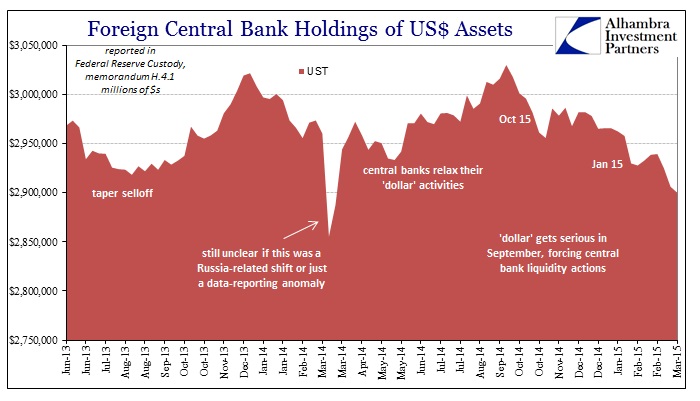

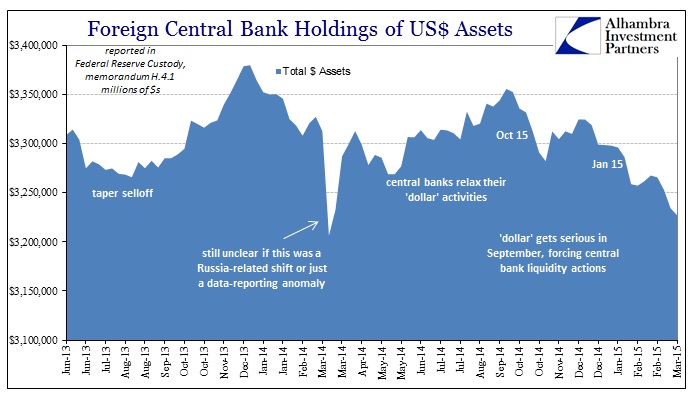

With funding markets and currencies showing pessimism once more with regard to the “dollar”, waiting for confirmation from TIC presentations is less than desirable. The Federal Reserve offers an alternate measure listed on its H.4.1 as a memoranda item. It tracks what the Fed holds in direct custody for foreign central banks and other “official” accounts and conduits. The holdings there are substantial, $3.23 trillion as of the last weekly report, but not comprehensive.

There are further problems with the data from the standpoint of trying to understand hidden “dollar” mechanics, but in some respects it is better than nothing. Aside from 2008 (which is another topic), the Fed’s custody report largely matches the broad picture presented by TIC data. We can then infer, reasonably, that there is at least a rough correlation which may allow some interpretations before TIC becomes available a few months hence.

Of the more recent weeks, there is clearly a move by central banks to raise “dollar” liquidity. Without any obvious and pressing need for liquidity for their own purposes (there are a few) we can therefore fairly assume “tightness” in their own jurisdictions as to “dollar” availability. The H.4.1 presents both US treasury holdings and “other dollar assets”, both of which demonstrate renewed “dollar” issues in the global system.

Again, this is not a perfect representation but in the interests of trying to develop a timelier picture of the overall “dollar” system it is moderately helpful. I think we can add this data series to oil prices, eurodollars and US credit markets in viewing a third “dollar” episode in succession while still in motion. So far, the impacts have remained foreign, but will that be the case if it is sustained? The damage overseas is already substantial, so it will be interesting to see if there is a break or a threshold that might “jump” to the wider “dollar” pool.

Stay In Touch