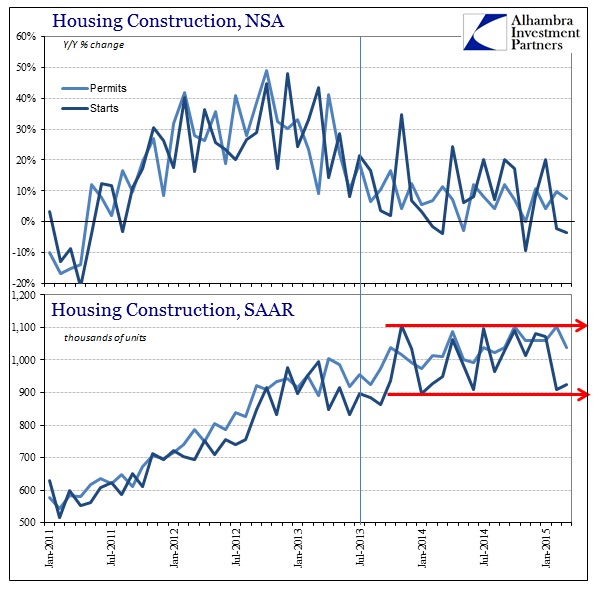

The latest figures from the Census Bureau on home construction continue to suggest that the home sales number from last month was, at best, a one-off abnormality. If new home sales were heading appreciably higher in what might have been perceived as a sustained advance, you would expect that new home construction would at least closely follow to take advantage of that “demand.” As it is, home construction continues on the same tepid pace, unperturbed by much of anything toward a renewed “boom.”

Overall, permits were right in-line with the recent trend that dates back all the way to 2013 and the MBS rout, while starts, which are much more volatile, sank in March. Those observations apply equally to the single-family segment as apartment construction.

The absence of enthusiasm over home construction of any type is itself evidence of absence of enthusiasm in the economy as a whole. Even factoring the continued tight mortgage standards that exist post-crisis, you would think by now growing incomes would have overcome some of those standards in sufficient quantity within the prospective buyer pool. And if not in owning, then certainly in renting.

Yet, the pace of apartment construction continues to tail off and occur at nowhere near the levels of the prior mini-bubble. That would tend to suggest that the rate of construction then was badly miscalibrated in expectation to the actual level of “demand” that exists today. That isn’t necessarily surprising given that all that construction took place under the QE3 assumptions that predominated then, about how QE in that format would finally unleash all the untapped economic potential. So the counter and downward trend since then is just another data point underscoring how badly QE faltered at least in the real economy, distinctly apart from asset prices.

As with so many other factors, there is an unmistakable downward drift, at least, in the pace of even permits for new multi-family dwellings which suggests that “demand” is still waning so far as even construction entities are recognizing it (dating back, of course, to June and July). For the economy as a whole, it’s just another of the “unexpected” gathering “headwinds.”

Stay In Touch