The Federal Reserve has an explicit 2% inflation target, whereby they pledge to maintain “loose” policy in order to achieve it. According to their preferred measure of such things, ill-suited as it is, the US economy has operated below that target since March 2012 – a stunning run of 30 consecutive months. The only other time where the US has failed to reach the Fed’s target for so long was the Great Recession (which shows you how effective “loose” policy really can be).

So we start from a position already below target, having remained there for “considerable time” (to turn that FOMC phrase around). Now the price of oil drops almost 40%, which will undoubtedly put further heavy downward pressure on that “inflation” measure, to which the Fed responds, outwardly, with a total shrug.

“I’m not very worried,” Fischer told an audience at the Council on Foreign Relations. “The lower inflation that we’ll get from the lower price of oil is going to be temporary.”

To which an inquiring mind might ask the FOMC Vice Chair as to exactly what is driving oil prices down to such a high degree, in tandem with credit market “inflation expectations.” What Fischer is arguing is that the economy is picking up, thereby, in his orthodox calculation, inflation = growth.

But investors in oil are very much aware and effected by economic considerations. If the economy is picking up, then certainly they would be bidding on the “insanely cheap” crude price which is highly “undervalued” in Fischer’s confident scenario. Yet that isn’t happening, as rational expectations theory is bending not as he suggests but totally backward.

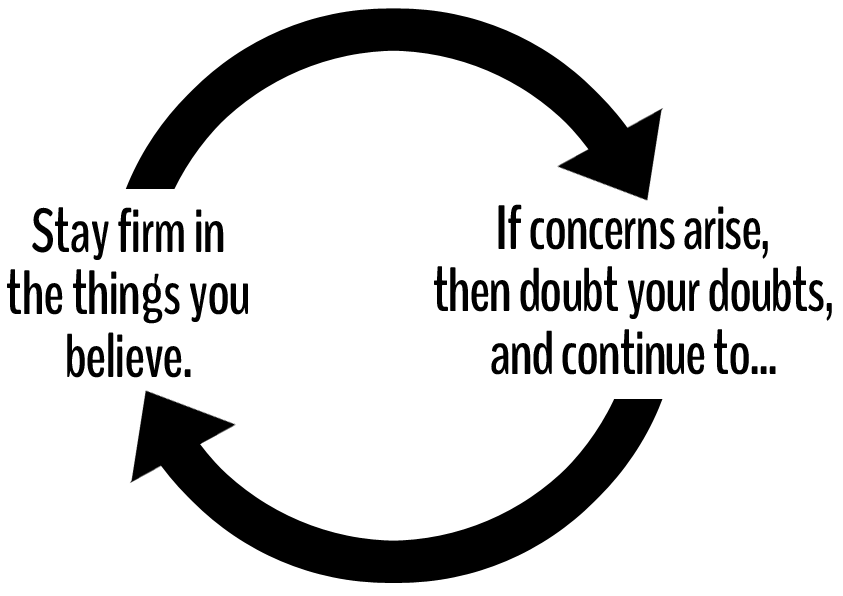

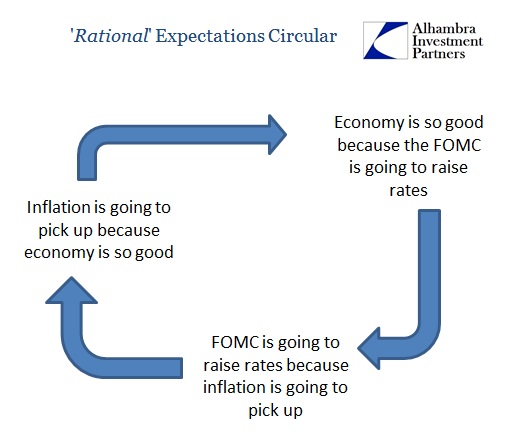

It is a core tenet of orthodox theory that inflation expectations erect the framework by which we act right now. It doesn’t matter the folly of such thinking, that is what central bankers believe as certainly it is driving Stanley Fischer’s circular reasoning here. And that is what this amounts to under rational expectations. He is saying that inflation will pick up as the economy gains strength because investors know that the economy is picking up and will be betting in that direction thus picking up inflation and the economy (just nevermind that investors are betting the other way).

What is really happening is that the FOMC is desperately trying to influence expectations with an historic twist – they are now trying to convince real economy participants and investors that inflation will pick up because the Fed is willing to raise interest rates. The Fed is so confident in the economy that it will do the opposite of what it takes (in their thinking) to get to their own inflation target. Inflation is low now but will pick up as the Fed “tightens”? I’m pretty sure their models say the exact opposite.

You know things are bad when even orthodox economics is turned upside down in such an obvious manner. It would be one thing if “inflation” was trending already in that direction, but to say such obvious nonsense in the face of falling prices, and we are talking about oil here, not soybeans and copper (though those are actually falling too!), is just more proof of the unease that has gripped not just global credit but policymakers themselves. We have already entered some orthodox Twilight Zone in the first place where central bankers are rushing suddenly to embrace falling prices! That is, or was, something they loathe to the highest degree, placing it among the greatest of monetary evils.

And he wonders why economists have to explain year in and year out why that never happens. It’s almost as if the economy slowed down in early 2012 and has never recovered; after having never recovered from the Great Recession. That looks not like improving fortunes but deepening attrition, an aspect that might lead to lower oil prices if the FOMC is not careful.

Stay In Touch