The initial indications from private retail metrics on the Black Friday kickoff were not good, though numerous attempts to downplay those results were initiated. The monthly retail sales figures from the Census Bureau will make that much harder as they square with the downbeat Black Friday estimates. In other words, Black Friday wasn’t “off” because consumers were “pulled” to shop earlier or later than Thanksgiving, rather they still have yet to show up at all anywhere.

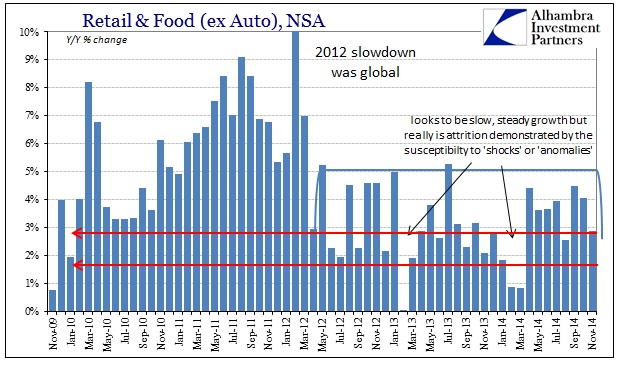

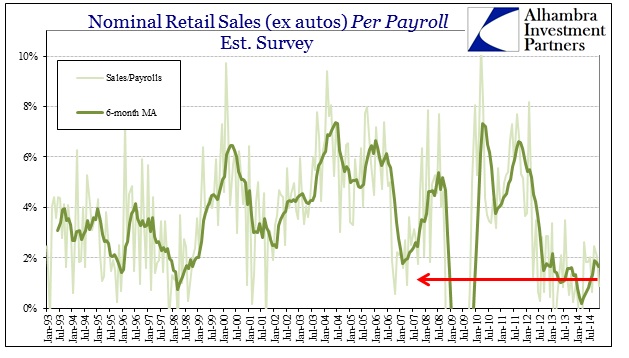

Once again, November’s increase was below 3% nominal growth which is not a recovery but a danger-zone. For all the jobs that have supposedly been created this year, the amount of spending per job is at an extremely low point. That would suggest that either those jobs are there but aren’t paying much at all; the jobs are paying but consumers would rather save; or the jobs might simply be the statistical phantoms that tax receipts suggest. None of those three options are particularly appealing.

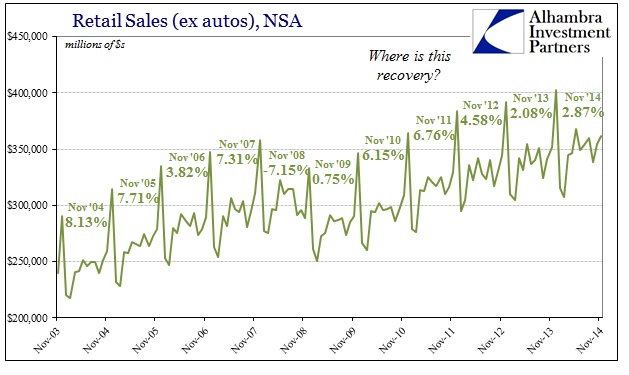

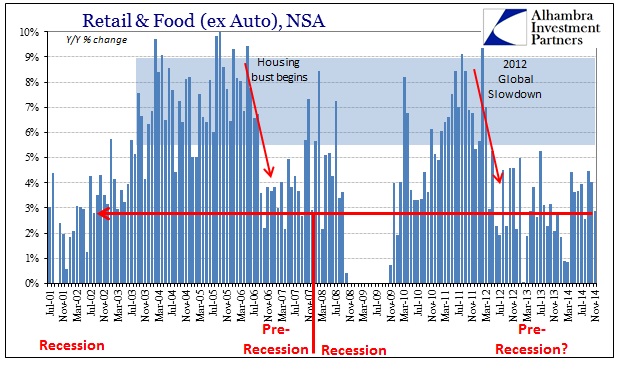

In terms of the Christmas shopping season, November is second to only December in overall dollar volume. The trends for the holiday shopping period are as they are for almost everything else, bending downward starting around 2012.

November 2014’s pace was significantly below November 2012 and much less than half of November 2010 and November 2011. While autos have played a “stabilizing” role in sales, this pattern is evident in retail trade even when you include artificially robust auto sales.

So far, November 2014 is a little less than November 2013, which was, yet again, the worst holiday season since the Great Recession. Growth rates now are nowhere near either what they were in 2010 and 2011 or the pre-crisis period of the housing bubble between the dot-com recession and the panic in 2008. I am at a total loss to see where a better economy is forming from all of this.

