Commentary has not been able to ignore changes in the Fed’s balance sheet mechanics with all the potential systemic shifts occurring as QE ends and the FOMC contemplates going even further. As I said last week, the total balance of bank “reserves” declined but not due to anything other than an operational test of the Fed’s Term Deposit Facility (TDF). With about $400 billion “auctioned” last week, the significance of the amount has only been to seriously confuse many observers who don’t understand how a central bank actually works.

As for “markets”, there has been precious little attention paid to any of it, with much bigger problems drawing focus. There has been the “little” matter of a global collapse in oil prices terming out while global credit markets in an uneasy state all year are now turning toward perhaps outright fear. The TDF just doesn’t rate, though perhaps it should (or it does, but in a manner wholly contradictory to how it is portrayed).

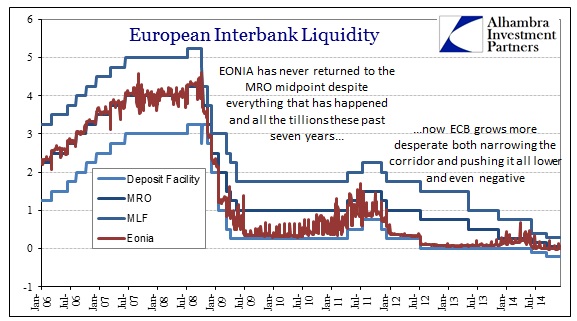

The TDF, like the reverse repo program (RRP) before it and the IOER before that, is an element of what is nothing short of curious fascination of the Federal Reserve with the European monetary operation. The Fed is seemingly obsessed with gaining a rate floor unlike anything it has ever done before but in full concert with the ECB’s interbank “corridor.” The cursory “pitch” for gaining an interbank interest rate “floor” is as an “exit” measure which would allow the Fed to more easily contain “spillage” or “leakage” from thwarting its master plan.

In viewing interbank mechanics as they are, that fascination just doesn’t make much sense. The Fed is worried that if they try to raise the federal funds rate, which somehow remains their main point of emphasis despite its almost total irrelevance to interbank markets today, the rest of the interbank market will not go along – creating a situation like that of late 2008 where the effective federal funds rate alongside repo rates and even t-bills remained durably and stubbornly below target. The TDF is supposed to “soak up” excess “reserves” to the point that rates remain almost fully harmonious.

If the Fed increases both the federal funds target and the interest payment on the TDF and IOER (regardless of the RRP which is almost useless to this point in the course of “exit” policy) their thinking is that the private interbank market will have to “compete” for funds, meaning a meaningful increase in rates in concert. It sounds easy in theory, but in practice there are numerous heady concerns not the least of which is sheer quantity.

When I speak of quantity it is not “reserves” that is relevant to interbank function, but collateral and balance sheet “capacity.” Neither of these factors is under the direct spell of the TDF, RRP or IOER. That includes, of course, the availability and demand for collateral in repo, but also extends to other interbank mechanics.

If, for example, the Fed raises the TDF rate but limits the quantity of accepted bids then it raises the specter of the same divergence in effective rates from targets that it is seeking to avoid in the first place. In other words, how much to be “soaked up” is the “right” amount to maintain both harmony and function? The Fed has absolutely no idea and neither does anyone else. Further, if they raise the TDF rate too much and place too high of a ceiling on quantity they may, in effect, take over the entire of the interbank market – which is what prompted (other than its ineffectiveness) a change in RRP with the Fed placing a cap on it.

The struggle of the FOMC to establish a rate floor is very emblematic of our times, as it is with the ECB unable to handle the relationship of Eonia and its MRO corridor midpoint. These problems are totally new to our banking experience. If you go back to the pre-crisis age, there were no interest rates “refusing” to get along with the “program”, as everything worked on its own without much by way of even minimal interference or manipulation from central banks. That is a key component that defies what is being proclaimed about current circumstances.

