given the severity of GOFO, it may even be pressing to not just find out those details but to further look to how broad this may actually be. When even 3-month GOFO is -10.25 bps (and 2-month -14.5 bps) there is a serious imbalance “somewhere.”

Stay In Touch