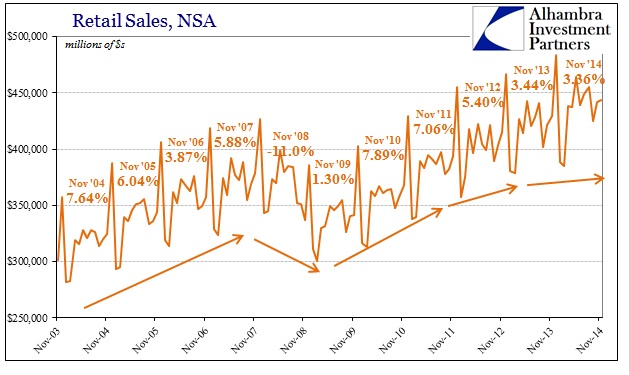

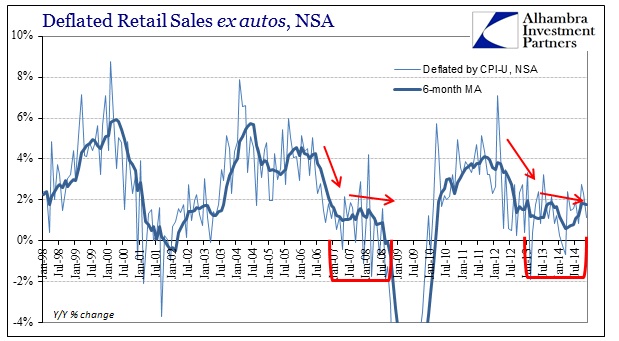

Instead, ominously, the track of consumerism is perfectly consistent with the elongated business cycle, especially the 2006-08 version. The slowdown in 2006 that coincided with the housing bust shows up as essentially a pre-recessionary state where, again, the economy looks to be stable and growing but at an unsatisfactory low rate.

If there is a difference between these two cycles, the one after the housing bust and the current after the 2012 global slowdown, then the most recent cycle is shorter in the expansion zone and a little bit longer in the pre-recession zone (perhaps). Even the first half (in terms of calendar) of the Great Recession looks more like pre-recession than what followed as a total collapse, meaning by the measure of retail sales there isn’t as much difference between pre-recession and mild recession as some clearly expect.

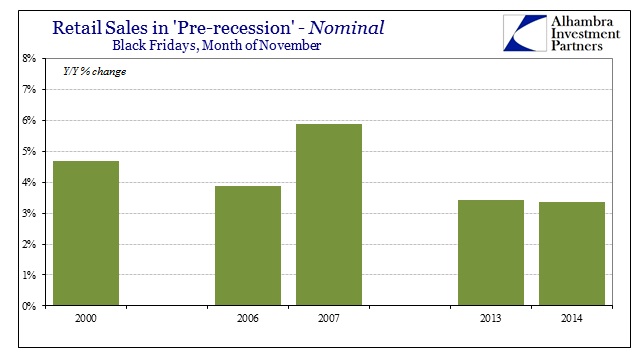

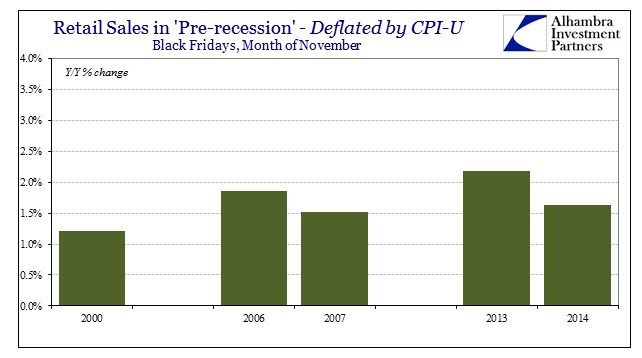

In nominal terms, including autos here, November retail sales are right in that pre-recession zone. Even accounting for inflation with the highly flawed CPI shows exactly the same feature:

Deflating nominal sales by the CPI-U confirms this comparison and cyclical pattern is not limited to price changes, as it goes much deeper.

Being in a “steady” state of low growth on par with the 2001 recession and the first part of the Great Recession is a demonstration of deep and far-reaching economic attrition. And that is really the primary interpretation of all of this, as contrary to the Establishment Survey growth is not bringing about widening expansion at all. This “steady” state is anything but, only marking time until the next stage down. Perhaps there will be a “positive shock” that will shake the US economy out its continued doldrums, but with the global economy heading clearly toward more distress it seems like oil prices and credit markets are marking not just foreign decay but this inclusiveness of US “cycles.”

Stay In Touch