WalMart finally broke its losing streak in same store comparable sales. Beating expectations, US comps rose 0.5% vs. the same 13 weeks in 2013. That must mean the consumer is resilient once more?

While there is certainly no scale in the positive figure for Q3 (the 13 weeks ended October 31) the trend seems to be moving in the “right” direction; after all this purported economic rebirth has to start, after five years, with something somewhere. Though WalMart does not provide detailed breakouts of its comparable sales like Target (down to the per ticket level), they have been at least updating loose proxies for volume and prices.

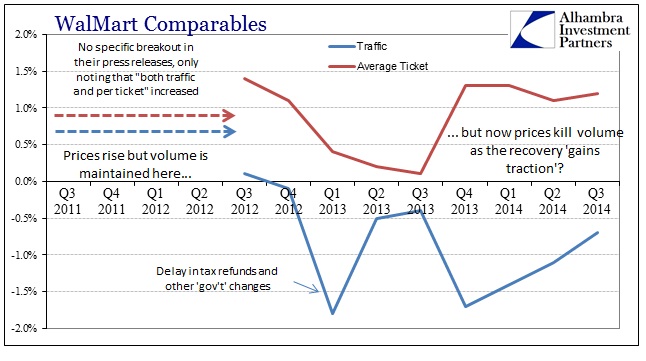

The company provides us with its comparable traffic figures and average ticket. From that we can reasonably assume revenue expansion (or contraction) due to volume or “inflation.” Of course, we have to be careful here as a decline in traffic is not necessarily a decline in volume, as people may instead shop four times a month at a WalMart instead of five, buying the same quantity of items in fewer trips.

Overall, however, the comparable details are largely in line (almost exactly, as it turns out) with what we have seen from Target. Volume, or at least comparable traffic, is inversely related to prices, or at least “per ticket.” More importantly, that inversion is apparent in 2013 and 2014 where it wasn’t outwardly corrosive in 2012 and before.

Before the middle of 2012, price increases were not depressing in WalMart volume, thus comparables were growing at a relatively decent rate. Then in the middle of 2013, prices advanced and suddenly volume drops precipitously at exactly the moment economists are proclaiming a final appearance of unquestionable recovery.

That would seem to suggest as if some of the economic accounts are not calibrated to the current circumstances, in this specific case as if price increases are not being accurately reflected in measurements like GDP. Again, that is only true if my read here on “average ticket” is equivalent to inflation. Fortunately (or unfortunately if you are a consumer), WalMart US CEO & President Greg Foran clears up any ambiguity:

“Our 0.5 percent comp was the first positive comp in seven quarters. Our overall grocery comp, which includes food and consumables, was relatively flat,” Foran said. “Comp sales were positively impacted by net inflation, but were negatively affected by SNAP-related headwinds. [emphasis added]

As with Target, people having to pay more to obtain less is something that just might contribute to an outbreak of electoral dissatisfaction, especially if wages and earned income (and now SNAP and gov’t programs) are not keeping up with price changes that do not “qualify” as “inflation.” That includes the company itself, as clearly some of those increasing input costs are being absorbed and not totally passed through; WalMart US operating income fell 1.2% for the 13 weeks despite positive comparable sales.

The larger implications of that are obvious in terms of “global growth.” Buying less stuff, regardless of positive revenue growth at the retail level, means that manufacturers make less and thus need fewer resources.

I actually agree with the orthodox interpretation about “inflation” in that commodity prices by themselves do not constitute “inflation”, but I heartily disagree in that commodity prices are not therefore unimportant. To the orthodox set, proper inflation includes the rising price of not just goods and services, but the exchange of labor. In that respect, the lack of “proper inflation” indicates the worst case where labor costs are already “too expensive” (for these circumstances) but commodity prices rise anyway.

The extreme form of that imbalance right now is Japan, but that is only a difference of degree. Thus the lack of official and orthodox “inflation” is the same lack of wage growth, which ends up the same in overemphasizing the role of price changes in setting economic trends (globally). Negative factors are negative factors.

Stay In Touch