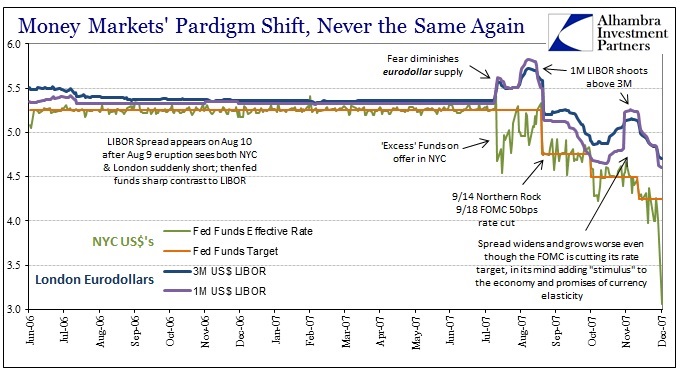

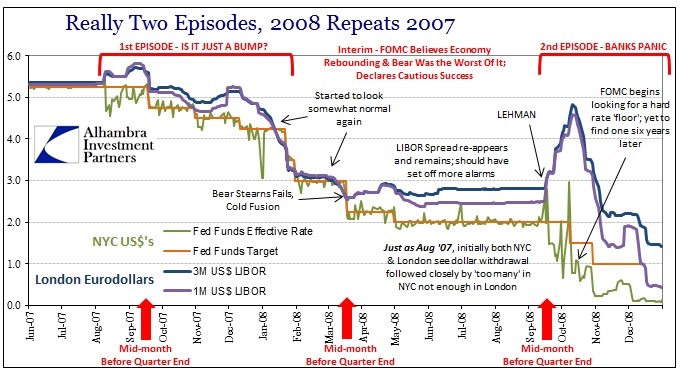

That fact had, until August 2007, led to the development of an apparently seamless financial system of wholesale “dollars” forming the basis of nothing short of massive asset bubbles. The transmission of monetary policy worldwide was based on this arbitrage “opportunity” of accounting convention, meaning that “dollars” would flow where rates were disparate – federal funds in the US and LIBOR in eurodollar London. The developing panic beginning in 2007 fractured this system, as you can plainly see on any LIBOR chart suddenly gaining a positive spread to federal funds – a spread that never dissolved throughout 2008 in sharp defiance of the FOMC’s growing confidence.

What happened in August 2007 was nothing short of a total break with the past. The global interbank markets have never recovered, and that is why these central banks are having so much difficulty “engineering” a return to the pre-crisis state. In other words, they all want to go back to 2005 before the housing bubble burst and use the financial system again as an easy “boost” to GDP.

Central banks are not aware (they are aware of far less than you would think) how irrevocably the system has changed. The global dollar short is never going to regain its prior function and station, which is what central banks should be most concerned with at this point as that forced “evolution” is front and center with the current thrust of dysfunction. The harder they try to assert dominance and the narrative that everything in finance has been fixed, the more it shows up as stark contradiction.

In many ways, this parallels the economic dysfunction that continues to this point. That observation is especially poignant and striking in repo mechanics – a truly healthy economy (as opposed to one that might have some positive numbers attached to it) produces “good” and usable collateral as that is the nature of true wealth building. Productive investment can (not “should”) be financialized to form the basis of sensible credit expansion (as “good” collateral allows sustainable limitations).

Starting in the late 1990’s (due to the massive shift in shadow operations in the 1980’s then augmented by Basel rules and FOMC policy) the financial system eschewed that traditional limitation and instead began to engineer and transform junk collateral into “quality” collateral. It was a synthetic process of essentially counterfeiting, and it stands now as a good representation of the appearance and ultimate domination of artificial economic forces. The counterfeiting lasted until August 2007, as did the artificial global economy.

The revelation in the 2008 panic and the Great Recession was really that artificiality being exposed for what it was – in the financial sense the collateral (MBS and corporates) was not priced correctly because of what they now call “reach for yield”; while in the economic sense the foundation of “growth” was debt over income. The common factor between those two seemingly separate deficiencies was interest rate repression. The parallels are more than coincidence, as the artificial economy produced almost exclusively artificial collateral of financial “engineering.”

In that sense, it is totally impossible to recreate the world of 2005 in both the economy and in the financial system. The Federal Reserve and the ECB want to go back to living the lie. If the highly linked economies in each locale were actually healthy and producing good collateral it may be possible, but in that state it would be totally unnecessary. In that sense, again secular stagnation, central banks are admitting that economic problems are not at all near a solution, contrary to all the heated rhetoric about the “recovery.”

The eurdollar system has undergone a paradigm shift, meaning we don’t know what awaits its ultimate attainment of a stable and steady state. What we can see right now is that it is still involved in morphing, thus upsetting the “best laid plans” of all the monetary “best and brightest.” They want you to believe that the crisis is all in the past and has been unquestionably “fixed”, but the reality is far different (October 15 put that notion to rest for anyone with at least passing familiarity). Crises are not always crashes, as the current situation can attest. In this case, it is a transition that has yet to fully develop, but the fact that such transition is still to be made is an indicator of where everything stands – including the global economy.

Stay In Touch