The continued release of increasingly bad data serves to further isolate the payroll report as something residing only of its own accord. There are far more relevant pieces of evidence that are clearly free of overly-dependent assumptions about factors that are less and less relevant to the actual economy as it exists post-crisis – and really post-2012. While the Establishment Survey refuses to acknowledge anything but the smallest deviations from an otherwise perfectly straight line, most of the rest of the economic accounts clearly show both what amounts to an elongated slowdown cycle and increasingly what looks like its potential end.

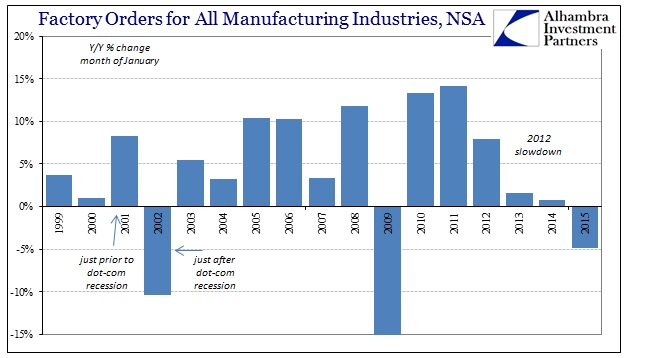

The latest report in that direction was factory orders, the broader cousin to the already-disappointing durable goods. The month of January was something we have not seen since prior recessions.

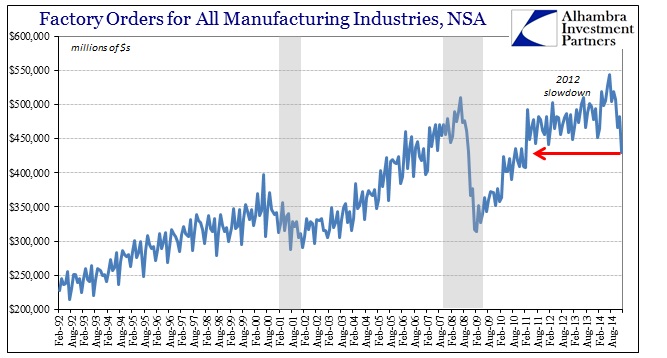

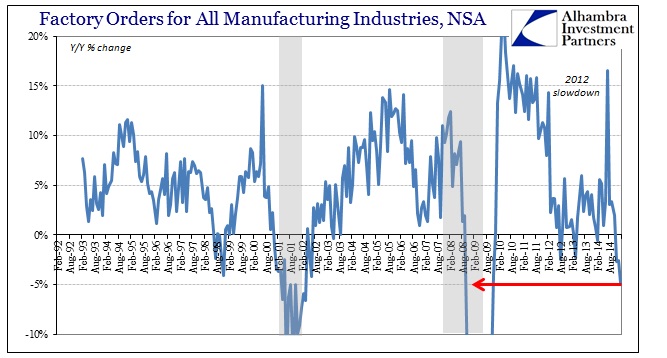

The seasonally-adjusted series, as if right no cue for payroll Friday, actually hides the seriousness somewhat. While the trajectories of factory orders clearly shifts in 2012, the dramatic tail that began, not coincidentally, last summer is somewhat obscured though still very striking on its own. It is, however, fully visible without any ambiguity via the unadjusted figures.

The level of factory orders for January 2015 was as low as it has been since the earliest months of 2011! Seasonality or not, that is huge slowdown in activity far below any reasonable expectation of accelerating growth. The speed of the decline is simply not something seen, frankly, outside of recession (even factoring the sharp upward spike in July and its subsequent “give back” in August due to volatility from Boeing).

This would provide a relatively strong link between growing economic retrenchment (demand) and commodity prices, oil in particular. Not only is there clearly less energy being used in production levels (which is not, in full, directly applicable to oil consumption) but more importantly in moving goods to market and then selling them. What should be more concerning is that not only is this slowdown remarkable in its scope and acceleration, but that those depressive factors were gaining as inventory levels continued to rise.

In other words, it would appear that dramatic increases in inventory occurred even despite a clear slowdown in production. That may clear up with some lag, but given that the production end started to slide in August and September when inventory was less nefarious than November and December it may be that there is still a good ways to go, on the downside, before production and inventories find more equality. That would be economically disruptive in its own right under clean, ceteris paribus conditions, but the pace of sales continues to decline as well making any production/inventory slowdown that much more tenuous toward broad economic dislocation – as it is, these kinds of major adjustments always overshoot.

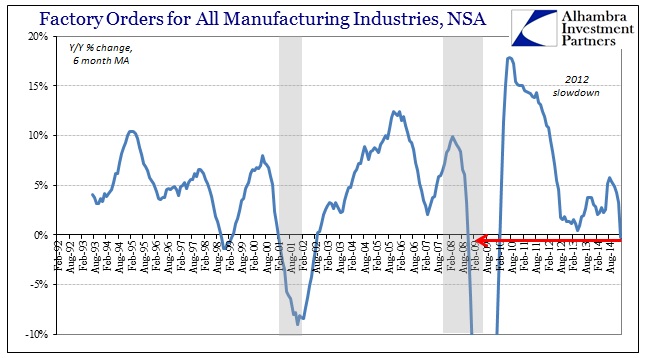

It is all-too-evident that there is something very wrong with “demand” in the US economy, which directly contradicts the Establishment Report while fully corroborating the “demand” view of oil prices. What is also obvious is that this slowdown is by far the worst we have seen during the elongated cycle peak dating back to early 2012. While year-over-year in January was nearly -5%, the worst single month since 2009, the 6-month average has just turned negative also for the first time since the Great Recession.

Outside of a relatively brief slowdown in the middle of 1998 (which I maintain was the first full-blown run at the elongated business cycle), a negative 6-month average has been solely related with recession itself. Even if the current period were similar to the localized cycle of 1998-99, that would still conform to the view of oil prices and the total slowdown in the global economy at that time (and thus, yet again, the great divergence between the global economy and stock prices).

There are innumerable data points that strongly demand recognition of the 2012 slowdown for what it was, but they now increasingly have attained a rate of deceleration that shows at the very least growing instability in the US economy, if not a full-blown end to the cycle itself. Credit and commodities may have pegged this one exactly right in timing and degree.

Stay In Touch