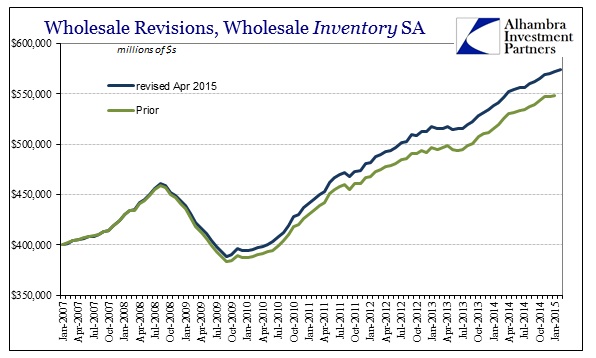

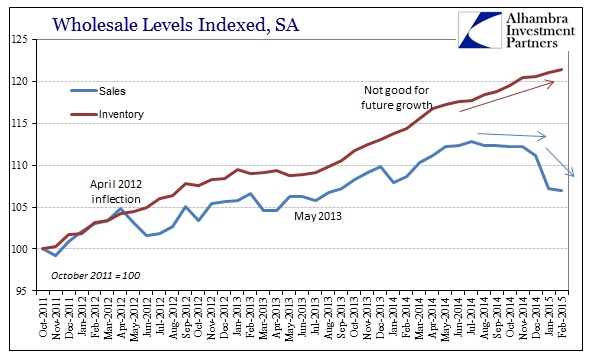

The wholesale sales and inventory figures were significantly revised this month going back more than a decade. The largest revisions were evident after 2007, which changes slightly the depth of the Great Recession and the “briskness” of the stunted recovery thereafter. Though both sales and inventory figures are much higher than previously believed (until they get revised again), the economic picture provided here is on balance slightly worse. From May 2013 forward, sales growth has been revised somewhat lower in relation to inventory growth, meaning the inventory problem is a bit worse despite the upward dollar figures in all these revisions.

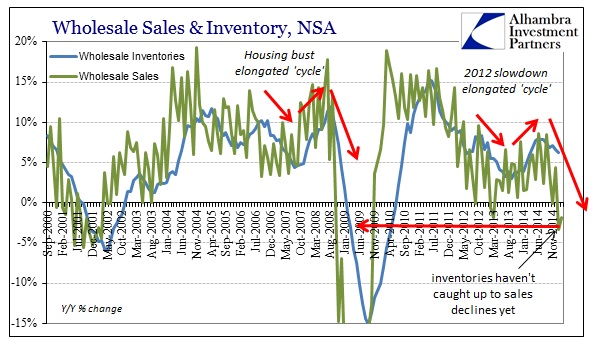

Unfortunately for the recovery idea, the overall trends were left pretty much intact which means that 2015 so far is shaping up very recessionary, at least so far in terms of sales. Wholesale sales, revised, fell again year-over-year in February for the first consecutive monthly decline since March 2013, and three out of the last four months for the first time since 2009.

By contrast, as you can see above, wholesale inventories are still growing at 6% Y/Y which leaves a tremendous gap that the supply chain is currently absorbing and thus financing internally. That will not continue, as either wholesalers will stop ordering new product or they will be forced to engage massive markdowns to get it all moving forward to retailers (who, as retail sales suggest, don’t really want it). In reality, the most likely course is there will be some of both as wholesalers will mark down inventory prices while cutting back further on new orders from manufacturers and overseas (both of which are already apparent).

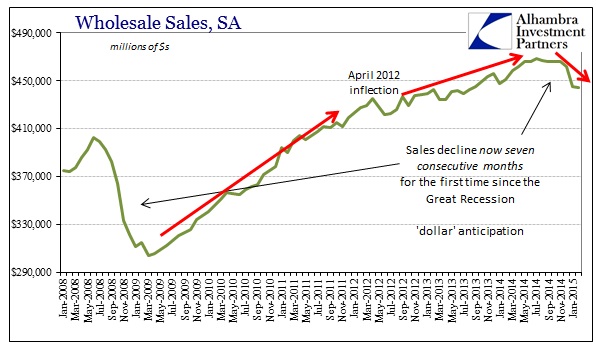

In terms of just sales, this kind of weak environment is consistent, historically, with only past recession. The data series originated in 1992, so we only have two “cycles” with which to compare, but that still leaves little doubt as to a serious economic decline in “demand.” This weakness is also apparent in the adjusted figures, as wholesale sales have fallen now for seven consecutive months; again, not seen since 2009.

There is no doubt as to the imprint of the 2012 slowdown in at least sales, with only a minor slowing in inventory, which helps explain how the “cycle” itself may get elongated. If businesses are willing to hold higher inventory with the premise of a promise for that elusive recovery, especially after QE, then the disparity between sales and inventory growth can continue longer than it may have in the past. That might even continue until some signal or level is reached where the idea that sales will eventually converge upward is no longer widely held as valid. A seven-month decline might be enough to initiate such a break, as would a renewed and heightened retailer rejection of further orders.

Immediately, thoughts tend toward petroleum as an alternate explanation that might reduce the impact of these figures. However, even adjusting for petroleum on sales and inventory, this disparity of too much inventory is not just apparent but at the widest gap, by far, since, again, 2009.

That is perhaps the most significant piece of these post-revision figures, as both January and February’s non-petroleum inventory-to-sales jumped by a huge amount. The question now is with factory orders already sliding at recessionary levels and inventories still growing contrary to sales, how much lower will everything get before adjusting to current conditions – conditions, I will reiterate yet again, that the “dollar” anticipated almost a year ago.

Stay In Touch