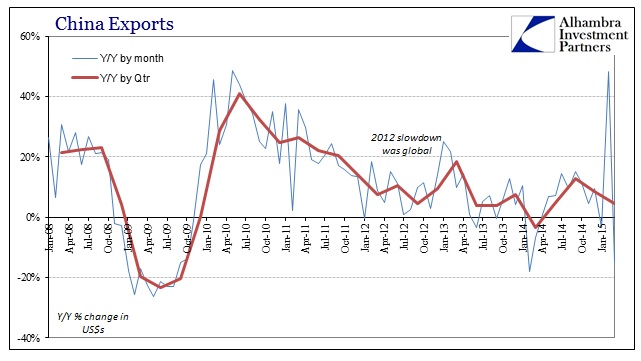

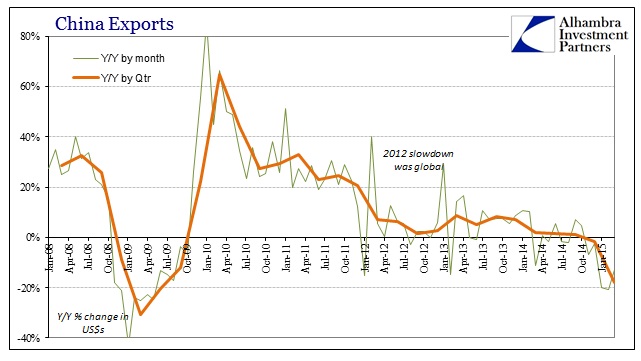

The Chinese lunar year always offers difficulty with Chinese economic figures, and this year was perhaps heightened in that respect since the New Year fell rather late on February 19. That suggests less dependable interpretations especially about February figures. So after rising a suspicious 48.3% in February, Chinese exports (in US$’s) are down 15% in March even though they were expected to have increased 12%. That February estimate was already problematic particularly since it was nowhere to be found at least as far as the US end since the Census Bureau reported essentially no growth in US imports from China in January and February.

Part of the dichotomy is surely “dollars” as a matter of finance rather than the dollar as purely currency. Whatever the entanglement, March’s numbers have even the credentialed economists, wholly unperturbed until now, suddenly nervous about not just China but the whole rest of it.

“It’s a very bad number that was much worse than expectations,” Louis Kuijs, an economist at RBS in Hong Kong, said about the export data.

“It leads to warning flags both on global demand and China’s competitiveness.”

Buffeted by lukewarm foreign and domestic demand, China’s trade sector has wobbled in the past year on the back of the country’s cooling economy, unsettling policymakers.

That last phrase, “unsettling policymakers” I think is wholly incorrect; if anything, the PBOC and Chinese government have been warning about this very scenario for some time. That would seem to apply as far backward as even late 2013 when the introduction of monetary and financial “reform” turned to a priority. If anything is “unsettled” about weakness in China, and more importantly what that signals the global economy, it is economists that are still operating under the knotted assumptions that monetary policy does more than bubbles and thus the US is “booming.”

The export end is still stuck inside the context of the 2012 slowdown, which is precisely the problem that PBOC-led “reform” is aiming to counter. The Chinese have given up on the US and Europe in terms of full recovery, and have realized it is pointless to build and nurture even larger domestic bubbles when the global economy remains clearly in the “wrong” direction three years after the slowdown.

It is the other side of the trade equation that has turned toward cyclical pessimism about where this is all headed. While exports may be an even lagging picture of the global economy, China’s unique place as the global supply pivot provides and suggests a temporal element between imports and exports. In other words, the pace of imports is like “orders” and the pace of exports is of “production.” If imports activity acts in that manner, then trade further down the supply chain is the Chinese read and expectation of future “demand.” And it is ugly – Great Recession ugly.

Regardless of the lunar year’s calendar “effects”, imports sunk by 17.8% in the first quarter which has nothing to do with the “competitiveness” of the “dollar.” That is the worst quarter since Q2 2009 – the very trough of that affair.

This has led to increasing speculation that this week’s GDP report will be less than even the 7% “target”, though you cannot underestimate the ability of the government to “somehow” meet its GDP target consistently. However, reported on Wednesday will be both Chinese retail sales and industrial production, both of which have been much lighter of late, so the economy apart from the full government distortion might be open regardless of GDP.

When even the economists are starting to get nervous, you know this is not the typical “apologize by year end for missing expectations.”

Stay In Touch