The perfect payroll report seems to have set off an angry wholesale market. While there was some indication of disorder prior to today, eurodollars in particular were sold once the Establishment Survey made it even more uncomfortable for Yellen’s position. Whereas the eurodollar curve had been unusually stable throughout May, it has been a different story in June. Economy or not, wholesale “money” is betting on if not rate hikes again then something changing.

Much like nominal treasury yields, eurodollar rates have retraced the December flattening (on the long end; intermediate different story, likely economy) mostly in the past few days.

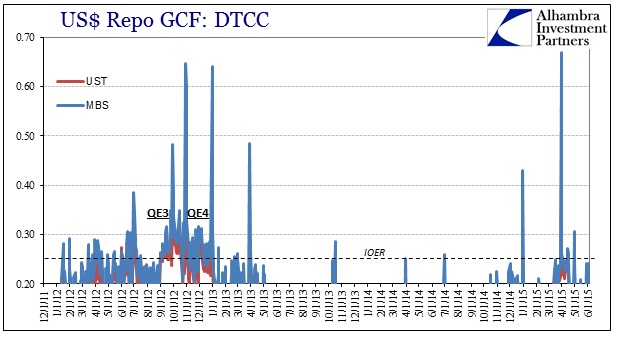

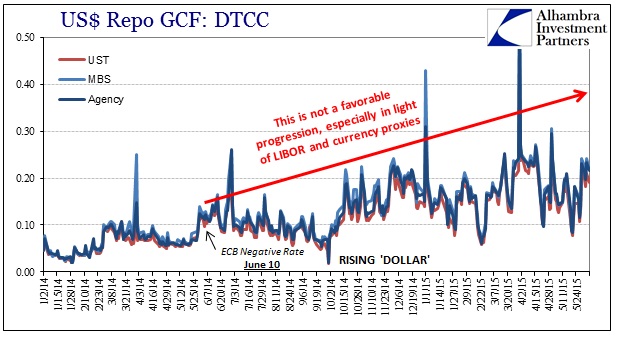

It remains to be seen how this will affect broader wholesale funding markets; so far currencies aren’t much disturbed but that could change over the weekend. Repo markets, however, have been agitated consistently since month-end, with GC rates in MBS and agency stubbornly above 20 bps (and UST GC falling to 19 bps just today).

Repo volume in MBS has been moving up since Yellen’s bubble recognition speech of May 6, which, if consistent with the last time that happened, might suggest interbank tightening already (since October 15, MBS volume seems to indicate repo-as-a-last-resort, especially in MBS). UST volume has mostly meandered around, which, given rate behavior recently, might be that reason for the increase in MBS volume as the only “spare” capacity.

This “agitation” isn’t as clear when viewed exclusively in recent context, but with a wider perspective repo markets show themselves to be in at least a constant state of just short of open disorder. The more benign paradigm that prevailed prior to June 2014 has clearly given way, the massive “dollar” move, and has not yet settled back down. That might mean a durable or even permanent rupture in systemic liquidity capacity not unlike that which occurred prior to QE3 and QE4.

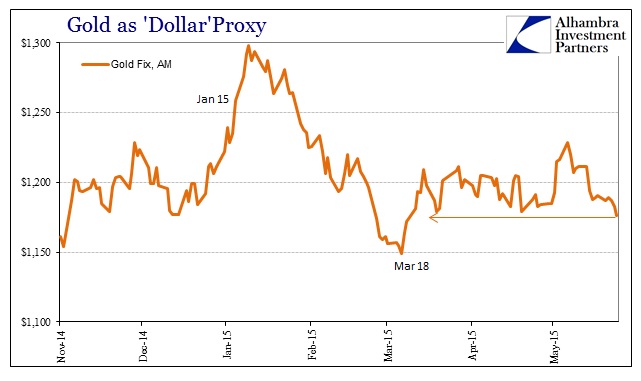

Even gold prices, a pretty good indication of “dollar” direction (especially longer term), have been under pressure since late May. Gold at this morning’s London fix was the lowest since the week after the March FOMC.

That would seem to provide a good explanation for UST volatility today, especially this morning. With this setup, we will see if and how that carries over next week.

Stay In Touch